Is Cobra the Growth Engine That Can Drive QuantumScape Higher?

QuantumScape Corporation QS has long been one of the promising names in the EV battery race—big on potential but still chasing commercial scale. With the introduction of its Cobra separator process, the company may finally have the growth engine it needs to bridge that gap.

Cobra is not just an incremental upgrade. It’s a 25 times leap in heat treatment speed over the old Raptor process, while requiring far less factory space and energy. The combination is critical. It means QuantumScape can produce more cells faster and cheaper, while keeping the equipment footprint lean. For a company that must eventually manufacture at a gigawatt-hour scale, Cobra changes the economics of the game.

This milestone positions QuantumScape to start B1 sample shipments later this year, a necessary step toward real-world vehicle integration and field testing planned for 2026. In other words, Cobra is the key to moving QS from the lab to the road. Investors who have waited for signs of commercial readiness now have something concrete to track.

Higher throughput and efficiency lower the cost per unit, which could help QS compete in a cost-sensitive battery market. If the company executes on its 2025 production goals—boosting reliability, uptime and process stability—Cobra could underpin the scale required for partnerships and long-term revenue growth.

How Do QuantumScape’s Rivals Stack Up?

Solid Power SLDP is advancing sulfide-based solid-state batteries but takes a different route to commercialization. Solid Power focuses on producing electrolyte materials and licensing its technology to automakers like BMW and Ford. While this lowers capital intensity, Solid Power relies heavily on partners to achieve volume manufacturing success.

SES AI SES is developing lithium-metal batteries that combine high energy density with AI-driven monitoring systems. SES AI has partnerships with auto biggies like GM, Hyundai and Honda, positioning it within global supply chains. Still, SES AI is just gradually advancing toward battery commercialization, with large-scale production yet to be proven.

The Zacks Rundown on QuantumScape

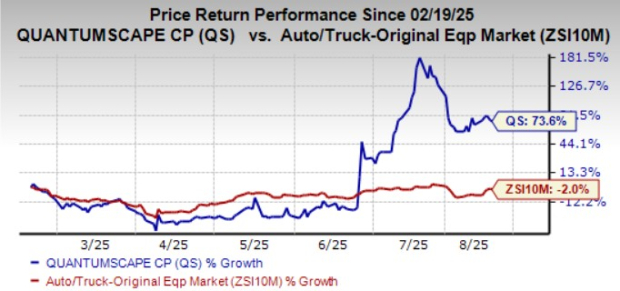

Shares of QS have increased around 74% over the past six months compared with the industry’s decline of 2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

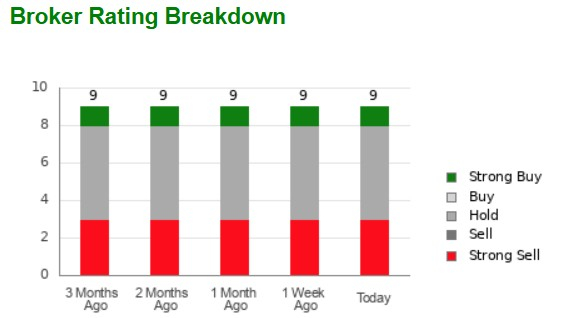

QuantumScape currently has an average brokerage recommendation (ABR) of 3.44 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by nine brokerage firms.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

See how the Zacks Consensus Estimate for QS’ earnings has been revised over the past 90 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SES AI Corporation (SES): Free Stock Analysis Report

QuantumScape Corporation (QS): Free Stock Analysis Report

Solid Power, Inc. (SLDP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English