Valley National (VLY) Is Up 8.6% After July Inflation Data Fuels Fed Rate Cut Hopes

- Recently, Valley National Bancorp benefited from improved investor confidence following a favorable July Consumer Price Index report, which showed annual inflation holding steady at 2.7% and boosted expectations for a potential Federal Reserve interest rate cut in September.

- This inflation data has led to increased optimism for banks, as a rate cut could stimulate lending activity and broader economic growth, influencing the outlook for financial institutions like Valley National Bancorp.

- We’ll explore how anticipation of a Federal Reserve rate cut may shape Valley’s investment narrative and prospects for growth and earnings.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Valley National Bancorp Investment Narrative Recap

Shareholders in Valley National Bancorp are essentially investing in the belief that regional banks with strong deposit growth and diversified lending can outpace local economic headwinds and regulatory pressures. The recent optimism from a steady inflation reading points to an increased likelihood of Federal Reserve rate cuts, a clear short-term catalyst for lending margins, though the company's persistent exposure to commercial real estate and region-specific risks remains a central concern that could overshadow near-term gains if not managed carefully.

The company's latest Q2 2025 results are especially relevant, as Valley National Bancorp reported rising net interest income and improved profitability. Against the backdrop of potential rate cuts, these results highlight that the current earnings momentum may align well with favorable changes in monetary policy, but underlying credit quality trends and charge-offs continue to merit close attention.

Yet, in contrast to the recent rally, investors should remain aware that Valley’s significant presence in New Jersey and New York still means exposure to ...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp is projected to reach $2.5 billion in revenue and $807.5 million in earnings by 2028. This outlook assumes a 16.6% annual revenue growth rate and an earnings increase of $381.8 million from the current earnings of $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $10.75 fair value, a 7% upside to its current price.

Exploring Other Perspectives

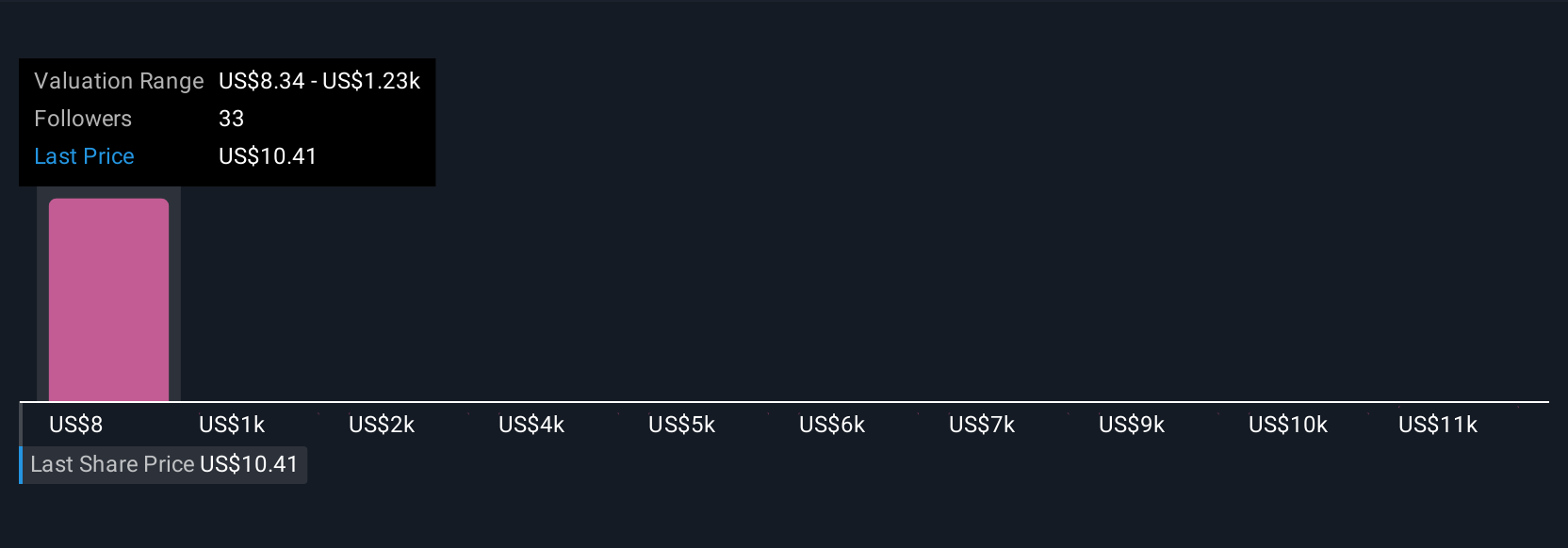

Five private investors in the Simply Wall St Community place fair value estimates for Valley National Bancorp stock between US$8.34 and US$12,190.04. While some forecast strong long-term revenue growth, persistent geographic and asset concentration risks continue to shape debate around the bank’s earnings consistency and resilience, inviting you to explore different viewpoints on what drives the company’s outlook.

Explore 5 other fair value estimates on Valley National Bancorp - why the stock might be a potential multi-bagger!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English