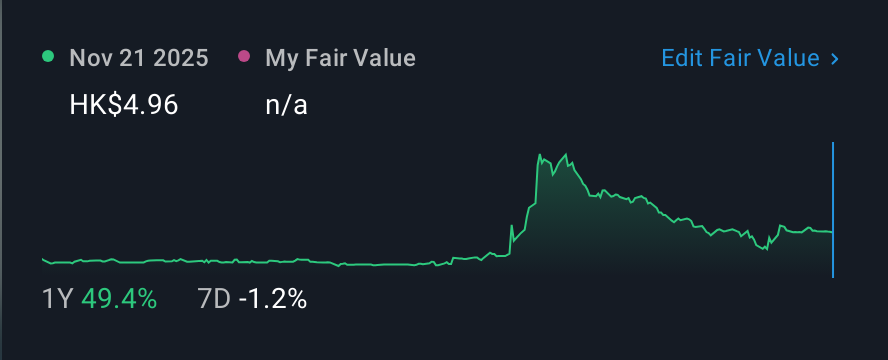

Victory Securities (Holdings) Company Limited (HKG:8540) Shares May Have Slumped 29% But Getting In Cheap Is Still Unlikely

The Victory Securities (Holdings) Company Limited (HKG:8540) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 118% in the last twelve months.

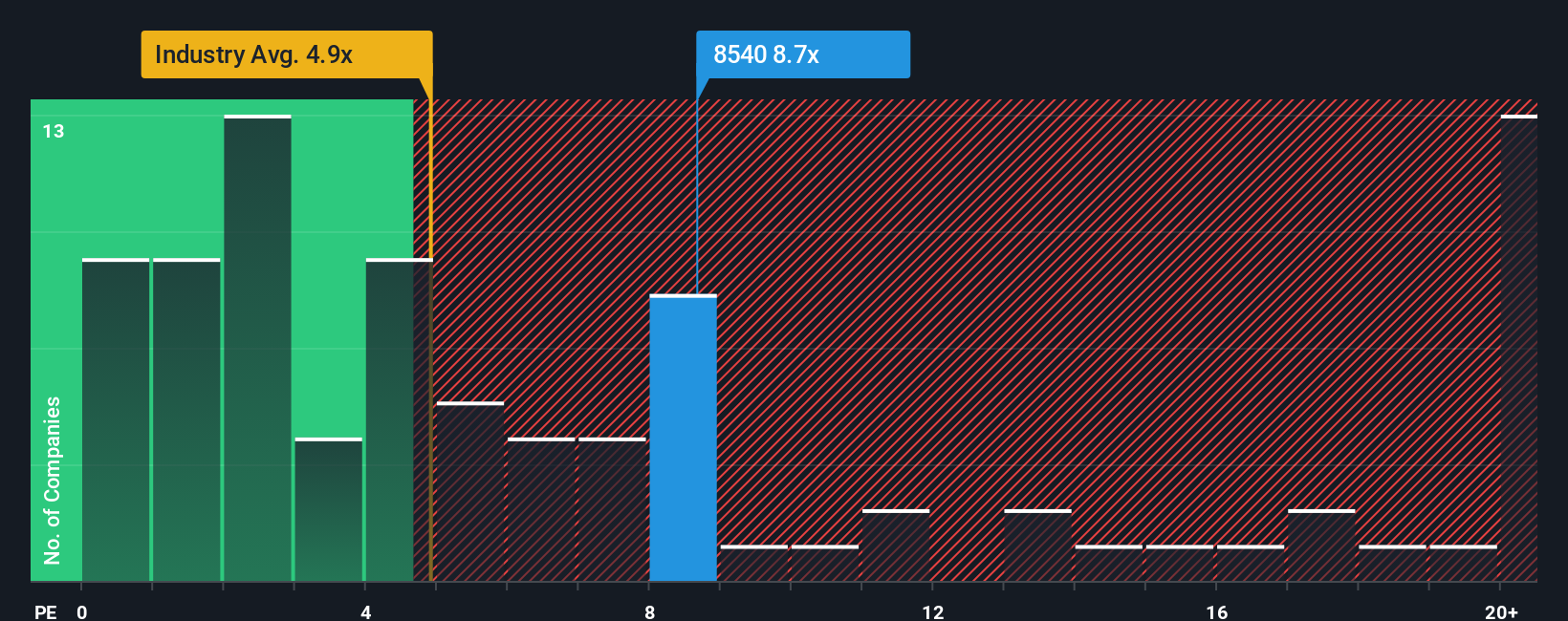

In spite of the heavy fall in price, Victory Securities (Holdings) may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.7x, when you consider almost half of the companies in the Capital Markets industry in Hong Kong have P/S ratios under 4.9x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Victory Securities (Holdings)

How Victory Securities (Holdings) Has Been Performing

Recent times have been quite advantageous for Victory Securities (Holdings) as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Victory Securities (Holdings)'s earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Victory Securities (Holdings)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 229%. The strong recent performance means it was also able to grow revenue by 132% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 43% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Victory Securities (Holdings)'s P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Victory Securities (Holdings)'s shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Victory Securities (Holdings) currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Victory Securities (Holdings) (3 are concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English