Some Emperor Watch & Jewellery Limited (HKG:887) Shareholders Look For Exit As Shares Take 30% Pounding

The Emperor Watch & Jewellery Limited (HKG:887) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 148%.

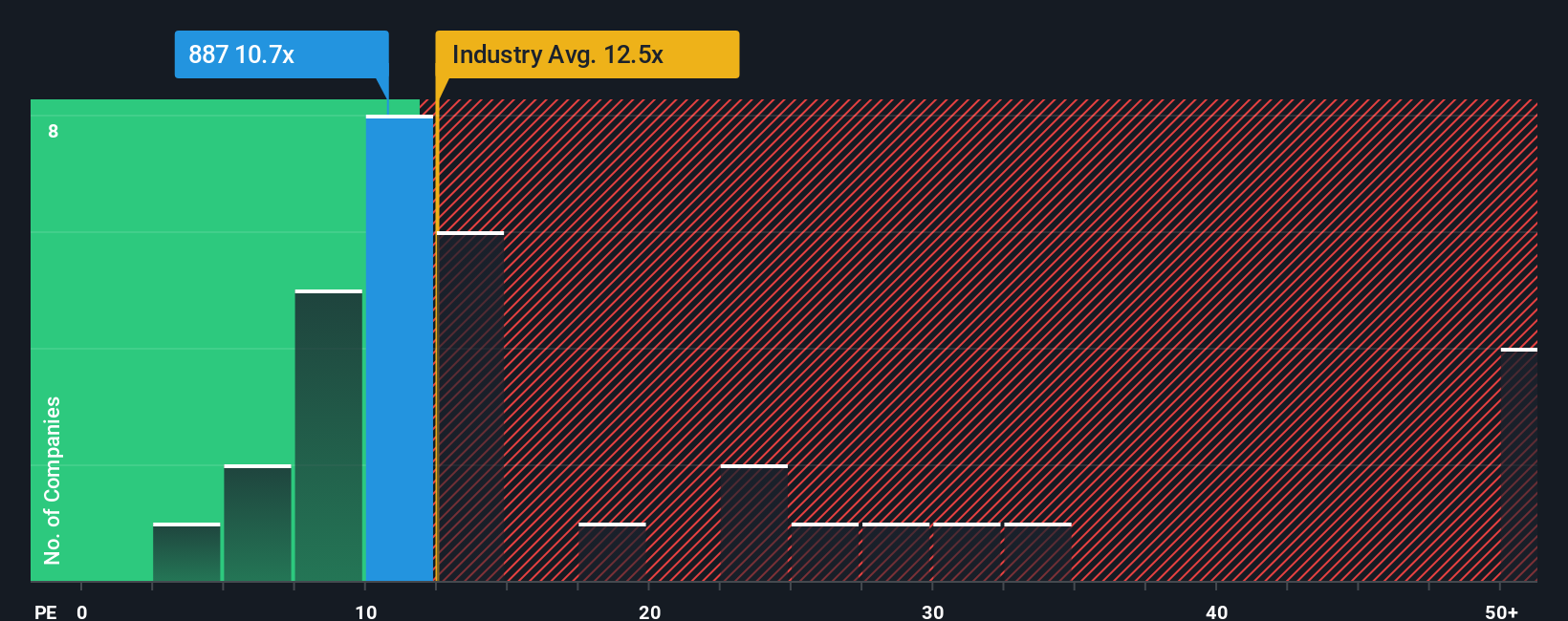

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Emperor Watch & Jewellery's P/E ratio of 10.7x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Emperor Watch & Jewellery over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Emperor Watch & Jewellery

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Emperor Watch & Jewellery's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Emperor Watch & Jewellery's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Emperor Watch & Jewellery's P/E

Following Emperor Watch & Jewellery's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Emperor Watch & Jewellery revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Emperor Watch & Jewellery (1 can't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Emperor Watch & Jewellery, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English