Insider Buying and Share Buybacks Could Be a Game Changer for OPKO Health (OPK)

- OPKO Health recently reported its second quarter 2025 results, posted a net loss of US$148.44 million, issued full-year revenue guidance of US$640 million to US$660 million, and completed a significant share buyback, repurchasing 39,472,129 shares for US$58.4 million.

- Chairman & CEO Phillip Frost made the largest insider purchase in a year, with insiders collectively holding 44% of the company, highlighting strong management-shareholder alignment.

- With the CEO’s major insider purchase and share buybacks in focus, we’ll explore how these moves influence OPKO Health’s investment thesis.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OPKO Health Investment Narrative Recap

To be an OPKO Health shareholder, you need to believe the company can convert its diversified pipeline and recent operational changes into meaningful, sustainable revenue while working through repeated net losses. The Q2 2025 results, marked by rising losses and reaffirmed revenue guidance, do not materially change the core short-term catalyst, which remains the successful transition of diagnostics and new product launches, but highlight that persistent unprofitability stays the top risk.

The recently completed buyback of over 39 million shares for US$58.4 million stands out among recent announcements. While this reduces share count and signals confidence from management, it contrasts sharply with the company's ongoing net losses and highlights the importance of margin expansion and operational execution as key factors for future value creation.

Yet, as management continues to return capital to shareholders, investors should be aware that ongoing losses and operating cash flow pressures may still...

Read the full narrative on OPKO Health (it's free!)

OPKO Health's narrative projects $754.1 million revenue and $40.6 million earnings by 2028. This requires 4.3% yearly revenue growth and a $217.7 million earnings increase from current earnings of -$177.1 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 175% upside to its current price.

Exploring Other Perspectives

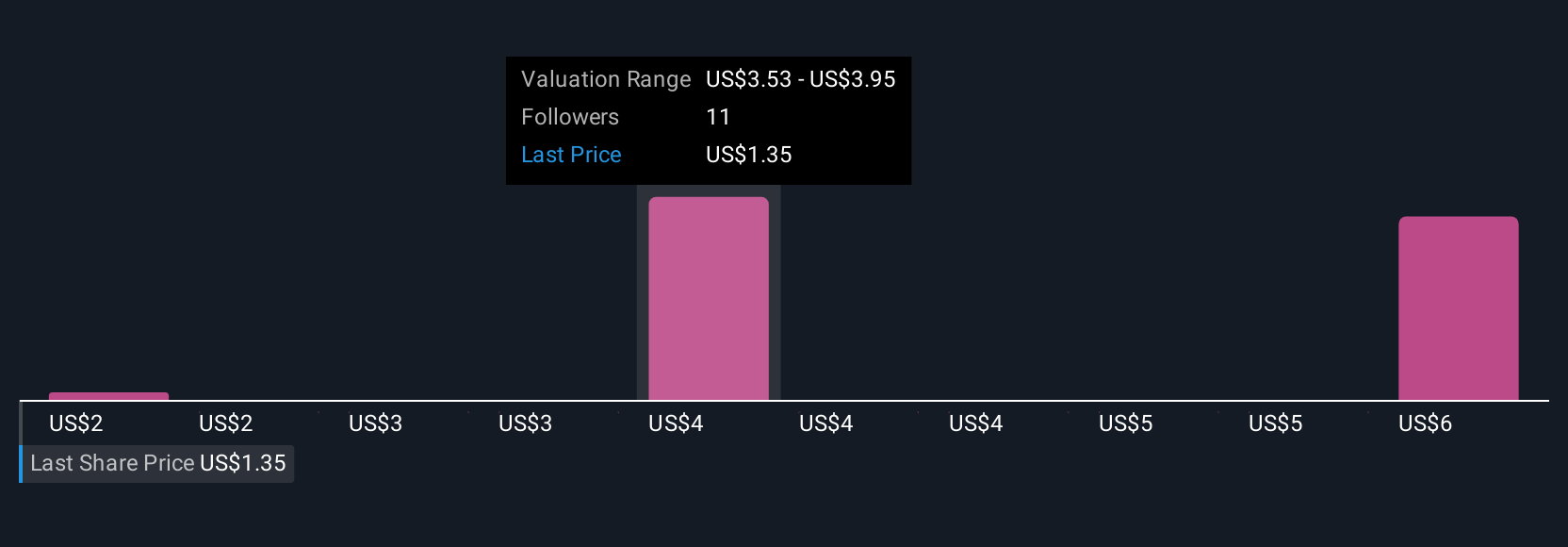

Fair value estimates from three Simply Wall St Community members range widely, from US$1.85 up to over US$6.05 per share. While some see deep value, the company's ongoing inability to reach profitability points to the need for careful assessment of future earnings potential and the risk of further shareholder dilution.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth just $1.85!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English