Did Icahn Enterprises' (IEP) Debt Raise and Smaller Loss Signal Strength or Just Buy Time?

- Icahn Enterprises recently completed a US$500 million senior secured notes offering due 2029 and reported second-quarter 2025 earnings, which included a narrower quarterly net loss year-over-year and the affirmation of its quarterly distribution.

- This combination of debt financing and financial results highlights the company’s efforts to manage its capital structure while continuing regular distributions despite ongoing net losses.

- We'll explore how the recent senior notes issuance shapes Icahn Enterprises’ investment story and impacts capital strength.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Icahn Enterprises' Investment Narrative?

For investors considering Icahn Enterprises, the big-picture proposition hinges on believing in the company’s ability to stabilize its capital structure and sustain distributions amid persistent operating losses and declining sales. The latest US$500 million senior secured notes issuance directly addresses near-term refinancing needs by targeting the redemption of higher-cost debt, but it also brings elevated interest costs that could weigh on future earnings. While the second-quarter 2025 results showed a reduced net loss year over year and the board reaffirmed its quarterly distribution, the company still faces challenges: falling sales, projected ongoing unprofitability, and concerns around dividend sustainability. Previously, short-term catalysts focused on dividend stability and potential cost reductions; after this debt refinancing, however, the biggest risk shifts further toward whether the business can generate enough cash flow to cover both interest and payouts without eroding value for shareholders.

Yet, the growing interest expense may reshape the profile of risk that investors need to keep in mind.

Exploring Other Perspectives

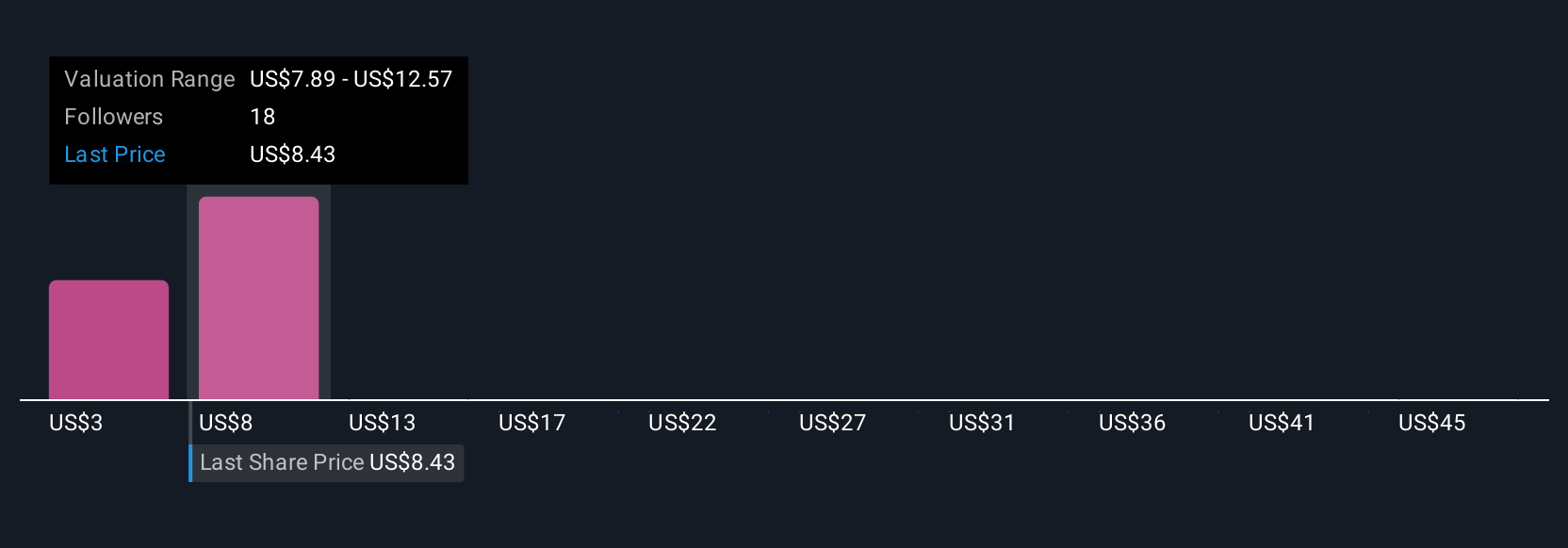

Explore 7 other fair value estimates on Icahn Enterprises - why the stock might be worth less than half the current price!

Build Your Own Icahn Enterprises Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Icahn Enterprises research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Icahn Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Icahn Enterprises' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English