Assessing MakeMyTrip (NasdaqGS:MMYT) Valuation Following Its Generative AI-Powered Myra Upgrade

MakeMyTrip (NasdaqGS:MMYT) just announced a bold upgrade to Myra, its AI-powered assistant, now infused with Generative AI that can help users plan and book their travel in both Hindi and English. This move is not just a cool tech update; it signals an intent to make seamless, conversational travel planning accessible to a broader slice of India’s population. With AI now guiding users through discovery, booking, and everything in between, it appears MakeMyTrip is aiming to lock in its position at the forefront of AI-driven hospitality in the region.

This new product launch comes at a time when the company’s share price has already seen some action. Over the past year, MakeMyTrip gained about 9%. It has also added roughly 1% in the past three months and about 6% in the last month alone. This suggests that momentum could be gathering now that growth initiatives like this are in the spotlight. With strong annual revenue and net income growth supporting the story, MakeMyTrip’s latest leap with Myra stands out as more than just another tweak to an app, especially in a sector where digital adoption drives competitive advantage.

After a year of solid gains and a burst of interest around the GenAI launch, the question remains: is the stock still priced for future growth, or does the current valuation leave room for upside from here?

Most Popular Narrative: 15.5% Undervalued

According to the community narrative, MakeMyTrip is currently trading at a meaningful discount to fair value. This suggests there could be potential upside if consensus forecasts are met.

Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, is positioning MakeMyTrip for higher conversion rates and better customer retention. This focus also supports expanding net margins through improved operating leverage.

Want to know the formula powering this bullish price target? There is an ambitious set of growth assumptions driving this double-digit gap between share price and fair value. These include big earnings increases, rising profit margins, and a valuation multiple that many companies aspire to achieve. Curious which aggressive financial forecasts are making analysts this optimistic? The full narrative outlines the bold projections and details where MakeMyTrip is expected to be in a few years.

Result: Fair Value of $120.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high customer acquisition costs and intensifying competition from both global and domestic players could present challenges for MakeMyTrip’s growth story.

Find out about the key risks to this MakeMyTrip narrative.Another View: Multiples Tell a Different Story

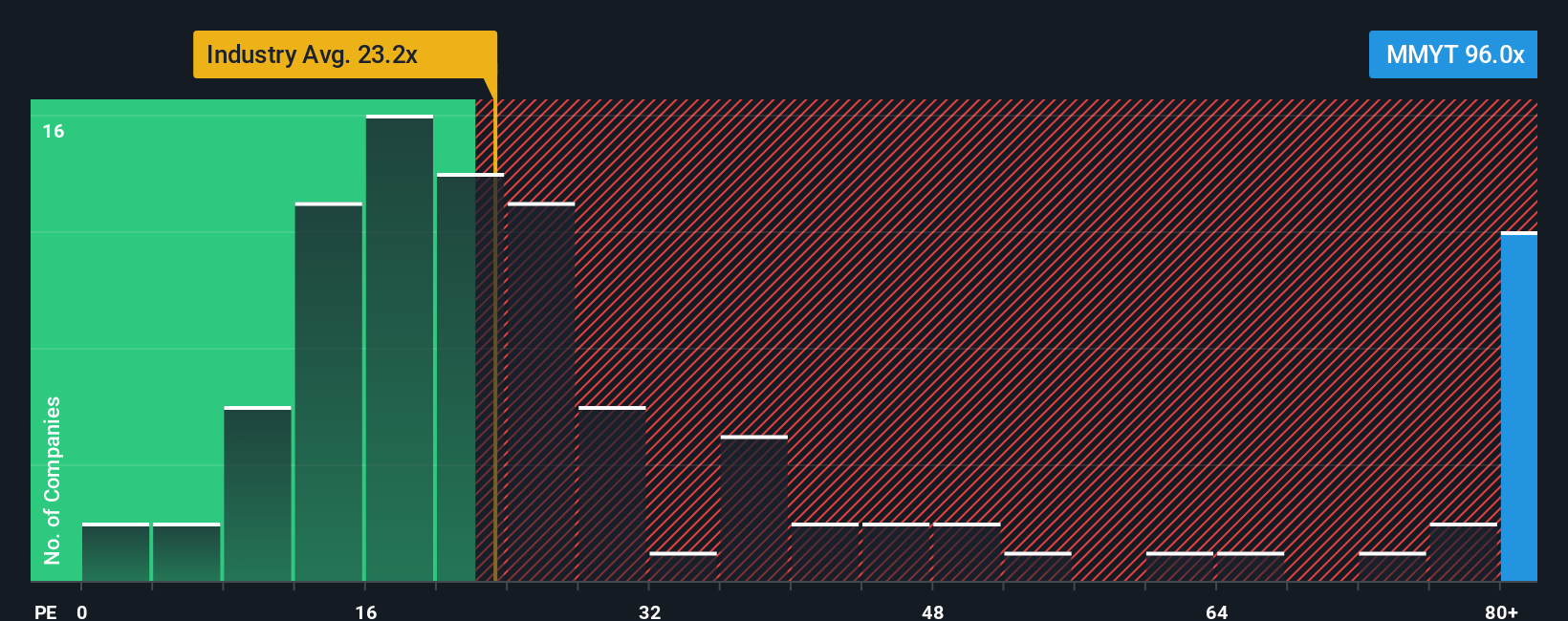

While analysts suggest the stock trades well below its fair value, the market’s most common gauge for hospitality companies actually tells the opposite. By this measure, MakeMyTrip appears much more expensive than its industry peers. The question remains whether the optimism is already reflected in the price, or if future performance will justify the bullish sentiment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If you have your own perspective or want to dig into the numbers directly, it takes less than three minutes to put together your own story. do it your way.

A great starting point for your MakeMyTrip research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on opportunities that could give your portfolio an edge. Whether you’re interested in value, consistency, or tomorrow’s breakthrough businesses, Simply Wall Street’s screener helps you spot companies with unique strengths. Discover your next big idea from these curated groups:

- Boost your income with stocks offering reliable payouts by tapping into dividend stocks with yields > 3%.

- Capitalize on the tech trend transforming medicine by uncovering pioneering businesses in healthcare AI stocks.

- Get ahead with undervalued companies that may be on the verge of a turnaround, found via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English