Should Strong Earnings and Increased Buybacks Prompt Action From Janus Henderson Group (JHG) Investors?

- Janus Henderson Group reported earnings for the second quarter and first half of 2025, showing higher revenue and net income year-on-year, while affirming its US$0.40 per share dividend and updating on sizeable share repurchases completed this year.

- This combination of rising profits, ongoing share buybacks, and continued dividend payments highlights the company's efforts to reward shareholders and signals management's confidence in the business outlook.

- We'll look at how Janus Henderson Group's stronger quarterly results and active capital returns influence its longer-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Janus Henderson Group Investment Narrative Recap

To be a shareholder in Janus Henderson Group, you need to believe in the company’s ability to grow assets under management through stronger institutional partnerships, innovation in active products, and disciplined capital returns to offset potential structural headwinds like fee compression and changing client preferences. The latest earnings report, with higher revenue and net income alongside active share buybacks and a maintained dividend, signals management’s commitment to near-term capital return, but does not fundamentally change the most important short-term catalyst: driving sustainable net inflows into new and existing mandates. Ongoing pressure from client shifts toward passive investments remains a key risk, and this set of results does not materially reduce that concern.

Of the latest developments, the update on substantial share buybacks, completing the repurchase of over 3.7 million shares for US$146.8 million under one tranche and more than 2.5 million shares for US$92.3 million under another, stands out. These buybacks align with management’s prioritization of capital return and can bolster earnings per share in the short run, but the longer-term narrative still relies on whether Janus Henderson can counterbalance persistent outflows in active equity products. In contrast, investors should be aware that shifting client demand for passive and low-fee offerings continues to present...

Read the full narrative on Janus Henderson Group (it's free!)

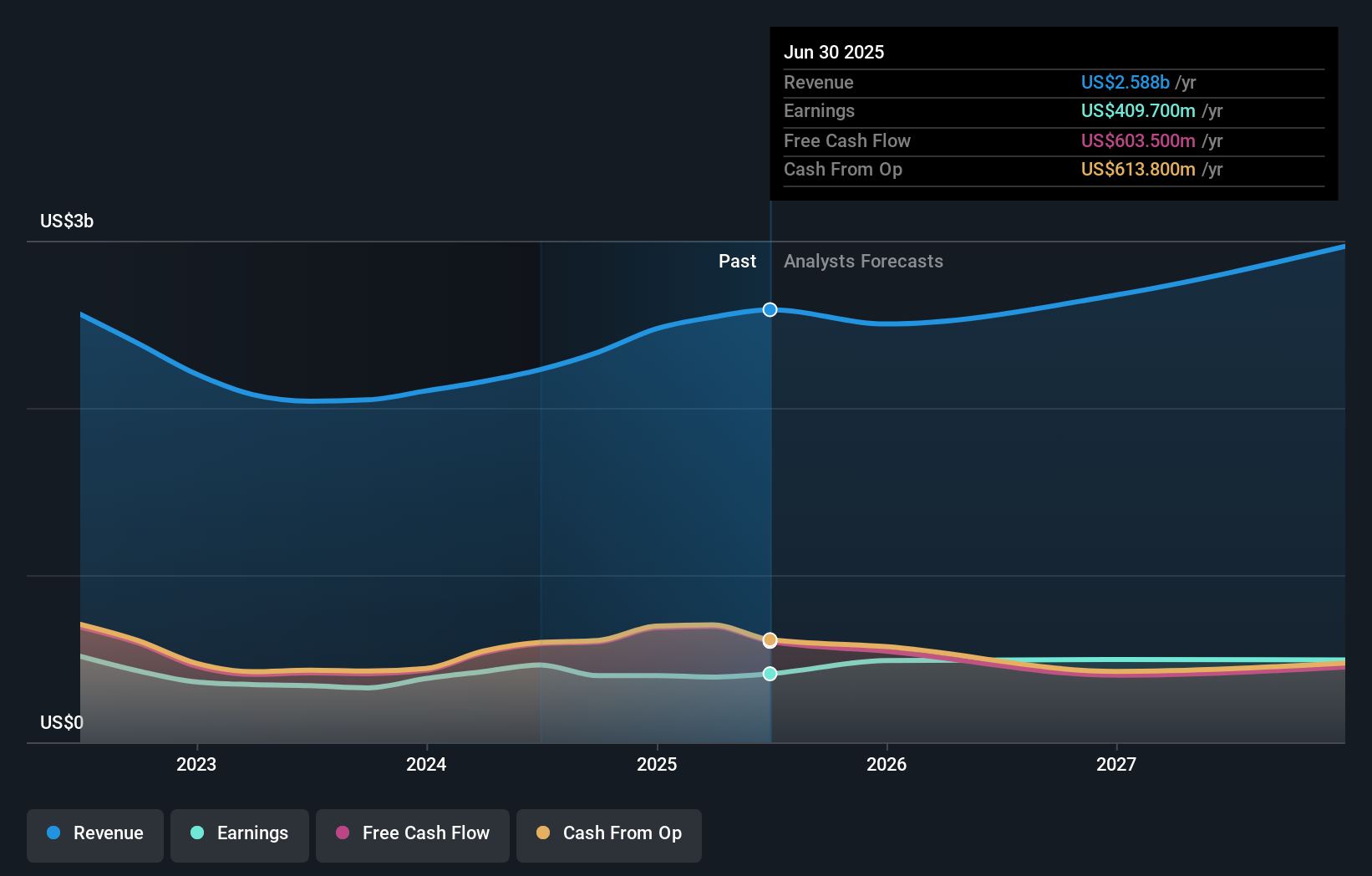

Janus Henderson Group's narrative projects $2.9 billion revenue and $510.9 million earnings by 2028. This requires 3.4% yearly revenue growth and a $101 million earnings increase from $409.7 million.

Uncover how Janus Henderson Group's forecasts yield a $45.11 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for Janus Henderson Group range widely from US$31.03 to US$47.96, based on three distinct analyses. While many see upside in the current buyback-driven results, persistent outflows in active strategies could temper future growth and remain crucial for you to watch; explore the full spread of community viewpoints for a broader investment picture.

Explore 3 other fair value estimates on Janus Henderson Group - why the stock might be worth as much as 8% more than the current price!

Build Your Own Janus Henderson Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Janus Henderson Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Janus Henderson Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Janus Henderson Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English