Globus Medical’s Strong Q2 and Buyback Might Change The Case For Investing In GMED

- Globus Medical reported strong second-quarter 2025 results, with sales of US$745.34 million and net income of US$202.85 million, along with reaffirmed full-year revenue guidance of US$2.80 billion to US$2.90 billion.

- The company completed a share buyback of 411,000 shares for US$24.99 million, signaling ongoing confidence in its capital allocation strategy.

- We’ll now explore how Globus Medical’s robust earnings growth and reaffirmed guidance influence its broader investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Globus Medical Investment Narrative Recap

Owning shares in Globus Medical means buying into the view that demand for innovative spine and orthopedic solutions, next-generation robotics, and successful acquisitions will translate into sustained growth and higher earnings. The company's latest quarterly results, with significant improvements in sales and profitability alongside reaffirmed annual revenue guidance, reinforce the strength of its core business drivers. However, these results do not materially change the immediate risks tied to integration of recent acquisitions or challenges in international expansion, both of which remain important for near-term investor focus.

Among recent announcements, the substantial year-over-year jump in net income, from US$31.76 million to US$202.85 million, and higher earnings per share stand out most. These strong results reflect both improved operational execution and the potential early momentum from recent acquisitions and new product launches, supporting optimism around earnings catalysts for the rest of the year. Yet, as positive as this is, investors should keep in mind that...

Read the full narrative on Globus Medical (it's free!)

Globus Medical's narrative projects $3.4 billion revenue and $538.8 million earnings by 2028. This requires 9.0% yearly revenue growth and a $182.2 million earnings increase from $356.6 million.

Uncover how Globus Medical's forecasts yield a $82.36 fair value, a 36% upside to its current price.

Exploring Other Perspectives

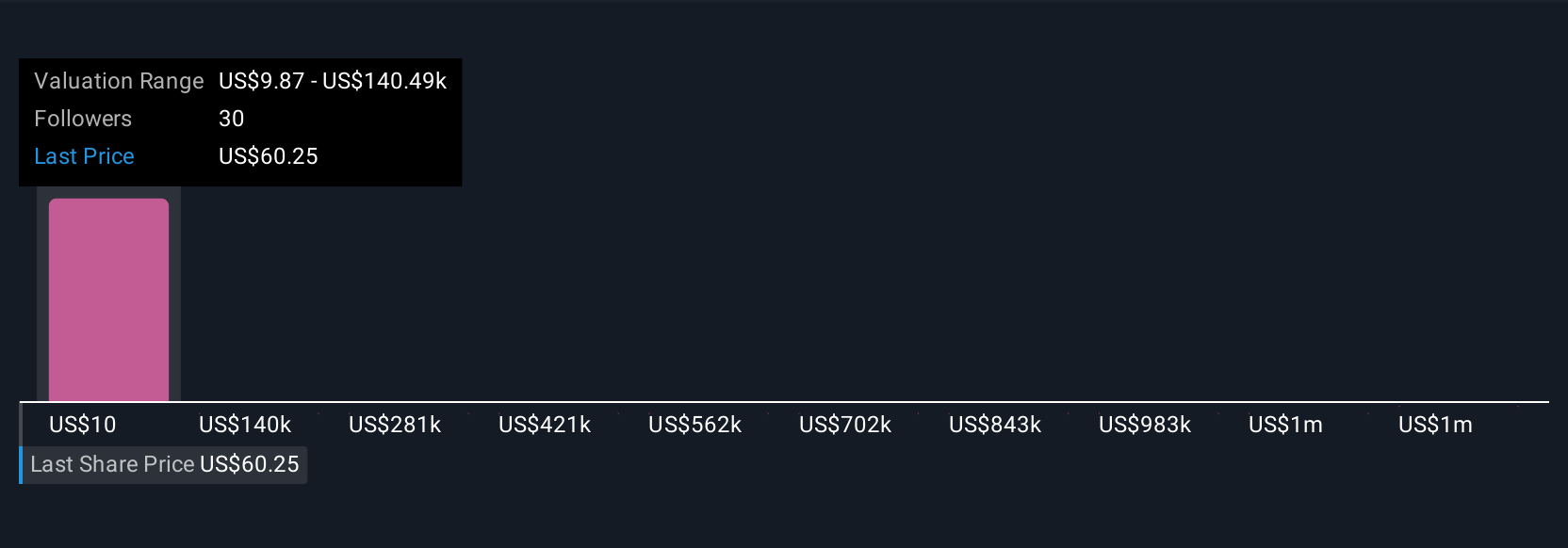

Five Simply Wall St Community members have assigned fair values ranging widely from US$9.87 to over US$1,404,794.88 per share. While so many opinions reflect differing conviction about Globus Medical's ability to integrate acquisitions, it is important to consider several viewpoints before forming your own outlook.

Explore 5 other fair value estimates on Globus Medical - why the stock might be a potential multi-bagger!

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English