GEO Group (GEO): Valuation Analysis Following Profit Turnaround, Higher Guidance, and Major Share Buyback

If you have been following GEO Group lately, there is plenty to talk about. The company just reported a strong turnaround in its latest earnings, swinging from a loss last year to a solid profit and increased revenue. In addition, management updated full-year guidance to forecast much higher net income, largely due to a significant facility sale. The company also announced a $300 million share buyback program. These developments have put the company back in the spotlight and might have investors wondering whether this momentum will continue.

Examining the stock’s performance over the past year, GEO Group’s share price has climbed more than 62%, making it one of the stronger names in its sector. However, that headline gain does not show the recent volatility. Shares have dropped about 18% in the past three months and are down 23% year to date. The short-term decline contrasts with the company’s three- and five-year returns, both of which have seen triple-digit growth. Recent news on earnings and buybacks has fueled speculation that sentiment may be changing again.

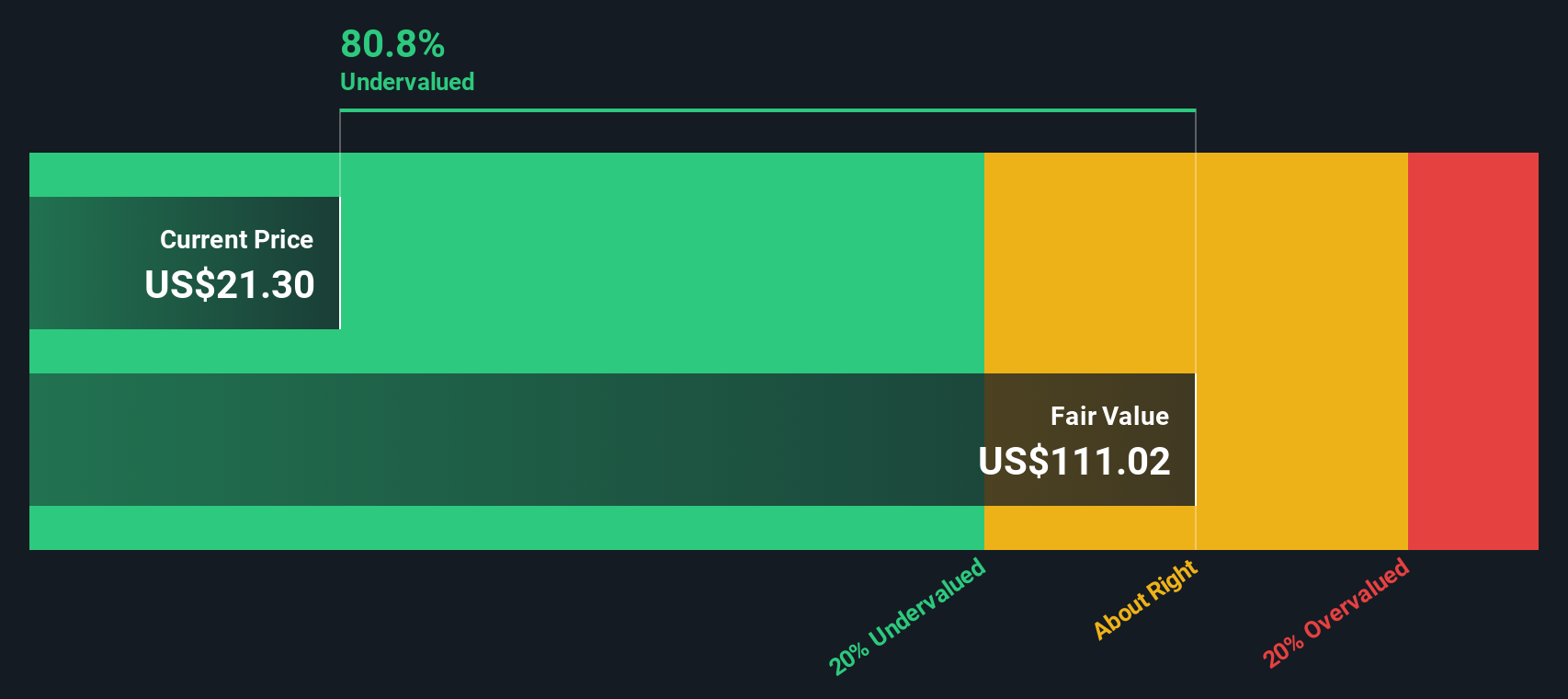

With the company posting clear improvements and buying back its own shares, the question remains whether GEO Group is trading at a discount to its fundamentals, or if the market has already incorporated expectations for the next phase of growth.

Most Popular Narrative: 44% Undervalued

According to community narrative, GEO Group is considered significantly undervalued based on analysts' consensus, which sees current prices lagging behind projected fair value. This view incorporates strong future earnings expectations and detailed forecasts for revenue expansion, margin growth, and contract wins.

The recent surge in federal funding for immigration enforcement and detention—$171 billion for border security and $45 billion earmarked for ICE detention, along with multi-year discretionary spending authority—creates a multi-year runway for substantial increases in facility activations, utilization, and new contract wins. These factors are expected to directly drive top-line revenue growth and EBITDA expansion through at least 2029.

Do you think the current GEO share price already factors in all the good news? You might want to look closer. This narrative is driven by unusually ambitious financial projections and margin expansion, framed by some of the sector's boldest PE expectations. Curious about the key metrics underpinning this valuation? The full narrative reveals the notable numbers and strategic assumptions analysts use to build their case for a major price move.

Result: Fair Value of $39.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, shifts in federal funding or policy could quickly dampen the outlook, limiting contract wins and curbing GEO Group’s expected revenue and profit growth. Find out about the key risks to this GEO Group narrative.Another View: Discounted Cash Flow Model

While analysts see GEO Group as significantly undervalued based on future profits and industry trends, our DCF model takes a different approach. This method estimates value from the company’s projected cash flows instead. The result? It also indicates GEO is undervalued, but it relies more on long-term assumptions about cash generation rather than short-term earnings multiples. Which approach should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GEO Group Narrative

If you think the story plays out differently or want to dive deeper into the numbers yourself, you can shape your own perspective in just a few minutes. So why not do it your way?

A great starting point for your GEO Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t settle for just one compelling stock story. Uncover your next great investing opportunity with tailored stock ideas that can put you ahead of the crowd. Here are powerful ways you can start building a winning portfolio right now:

- Target higher income by checking out dividend stocks with yields > 3%, where you’ll access stocks offering attractive yields above 3 percent and the potential for ongoing cash returns.

- Get ahead of the curve with AI penny stocks, a resource to pinpoint AI-driven companies that may benefit as artificial intelligence transforms industries worldwide.

- Upgrade your strategy by searching undervalued stocks based on cash flows for companies currently trading below their intrinsic value based on cash flow fundamentals. This can help give you an edge in value investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English