5 Artificial Intelligence (AI) Stocks to Buy and Hold for the Next Decade

Key Points

Nvidia and Taiwan Semiconductor are slated to profit from the huge AI computing power buildout.

Meta Platforms and Alphabet are using AI to improve advertising.

Amazon's cloud computing division is seeing strong AI demand.

The best investing strategies involve buying great companies and holding them over long periods to let them be, which has yielded impressive returns if you picked the right businesses.

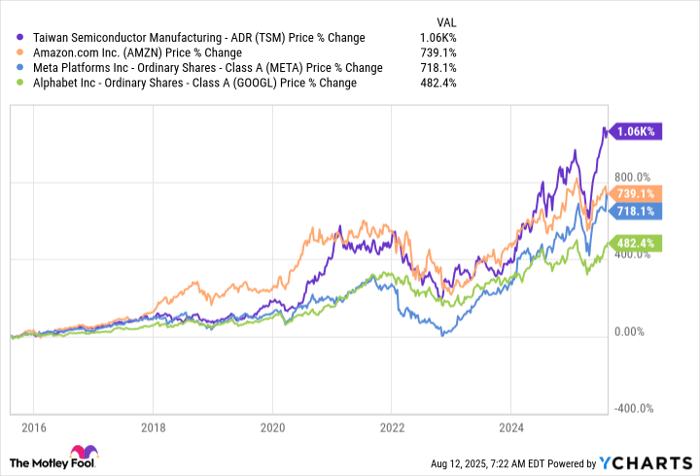

Among the top performers over the past decade have been Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). I removed Nvidia from the chart below because it's up over 30,000% in the past decade, which skews the graph, but the other four have also done phenomenally well.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The "worst" performer of the remaining four has been Alphabet, with its stock rising nearly five times in value.

These five stocks have had a strong run over the past decade, but I still believe they are excellent picks for the next decade, mainly due to the proliferation of artificial intelligence (AI). They are at the top of my list right now, and I think buying shares with the mindset of holding for the next decade is a wise investment strategy.

Image source: Getty Images.

Nvidia and Taiwan Semiconductor are providing AI computing power

All five of these stocks are benefiting in various ways from the AI race.

Nvidia makes graphics processing units (GPUs), which are currently the most popular computing hardware for running and training AI models. It owns this market, and its dominance has allowed it to become the world's largest company.

There's still a huge AI computing demand that hasn't been met, which bodes well for Nvidia's future. Because of this, it remains one of the best stocks to buy and hold over the next decade.

Taiwan Semiconductor (TSMC for short) is a manufacturer that produces chips for many of the major players in AI, including Nvidia. These companies don't have chip production capabilities, so they farm that work out to TSMC, which has earned its reputation for being the best foundry in the world through continuous innovation and impressive yields. There are few challengers to its supremacy, and this position will help it continue to be a market-crushing stock for the foreseeable future.

Nvidia and Taiwan Semiconductor are seeing huge growth right now because they're providing the computing power necessary for AI. The next three are also benefiting and will likely see even more success over the next decade.

More AI applications will rise over the next few years

At first glance, Amazon doesn't seem like much of an AI company. However, it has large exposure through its cloud computing wing, Amazon Web Services (AWS), which is the largest cloud computing provider.

It's seeing strong demand for increased computing capacity for AI workloads. With this demand expected to rapidly increase over the next decade, this bodes well for AWS, which makes up the majority of Amazon's profits, helping drive the stock to new heights.

Meta Platforms is developing its own in-house generative AI model, Llama. It has several uses for it, but the biggest is maintaining its role at the top of the social media world.

Meta owns two of the biggest social media platforms, Facebook and Instagram, which generate most of their money through ad revenue. The company has integrated AI tools into its ad services and has already seen an uptick in interaction and conversion rates. This effect will become even greater as generative AI technologies improve, making Meta a strong stock pick for the next decade.

Lastly is Alphabet. Many think Alphabet will be displaced by AI because it gets the majority of its revenue through Google Search, which is seen as a target for AI disruption. However, that hasn't happened yet, and Google Search continues to get larger, with revenue rising 12% in the second quarter.

Part of its success can be attributed to the rise of its Search Overviews, which are a hybrid between a traditional search engine and generative AI. This feature has become popular and could be enough to keep Google on top in search, allowing it to achieve new heights over the next decade.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English