Will Royal Caribbean's Fleet Growth Anchor Its 2025 Demand Strategy?

Royal Caribbean Cruises Ltd. RCL is expanding capacity through a steady pipeline of new ships, aiming to strengthen demand in 2025. The company’s strategy centers on moderate capacity growth, with each addition designed to drive pricing power, attract new guests and support yield expansion.

In the second quarter of 2025, the company’s capacity increased 6% year over year, supported by new ships alongside improvements across the existing fleet. Net yield growth of 5.2% was evenly split between new hardware and the current portfolio. The company noted that the new ships are generating strong pricing and load factors, reinforcing the demand impact of fleet additions.

The delivery of Star of the Seas in late August and the launch of Celebrity Xcel in November are expected to boost fourth-quarter capacity by 10% year over year. These ships join recent entrants in the short-cruise market, such as Utopia of the Seas and Wonder of the Seas, which are driving repeat bookings and attracting younger demographics.

Looking beyond 2025, Royal Caribbean plans to introduce seven new ships over the next few years, including Legend of the Seas in 2026, Icon 4 and Celebrity River in 2027, and Oasis 7 and Edge 6 in 2028. This measured rollout is designed to enhance global reach and diversify offerings, with each addition positioned to deliver premium yields.

The company emphasized that fleet growth is part of a broader demand strategy, supported by exclusive destinations, digital engagement and loyalty programs. With record bookings and strong demand across itineraries, the company’s expanding fleet is expected to remain a central driver of its 2025 growth momentum.

Competitive Positioning in the Cruise Industry

Norwegian Cruise Line Holdings Ltd. NCLH is pursuing steady fleet growth with a pipeline that supports approximately 29.7% gross capacity expansion by 2028, reflecting a CAGR of about 4% from 2023. In the second quarter of 2025, Norwegian Cruise expanded its fleet with the delivery of Oceania Cruises’ Allura, the brand’s eighth ship and second in the Allura Class. Norwegian Cruise also confirmed orders for two additional Sonata Class ships, bringing total orders to 13 vessels across three brands, reinforcing its long-term growth strategy.

Carnival Corporation & plc CCL is advancing its fleet strategy through a mix of newbuilds and refurbishments aimed at enhancing guest experiences and driving demand. It has ordered two new AIDA ships for delivery in 2030 and 2032. It is preparing to debut Carnival Festivale and Carnival Tropicale in 2027 and 2028, respectively. The upcoming launch of Star Princess, sister ship to Sun Princess, further underscores Carnival’s focus on modern, guest-centric ships to support long-term growth.

RCL’s Price Performance, Valuation & Estimates

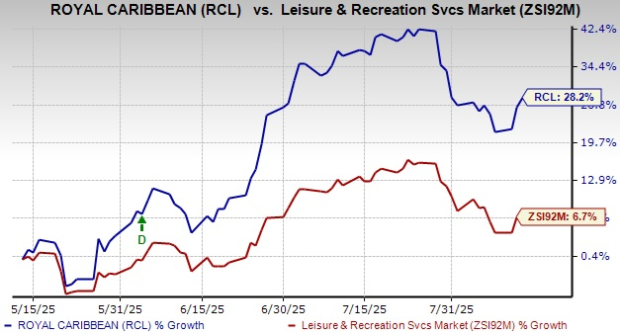

Shares of Royal Caribbean have gained 28.2% in the past three months compared with the industry’s growth of 6.7%.

Image Source: Zacks Investment Research

From a valuation standpoint, Royal Caribbean trades at a forward price-to-sales ratio of 4.47x, significantly up from the industry’s average of 2.33x.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for RCL’s 2025 and 2026 earnings implies a year-over-year uptick of 32.2% and 17.7%, respectively. The EPS estimates for 2025 have increased in the past 30 days.

Image Source: Zacks Investment Research

RCL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carnival Corporation (CCL): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English