How to Play INTC Stock as the Intel Soap Opera Turns from Horror to Suspense

The last year hasn’t been anything short of a rollercoaster ride for Intel (INTC). It has been a soap opera of sorts, oscillating between horror and suspense for investors. The most recent addition to the saga is a report that the U.S. government is considering taking a stake in the beleaguered chipmaker. In this article, we’ll look at Intel’s outlook in light of these reports. But before that, let’s examine how Intel’s story unfolded.

Over the last year, Intel has experienced a lot, but unfortunately, not much has been positive for its stakeholders. It began with the disastrous Q2 2024 earnings release, which sent its stock south by 26%, its worst single-day performance in five decades.

The Intel Soap Opera: A Timeline of How We Got Here

Intel also suspended its dividend while announcing a 15% reduction in its workforce, the biggest cut in history. Things didn’t improve thereafter, and the company posted a record loss of $16.6 billion in Q3 2024. In December, Intel’s then-CEO Pat Gelsinger was pushed out as his transformation strategy, particularly the pivot to the foundry business, turned out to be disastrous. The company subsequently announced Lip-Bu Tan as his replacement, who is also trying his hand at turning around the once-iconic chip company.

In a July filing, Intel warned that it might need to exit the foundry business as despite burning billions of dollars on that business, Intel hasn’t been able to sign up any significant customers.

Is Intel Up for Sale?

The rumor mill has been running hot when it comes to Intel, and Qualcomm (QCOM), Taiwan Semiconductor Manufacturing Company (TSM), and Arm Holdings (ARM) have been said to have expressed interest in the company. Some reports even suggested that President Donald Trump put TSM's taking a stake in Intel as a precondition for a trade deal with Taiwan.

The relations between Trump and Intel have been volatile at best. The president was critical of the CHIPS and Science Act, of which Intel was the biggest beneficiary. Trump, however, has not unravelled the legislation.

Trump recently called Intel CEO “compromised,” asking him to “resign immediately.” However, he soon termed him a “success story” after a White House meeting. Shortly after that meeting, reports surfaced that the U.S. government is considering taking a stake in Intel.

The reports don’t exactly look like a fantasy, even though it's quite unusual for the U.S. government to invest in private companies, especially in a near-normal economy as we have now. However, Intel’s position as the only U.S.-based chipmaker makes it strategically important to the country, given the artificial intelligence (AI) euphoria-fueled rise in chip demand. On a similar note, the U.S. government took a stake in MP Materials (MP), which is the only rare earth producer and processor in the country.

INTC Stock Forecast

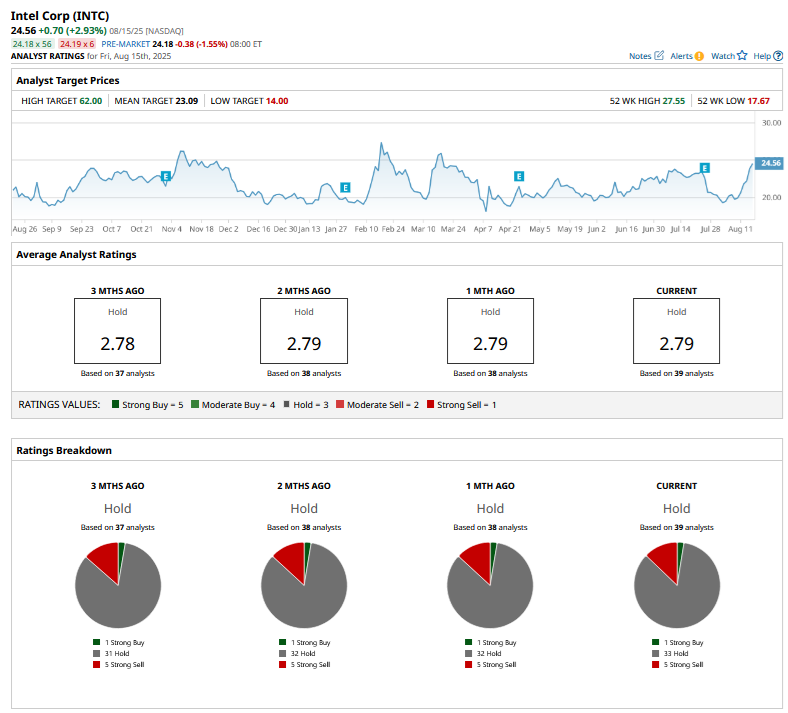

Intel’s recent price action has been driven by rumors and speculation, which may or may not materialize. Sell-side analysts have been on the sidelines when it comes to Intel, and nearly 85% actively covering INTC rate it as a “Hold” or some equivalent. Thanks to the recent rally in Intel stock, it has run ahead of the mean target price of $23.09.

Should You Buy Intel Stock?

Intel is a key piece of the manufacturing onshoring story that the Trump administration is pushing hard for. The company has spent billions of dollars in developing its 18A production process, which it believes will be the “foundation of at least next 3 generations of Intel client and server products.”

However, while Intel sounded quite optimistic about the 18A during the Q2 2025 earnings call last month, a Reuters report later said that it is facing quality issues. Intel is already running behind TSM in manufacturing technology, and any issues with 18A will kill the hopes of bridging that gap.

Intel’s balance sheet is also quite stretched with a debt pile of $44 billion at the end of June, which has prompted rating downgrades by leading credit rating agencies, most recently from Fitch.

Talking of valuations, given its depressed near-term earnings, the forward price-earnings multiple looks redundant. The stock’s forward price-sales multiple of 2.06x is a slight discount to the average multiples over the last three years, but it should be seen in the context of its financial and operating performance, where it continues to lag behind peers by a mile. Intel trades at just about its book value, which would have suggested undervaluation under normal circumstances.

All said, Intel is a key moving part of the U.S. manufacturing ecosystem, and the Trump administration is taking an interest in the company for a reason. While I don’t find the current price levels too attractive to add more to my position in Intel, I continue to stay invested as Intel explores its future with steering from the Trump administration.

On the date of publication, Mohit Oberoi had a position in: INTC . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English