Should Allot Stock Be in Your Portfolio Before Q2 Earnings?

Allot Ltd. ALLT is scheduled to report its second-quarter 2025 results on Aug. 14, before the bell.

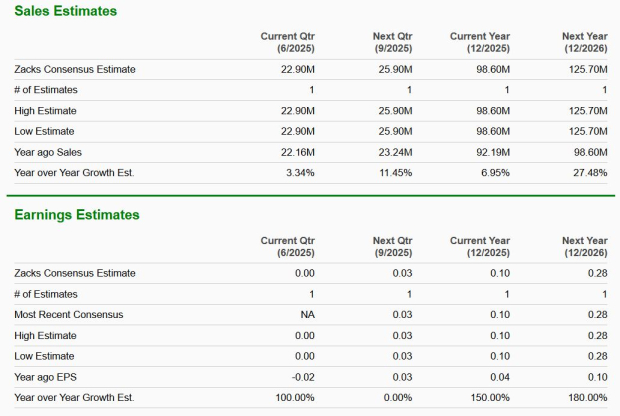

The Zacks Consensus Estimate for earnings in the to-be-reported quarter stands at a breakeven compared with a loss of 2 cents in the year-ago reported quarter. The consensus estimate for revenues stands at $22.9 million, indicating a 3.3% year-over-year increase. There has been no change in analyst estimates or revisions for the to-be-reported quarter lately.

Image Source: Zacks Investment Research

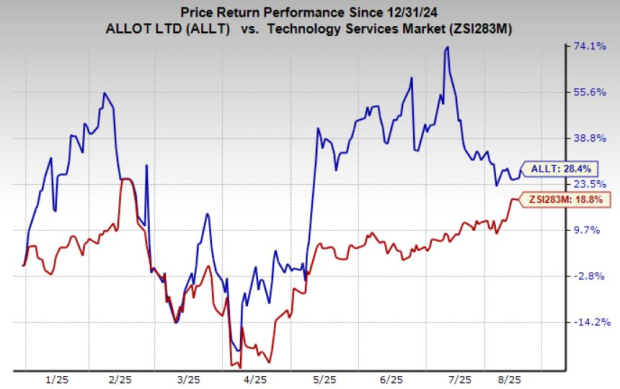

Image Source: Zacks Investment Research

ALLT’s Lesser Chance of Q2 Earnings Beat

Our proven model doesn’t conclusively predict an earnings beat for ALLT this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

ALLT has an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

ALLT Should be Riding Growth Momentum

Strong demand for Smart and Tera III products, driven by multiple multi-million-dollar agreements with new tier-1 customers, is boosting revenue. Growing interest in SECaaS offerings, highlighted by Verizon Business integrating the service into new mobile plans, is expanding the customer base and driving recurring revenue streams higher.

Rising high-margin recurring revenues from SECaaS, combined with increased ARR, are expected to grow around 50% year over year, improving profitability. Efficient execution and scaling of operations, alongside strong sales momentum for premium solutions like Tera III, are enhancing margins and supporting the company’s goal of achieving profitable growth in full-year 2025.

Radware RDWR and Ceragon Networks CRNT operate in similar network/security and telecom infrastructure spaces. Radware is seeing traction in its security portfolio with large enterprises, while Ceragon Networks is expanding its wireless transport solutions footprint in emerging markets. Radware’s ongoing shift toward subscription-based services and Ceragon Networks’ focus on 5G backhaul upgrades mirror ALLT’s recurring-revenue-driven margin expansion strategy.

ALLT Stock Looking Pricey

ALLT shares have surged 28% year to date. This performance has significantly outpaced the 19% growth of its industry.

At this moment, it is worth noting that at its current valuation, Palantir is looking pricey. Based on the trailing 12-month EV-to-EBITDA, ALLT is currently trading at 71.63X, way above the industry’s 35.85X. If we look at the forward 12-month Price/Earnings ratio, the company’s shares are currently trading at 36.22X forward earnings, well above the industry’s 24.49X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investment Considerations

Allot’s solid product demand, especially for Smart and Tera III solutions, alongside the growing adoption of its SECaaS offerings, positions the company for steady revenue and profitability improvements. Strategic wins with tier-1 customers and partnerships like Verizon’s mobile plan integration enhance recurring revenue visibility and long-term growth potential. However, the stock’s strong year-to-date rally has pushed valuations to elevated levels, leaving limited near-term upside without a meaningful earnings catalyst. While the business outlook remains positive, the current price already reflects much of the optimism. Investors may consider a hold strategy, monitoring execution on growth initiatives and upcoming results for opportunities to accumulate on potential price corrections.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Radware Ltd. (RDWR): Free Stock Analysis Report

Ceragon Networks Ltd. (CRNT): Free Stock Analysis Report

Allot Ltd. (ALLT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English