Why HASI Is Up 10.1% After Surging Q2 Net Income Despite Lower Revenue and a Dividend Boost

- HA Sustainable Infrastructure Capital, Inc. recently reported its second quarter 2025 earnings, revealing US$85.69 million in revenue and US$98.45 million in net income, and announced a quarterly cash dividend of US$0.42 per share payable in October.

- While revenue declined from a year earlier, net income saw a very large increase, reflecting significant changes in the company's financial performance.

- We'll explore how the diverging trends in revenue and net income impact HA Sustainable Infrastructure Capital's investment narrative going forward.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

To believe in HA Sustainable Infrastructure Capital, you need confidence in its ability to generate value even as revenue trends fluctuate. The latest quarterly update delivered a very large jump in net income despite a revenue drop, potentially easing immediate concerns about profit growth but raising questions about underlying sustainability. This shift may temporarily soothe risk perceptions tied to earnings quality and dividend sustainability, especially considering another steady dividend was declared. However, core risks such as modest return on equity, ongoing concerns about debt coverage by operating cash flow, and the gap between forecast earnings growth and broader market expectations remain front of mind. While the earnings surprise might give the stock some short-term momentum, the main catalysts and headwinds from before this update, like sector competition and the cost of capital, still shape its outlook and could be impacted by more quarters of volatile results. Yet, not every report smooths over the risks linked to cash flow and debt.

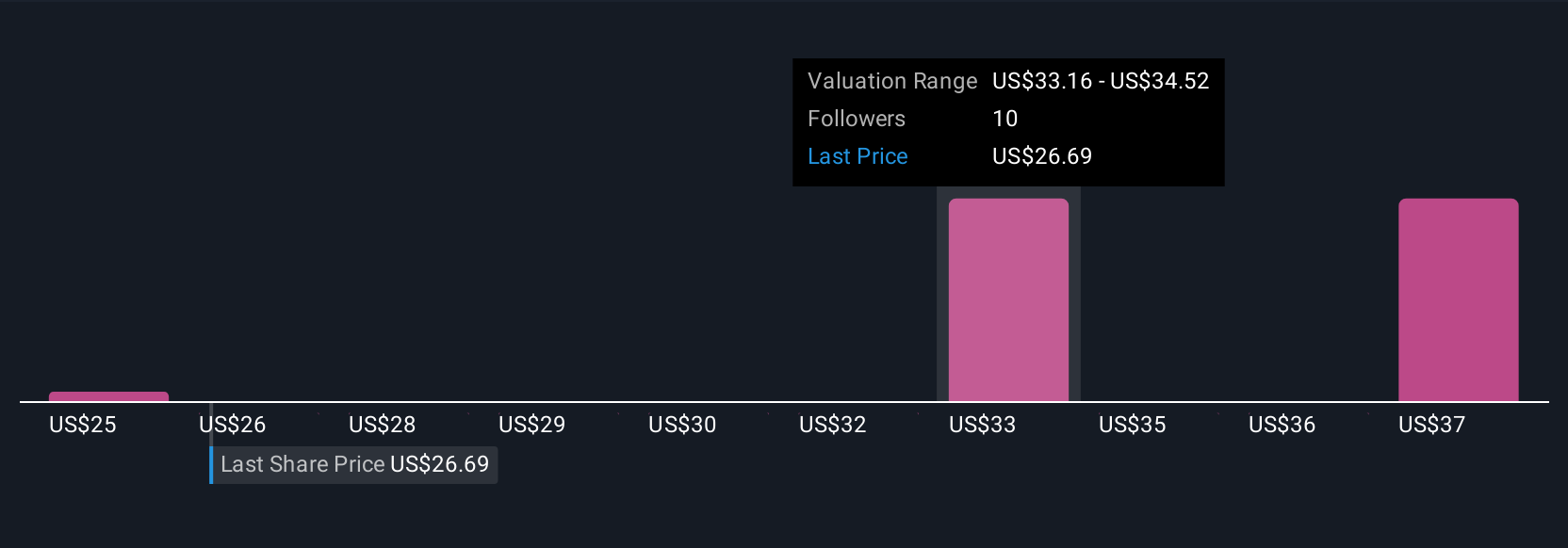

HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 14%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth as much as 43% more than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English