Is Clover Health (CLOV) Reassessing Its Path to Profitability After Latest Shift to Net Loss?

- Clover Health Investments, Corp. recently reported its second quarter 2025 results, highlighting a net loss of US$10.58 million, a reversal from net income of US$7.41 million in the same period last year.

- This swing from profit to loss signals a meaningful shift in the company’s recent financial performance, likely influencing how investors view the business’s operational trajectory.

- We’ll explore how the move from net income to net loss may impact Clover Health’s roadmap toward profitability and growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Clover Health Investments Investment Narrative Recap

To own shares of Clover Health Investments, an investor needs to believe in the company's ability to leverage its technology-driven care model and Medicare Advantage focus to drive long-term growth and work toward sustainable profitability. The recent swing from net income to a net loss in the second quarter is a setback but does not appear to materially change the most important short-term catalyst, securing the 4-star rating payment upgrade for its PPO plans in 2026, though it may add to concerns about profit consistency, which remains the primary risk.

Among recent announcements, the addition of Clover Health to major Russell indices in June 2025 stands out as particularly relevant. This index inclusion can boost visibility and potentially increase liquidity, supporting near-term investor interest, especially as ongoing operational performance and progress toward profitability remain in focus for both analysts and shareholders.

By contrast, those considering an investment should also keep in mind the company’s exposure to risks tied to elevated medical and pharmacy utilization...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments' outlook projects $3.0 billion in revenue and $160.1 million in earnings by 2028. This scenario assumes a 22.8% annual revenue growth rate and a $202.2 million increase in earnings from the current level of $-42.1 million.

Uncover how Clover Health Investments' forecasts yield a $3.65 fair value, a 38% upside to its current price.

Exploring Other Perspectives

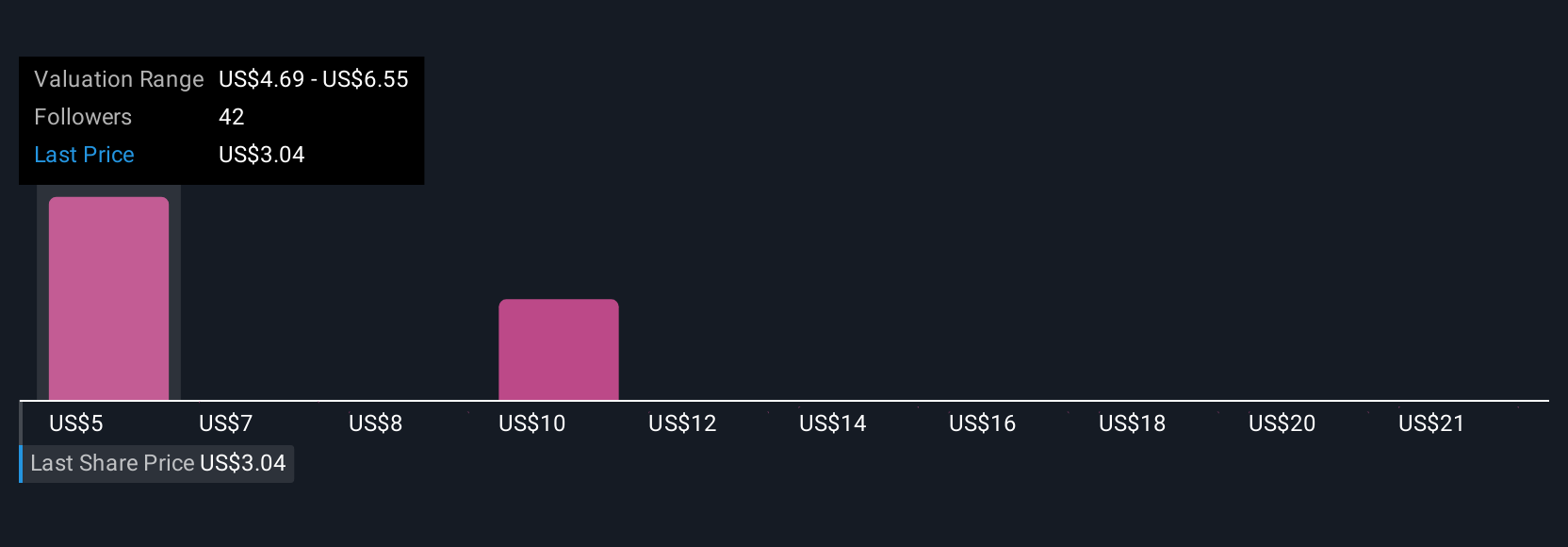

Twelve members of the Simply Wall St Community valued Clover's shares between US$3.65 and US$23.32 before this quarter's loss was reported. While many see upside in the 4-star payment catalyst, keep in mind that profit volatility remains a central concern for the company’s future returns.

Explore 12 other fair value estimates on Clover Health Investments - why the stock might be worth over 8x more than the current price!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English