Is Spectrum Brands Holdings’ (SPB) M&A Focus and Share Buyback Shaping Its Growth Trajectory?

- Spectrum Brands Holdings reported third quarter earnings showing net income growth to US$19.9 million despite lower sales of US$699.6 million, and completed a significant share buyback totaling over 4.74 million shares for US$384.45 million.

- Management also highlighted active efforts to pursue accretive acquisitions in Pet and Home & Garden businesses, signaling a focus on both organic and inorganic growth for the future.

- We will explore how management's emphasis on M&A to address product gaps may influence the company's investment thesis and outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Spectrum Brands Holdings Investment Narrative Recap

To be a shareholder in Spectrum Brands Holdings today, you need to believe management can leverage a “super healthy” balance sheet and disciplined M&A to accelerate growth in core pet and home & garden segments, despite soft category demand and margin pressures. The latest acquisition push may complement the company’s focus on product gaps and margin improvement, but it does not yet alter the primary risk: ongoing sales headwinds from consumer softness and heightened retail bargaining power.

Among recent updates, Spectrum’s completed US$384.45 million share buyback stands out in the context of short-term catalysts. Reducing the float could support earnings per share, but with persistent input cost volatility and supply chain dependence, the efficacy of this move for supporting margin recovery in the near term remains uncertain.

Yet, against this backdrop, investors should be aware of the persistent challenge of private label expansion and retailer consolidation, especially when...

Read the full narrative on Spectrum Brands Holdings (it's free!)

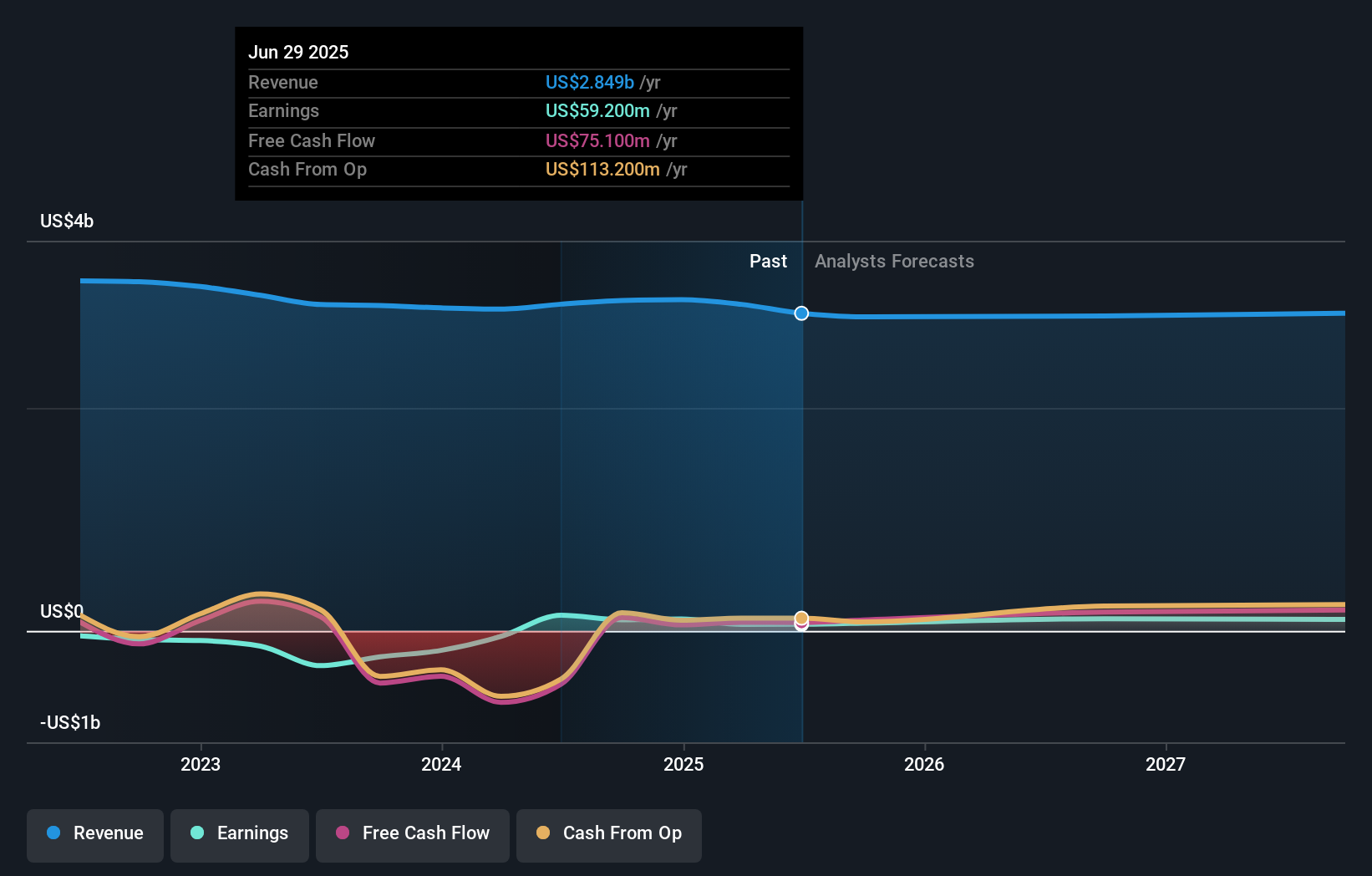

Spectrum Brands Holdings' outlook foresees $2.9 billion in revenue and $126.2 million in earnings by 2028. This reflects a 0.6% annual revenue decline and a $67 million increase in earnings from the current $59.2 million.

Uncover how Spectrum Brands Holdings' forecasts yield a $78.71 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Spectrum Brands span from US$78.71 to US$235.12 based on 2 individual analyses. While expanding its pet platform is seen as a potential growth driver, the breadth of these valuations reminds you to consider how forces like shifting retailer dynamics may impact future results.

Explore 2 other fair value estimates on Spectrum Brands Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Spectrum Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Spectrum Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spectrum Brands Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English