Is GlobalFoundries’ (GFS) Expanded Apple Partnership Redefining Its U.S. Semiconductor Leadership Narrative?

- Cyient Semiconductors Private Limited recently announced a channel partner agreement with GlobalFoundries, enabling Cyient to resell GlobalFoundries' semiconductor manufacturing services and technologies to expand access to advanced process technologies and manufacturing capabilities.

- This collaboration, together with GlobalFoundries’ newly deepened partnership with Apple and a strong quarterly earnings report, highlights the company's expanding role in the global semiconductor supply chain and its focus on high-performance, energy-efficient solutions.

- We’ll explore how this expanded Apple partnership strengthens GlobalFoundries’ investment narrative, particularly its position in U.S. semiconductor manufacturing.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

GlobalFoundries Investment Narrative Recap

Owning GlobalFoundries shares means believing in its position as a leading provider of mainstream semiconductor manufacturing, benefiting from rising chip demand across diverse markets while expanding U.S. capacity. Recent partnerships with Apple and Cyient Semiconductors reinforce access to key segments, but do not fundamentally change the current balance between promising catalysts, like U.S. investments or auto chip demand, and persistent risks such as reliance on mature process technologies and pricing pressures in mobile chips.

Among the latest announcements, the expanded Apple partnership stands out for its relevance to U.S. manufacturing strength and improved customer stickiness, reinforcing GlobalFoundries’ strategy to regionalize supply chains. While this may help with long-term revenue visibility and margin stability, the immediate impact on addressing advanced node competition or alleviating volatility from global trade disruptions and capital intensity appears limited.

However, investors should be mindful that, unlike the potential growth drivers, persistent pricing pressure in the mobile segment remains a risk that...

Read the full narrative on GlobalFoundries (it's free!)

GlobalFoundries' outlook anticipates $8.9 billion in revenue and $1.4 billion in earnings by 2028. This projection is based on annual revenue growth of 9.0% and a $1.515 billion increase in earnings from the current level of -$115.0 million.

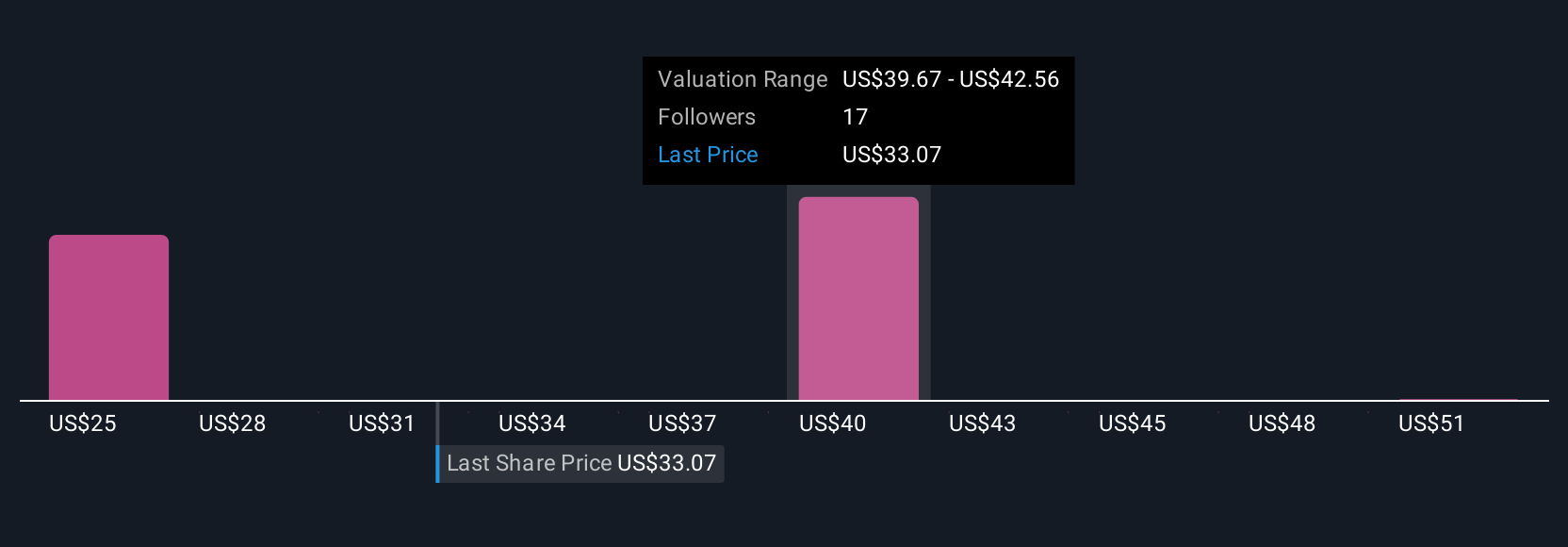

Uncover how GlobalFoundries' forecasts yield a $41.54 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for GlobalFoundries range from US$25.20 to US$54.14 per share. While some see strong upside, ongoing pricing pressure risks may shape future results and suggest the value of reviewing multiple viewpoints.

Explore 6 other fair value estimates on GlobalFoundries - why the stock might be worth as much as 65% more than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

No Opportunity In GlobalFoundries?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English