Are Denali Therapeutics' (DNLI) Rising R&D Losses a Sign of Strategic Commitment or a Risk Factor?

- Denali Therapeutics announced its second-quarter and six-month 2025 financial results, reporting a net loss of US$124.12 million for the quarter and US$257.09 million for the half-year, both higher than the same periods last year.

- The company’s increasing net losses highlight ongoing investment in research and development as it advances its neuroscience-focused pipeline.

- We'll explore how the growing net losses impact Denali Therapeutics' investment narrative, particularly amid heightened spending on R&D initiatives.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Denali Therapeutics' Investment Narrative?

For a shareholder in Denali Therapeutics, the real test is belief in the long-term potential of the company’s neurodegenerative and rare disease pipeline, which is still some distance away from generating commercial revenue. The latest quarterly net losses, even higher than last year’s, reflect aggressive investment in research and development, as Denali pushes ahead, particularly with the anticipated FDA review of tividenofusp alfa for Hunter syndrome. While this increased spending intensifies the need for future fundraising or partnerships, most short-term catalysts, especially regulatory decisions for key pipeline candidates, appear to remain intact after this earnings release. For now, the bigger risks are the continued cash burn and dependency on capital markets, which have already seen volatility. The recent earnings update underscores the importance of progress in pivotal product approvals to keep investor confidence on track, although it does not materially shift the critical milestones ahead.

But with higher losses and no near-term revenues, funding risk looms larger than before.

Exploring Other Perspectives

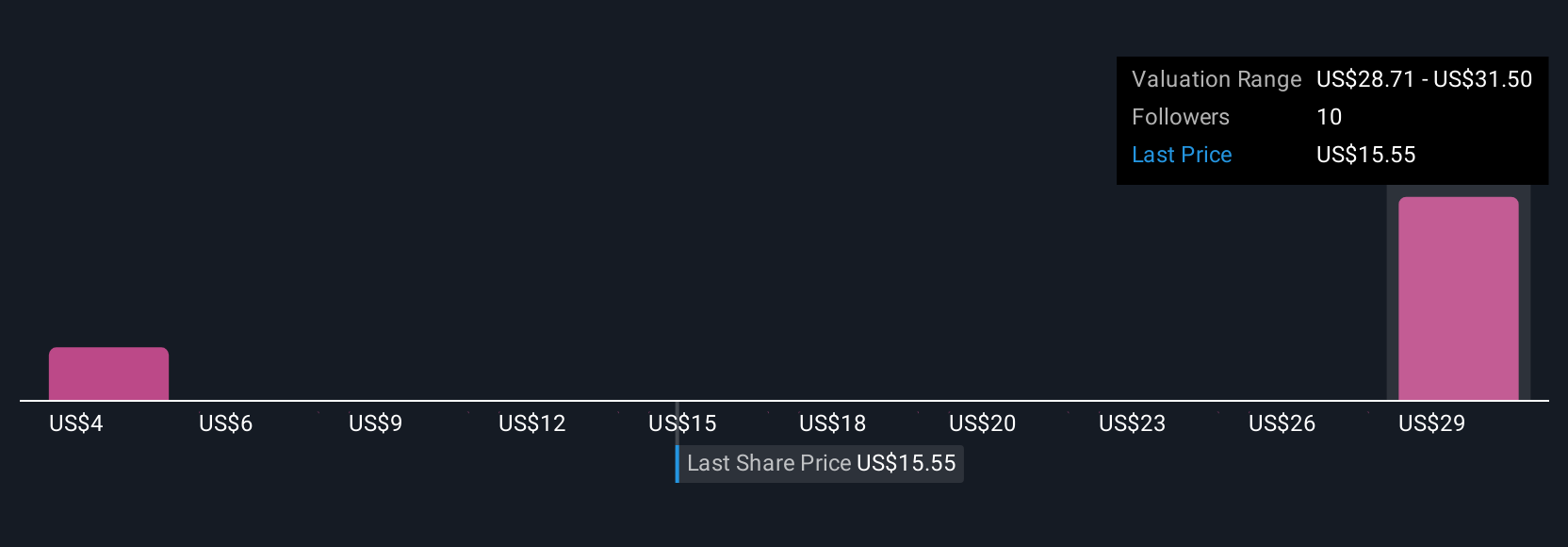

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English