Why DENTSPLY SIRONA (XRAY) Is Down 7.1% After Weaker Sales and Ongoing Legal Uncertainty

- DENTSPLY SIRONA recently reported a decrease in quarterly sales to US$936 million and a net loss of US$45 million, reaffirmed full-year 2025 earnings guidance projecting net sales of US$3.60 billion to US$3.70 billion, and maintained its quarterly cash dividend at US$0.16 per share.

- Ongoing legal challenges, including efforts to dismiss investor lawsuits related to prior losses and regulatory issues, continue to impact company sentiment and add uncertainty around future performance.

- We will explore how the combination of weaker earnings and unresolved legal matters could alter DENTSPLY SIRONA’s investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DENTSPLY SIRONA Investment Narrative Recap

To invest in DENTSPLY SIRONA, you must believe in its turnaround potential, rooted in digital dentistry adoption and operational efficiencies, despite recent quarterly sales declines and mounting net losses. While legal uncertainties persist, the short term catalyst remains the company’s ability to stabilize core business performance; so far, the latest earnings news largely signals continued pressure rather than a material shift to either risk or recovery in the near term.

Among the recent announcements, the reaffirmed 2025 sales guidance of US$3.60 billion to US$3.70 billion stands out. This outlook, explicitly shaped by existing tariffs and trade policy, is particularly relevant as it reinforces how external macroeconomic headwinds continue to challenge any swift financial rebound, keeping top-line targets under scrutiny.

By contrast, ongoing investor lawsuits and unresolved regulatory issues add an unpredictability to DENTSPLY SIRONA’s story that investors should not overlook...

Read the full narrative on DENTSPLY SIRONA (it's free!)

DENTSPLY SIRONA's narrative projects $3.9 billion in revenue and $252.2 million in earnings by 2028. This requires 1.6% yearly revenue growth and a $1,160.2 million earnings increase from current earnings of -$908.0 million.

Uncover how DENTSPLY SIRONA's forecasts yield a $17.14 fair value, a 31% upside to its current price.

Exploring Other Perspectives

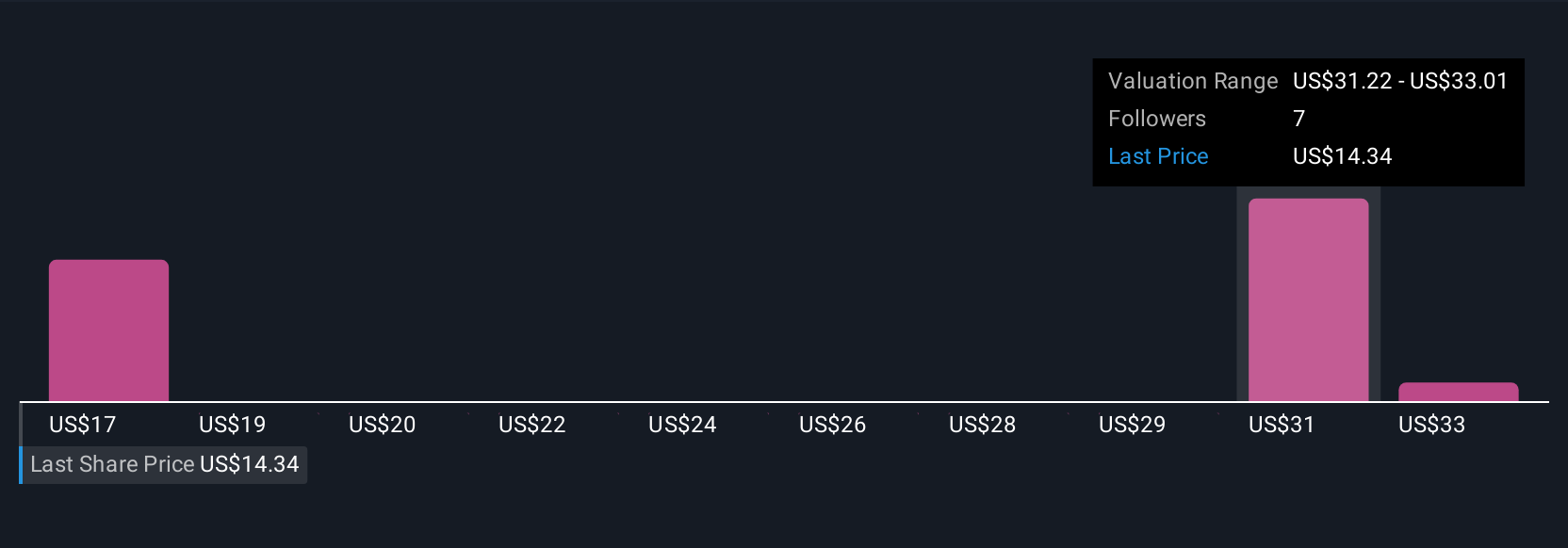

Simply Wall St Community members estimate fair value for DENTSPLY SIRONA between US$17.14 and US$34.81, based on three distinct analyses. As trade policy shifts pressure earnings prospects, you can see how differently market participants interpret future potential, explore their views to shape your own outlook.

Explore 3 other fair value estimates on DENTSPLY SIRONA - why the stock might be worth over 2x more than the current price!

Build Your Own DENTSPLY SIRONA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DENTSPLY SIRONA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DENTSPLY SIRONA's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English