How Investors May Respond To Lotus Technology (LOT) £80 Million Loan Injection and Leadership Change

- Earlier this month, Lotus Technology Inc. announced that Mr. Anish Melwani resigned as an independent director for personal reasons and entered into a loan agreement of up to £80 million with Lotus Cars Limited, bearing 8% annual interest and a final repayment date of December 31, 2025.

- This significant financial support, combined with the move to acquire key equity interests in Lotus UK, signals an ongoing effort to enhance integration and control over manufacturing and engineering operations.

- Let's examine how the new £80 million loan to Lotus Cars could influence Lotus Technology's investment outlook and operational flexibility.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Lotus Technology Investment Narrative Recap

To be a shareholder in Lotus Technology, you need to believe in the company’s ability to achieve global expansion and operational integration, especially as it seeks to consolidate control of its UK operations. The recently announced £80 million loan to Lotus Cars Limited does not materially alter the most important short-term catalyst, completion of the 51% Lotus UK equity deal, or the biggest risk, which remains the company’s ability to achieve profitability and manage its high debt levels.

Of the recent announcements, the loan agreement with Lotus Cars stands out because it directly supports the operational integration catalyst. The additional capital could help enable synergies between Lotus Technology and its UK entities, fostering efficiencies that may improve margin potential, though financial risk is still high until sustainable profit can be demonstrated.

Yet, it's also important for investors to recognize that ongoing balance sheet pressures mean there could be increased sensitivity to...

Read the full narrative on Lotus Technology (it's free!)

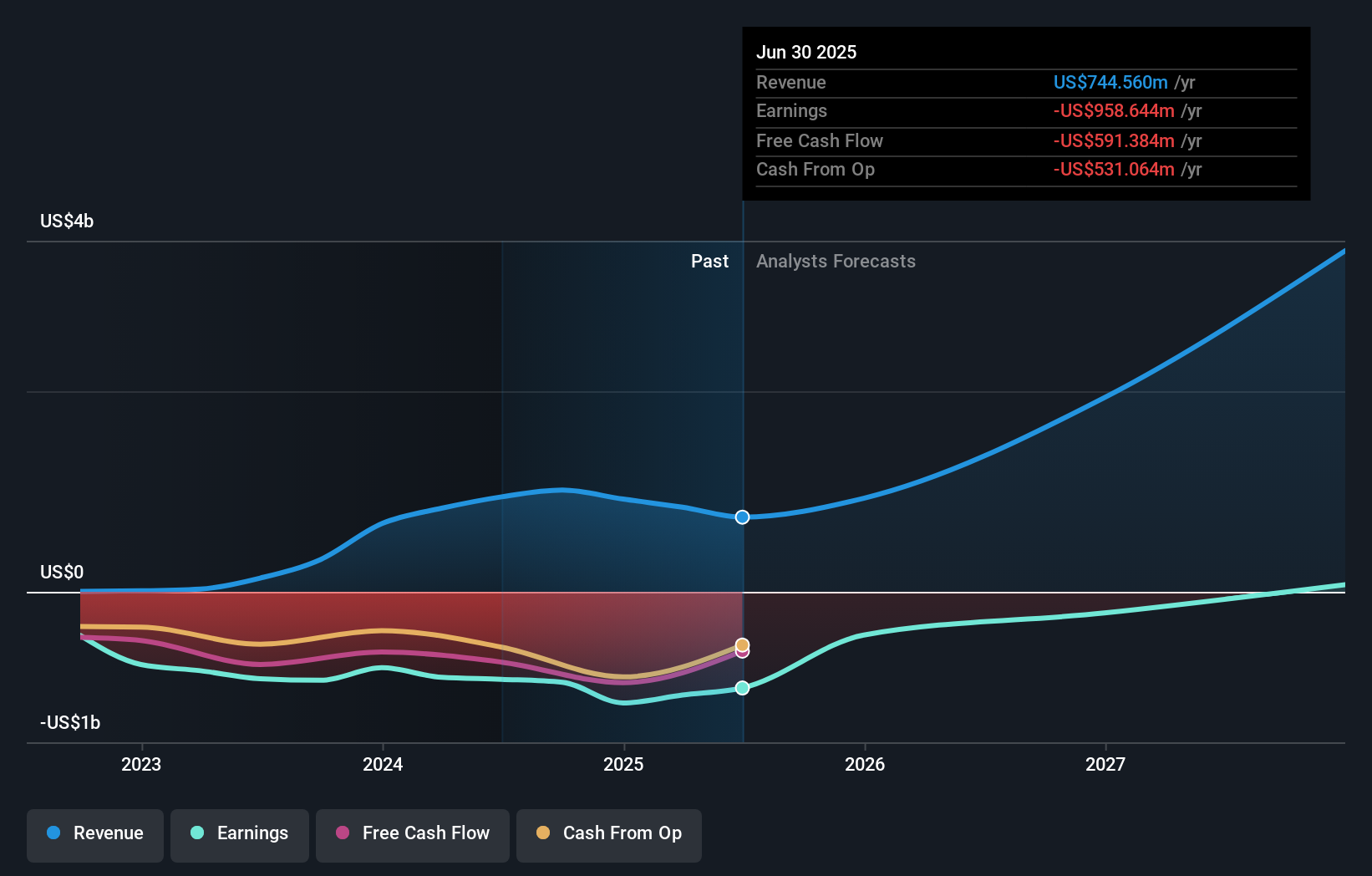

Lotus Technology's narrative projects $3.7 billion revenue and $200.2 million earnings by 2028. This requires 63.7% yearly revenue growth and a value increase in earnings of about $1.2 billion from the current -$1.0 billion.

Uncover how Lotus Technology's forecasts yield a $3.00 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members all assigned a fair value estimate of US$3.00 to Lotus Technology, offering one perspective ahead of the latest news. Given the ongoing risk from high leverage, it’s worth investigating several views on the company’s financial foundation and future prospects.

Explore another fair value estimate on Lotus Technology - why the stock might be worth as much as 49% more than the current price!

Build Your Own Lotus Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lotus Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lotus Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English