Inter & Co (INTR) Is Up 5.7% After Q2 Earnings Beat With Strong Net Interest Income Growth

- On August 6, 2025, Inter & Co reported second quarter earnings with net interest income rising to R$1.47 billion and net income growing to R$315.13 million, both higher than the previous year.

- Strong earnings per share growth highlights effective operational execution and improved profitability, reflecting the company's momentum in digital banking and financial services.

- We'll explore how this robust year-over-year net interest income increase may influence Inter & Co's future growth outlook and risk profile.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Inter & Co Investment Narrative Recap

For investors interested in Inter & Co, the core belief is that the digital bank can keep scaling its rapidly growing client base and cross-sell more high-margin financial products, driving sustainable revenue and profit expansion. The strong second quarter results, with higher net interest income and earnings, reinforce optimism around recent momentum and strengthen the case for ongoing revenue growth, the key short-term catalyst. However, the high share of lending to riskier segments and potential non-performing loan spikes remain a central risk in the background.

Among recent developments, the appointment of a seasoned Global Chief Legal Officer earlier this year stands out, particularly as it could bolster Inter & Co's compliance and regulatory foundation amid ongoing business expansion. This is increasingly relevant given the company's ambition to scale new products and manage risks associated with a growing and diversified loan book.

But with loan growth targets still aggressive, investors should watch carefully for any signs that...

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.8 billion revenue and R$2.9 billion earnings by 2028. This requires 37.4% yearly revenue growth and a R$1.8 billion earnings increase from R$1.1 billion today.

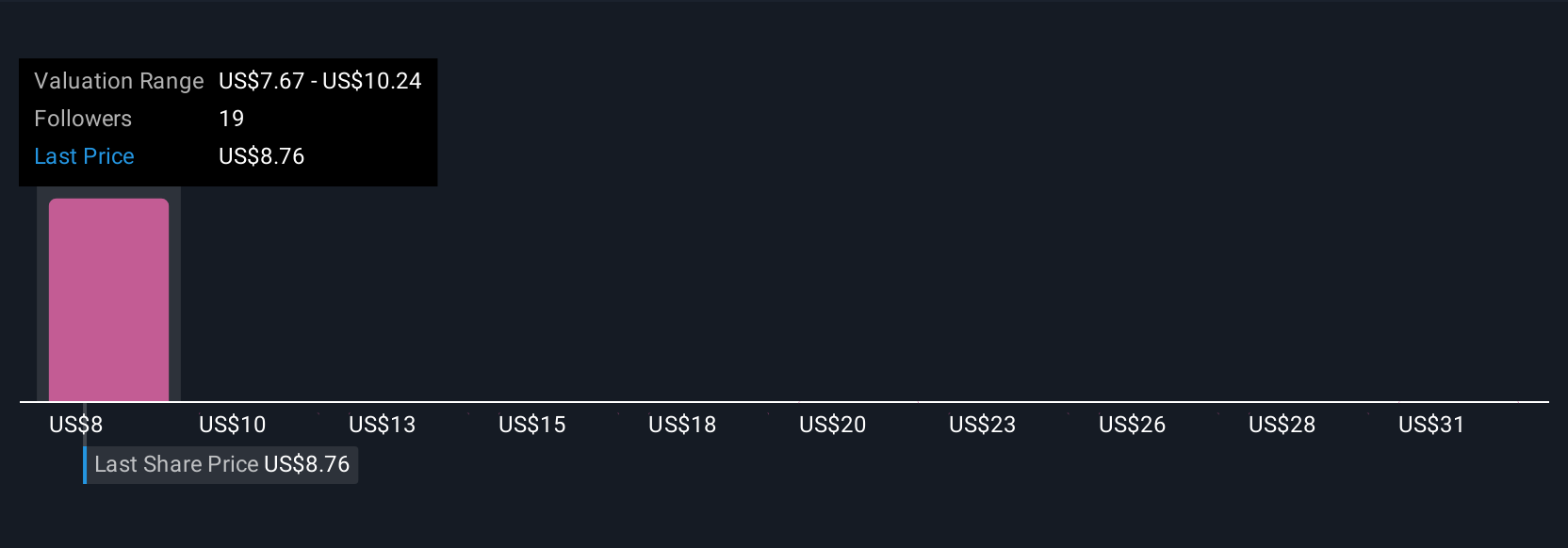

Uncover how Inter & Co's forecasts yield a $8.09 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Inter & Co's fair value between R$7.97 and R$33.30. While some anticipate accelerated revenue growth, views on credit quality and margin risk suggest the company's performance could take several different paths, explore these diverse perspectives to inform your view.

Explore 5 other fair value estimates on Inter & Co - why the stock might be worth just $7.97!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English