Akamai Technologies Stock: Analyst Estimates & Ratings

With a market cap of $10.7 billion, Akamai Technologies, Inc. (AKAM) is a global leader in content delivery, cloud infrastructure, and security solutions. The company helps organizations accelerate digital experiences, safeguard applications and APIs, and optimize cloud performance for users worldwide.

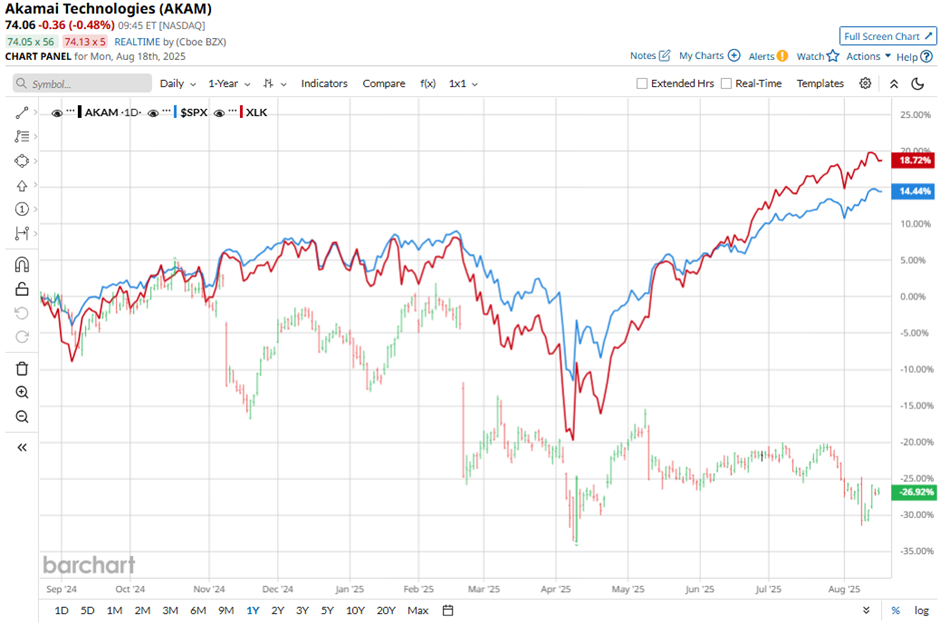

Shares of the Cambridge, Massachusetts-based company have underperformed the broader market over the past 52 weeks. AKAM stock has dropped 26.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.4%. Moreover, shares of Akamai Technologies have decreased 22.2% on a YTD basis, compared to SPX's 9.7% rise.

Looking closer, the cloud services provider stock has also fallen behind the Technology Select Sector SPDR Fund's (XLK) 20.2% return over the past 52 weeks.

Despite Akamai posting better-than-expected Q2 2025 results with adjusted EPS of $1.73 and revenues of $1.04 billion on Aug. 7, shares of AKAM fell 5.7% the next day. Investors reacted negatively to GAAP net income dropping 21% year-over-year to $103.6 million due to higher operating expenses of $892 million.

For the fiscal year ending in December 2025, analysts expect AKAM's EPS to dip 11.9% year-over-year to $4. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

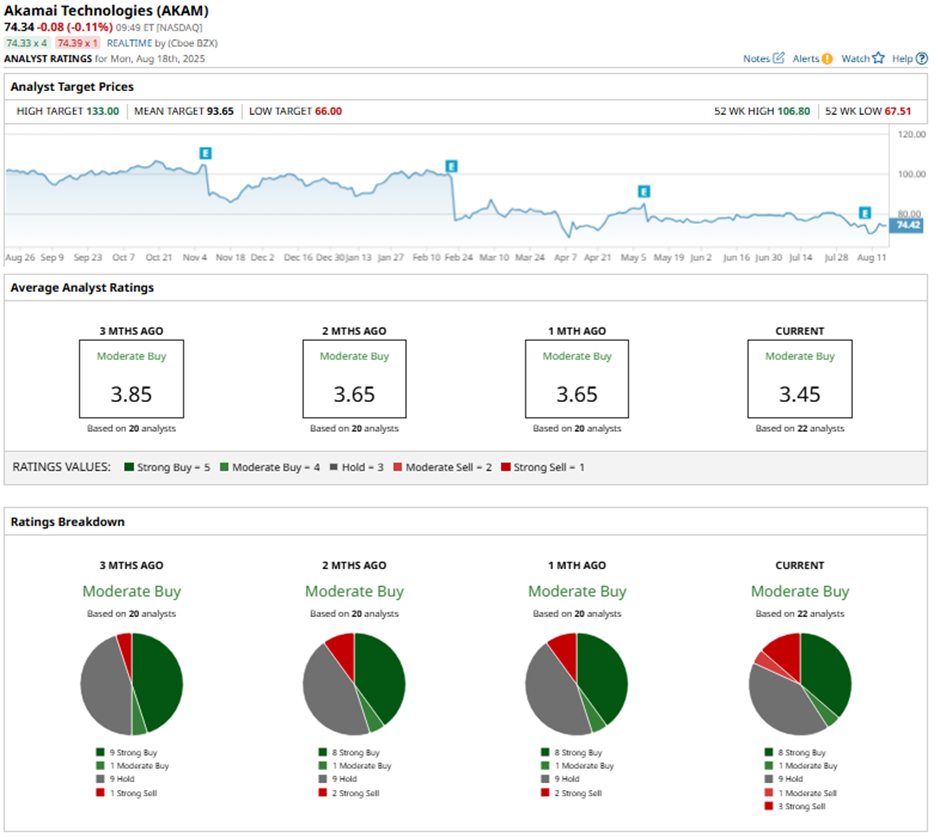

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buys,” one “Moderate Buy” rating, nine “Holds,” one “Moderate Sell,” and three “Strong Sells.”

On Aug. 8, Scotiabank lowered Akamai’s price target to $95 while maintaining an “Outperform” rating.

As of writing, the stock is trading below the mean price target of $93.65. The Street-high price target of $133 implies a potential upside of 78.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English