How Investors Are Reacting To UTI’s Earnings Beat and Skilled Trades Expansion in San Antonio

- Earlier this month, Universal Technical Institute reported higher third-quarter and year-to-date earnings, updated its fiscal 2025 guidance upward, and announced leadership changes at its San Antonio campus to support its skilled trades expansion.

- The addition of advanced EV diagnostic tools at multiple campuses and recent insider share purchases reflect broad-based efforts to address evolving industry needs and suggest growing internal confidence in UTI’s direction.

- We'll now explore how the strong earnings update and San Antonio campus expansion influence Universal Technical Institute’s investment outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Universal Technical Institute Investment Narrative Recap

To be a Universal Technical Institute shareholder, you need to believe that sustained demand for skilled trades and technical training will drive enrollment growth and justify continued expansion, even as the company diversifies beyond its legacy auto and diesel programs. The recent San Antonio campus leadership appointment and robust Q3 earnings, while positive, do not materially lower the biggest risk: that accelerated investments in new campuses might not deliver proportional student demand, potentially impacting returns in the short term.

Of the recent announcements, the expanded partnership with TOPDON to provide advanced EV diagnostic tools at UTI campuses stands out. This initiative directly aligns with current industry shifts and could strengthen UTI's short-term catalyst by helping the company counter over-reliance on auto programs while preparing students for emerging transportation technology roles.

By contrast, investors should also be aware of the risk that rapid campus and program expansion could stretch resources and depress returns if new student demand falls short...

Read the full narrative on Universal Technical Institute (it's free!)

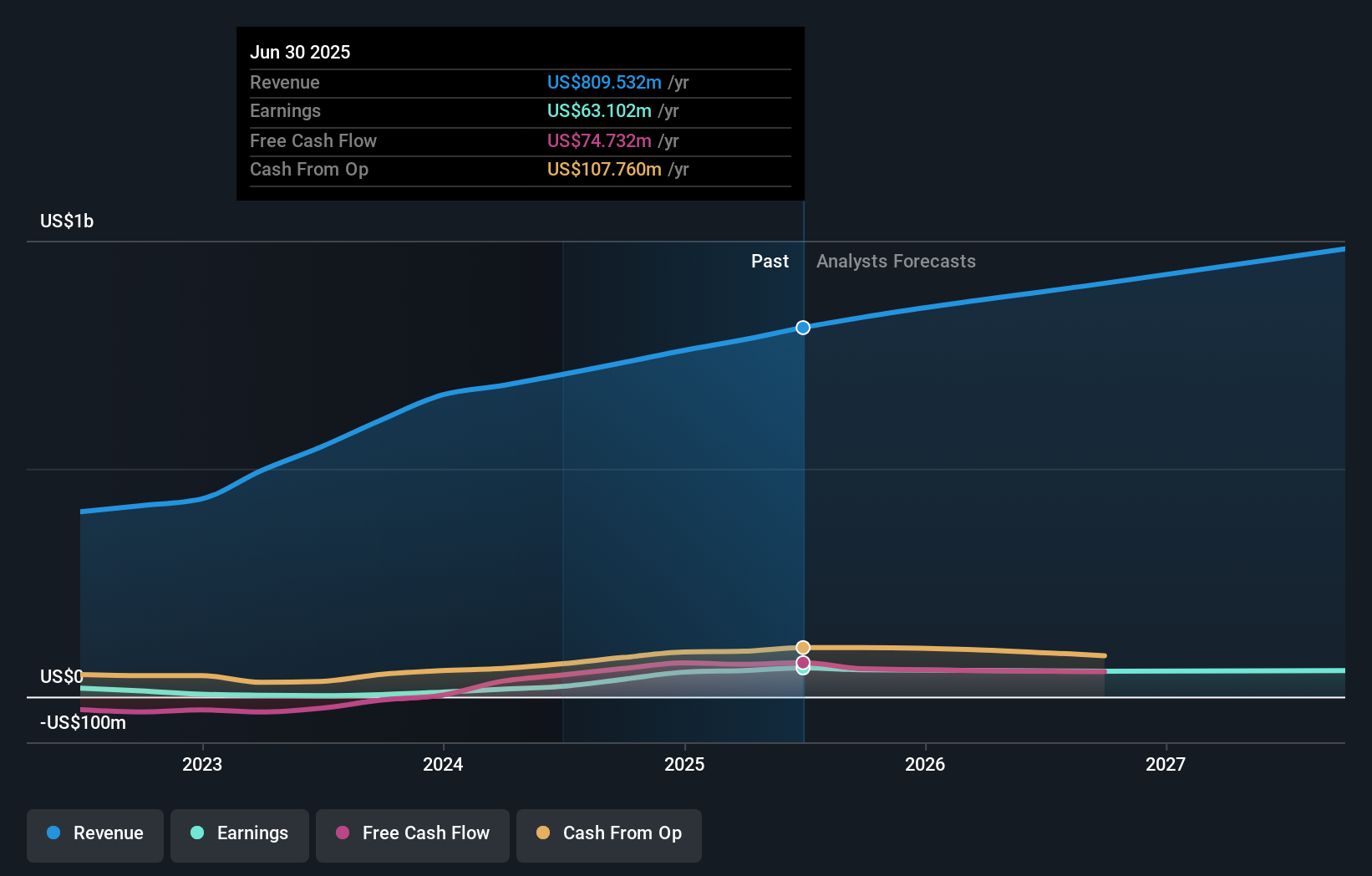

Universal Technical Institute's outlook anticipates $1.0 billion in revenue and $54.0 million in earnings by 2028. This is based on an 8.9% annual revenue growth rate, but earnings are expected to decrease by $9.1 million from the current $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Fair value opinions from the Simply Wall St Community range widely from US$18.19 to US$37.60, providing two different views on Universal Technical Institute’s true worth. Given the company’s recent capital allocation to new campuses and technology, the question of whether expansion translates to earnings growth remains central for many market participants, explore how your view compares.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth 30% less than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English