How OPKO Health’s (OPK) Clinical Advances and Labcorp Deal Have Reshaped Its Investment Story

- OPKO Health recently advanced its Phase 1 Epstein-Barr virus vaccine trial and presented encouraging data for its oral GLP-1/glucagon dual agonist for obesity and MASH at ENDO 2025, while also announcing a plan to sell BioReference oncology and clinical testing assets to Labcorp to concentrate on its core businesses.

- This combination of clinical progress and repositioning initiatives highlights OPKO’s sharpened focus on developing high-impact treatments and strengthening its diagnostics portfolio through organizational streamlining.

- We’ll explore how the planned divestiture of BioReference assets to Labcorp could reshape OPKO’s investment narrative and future growth focus.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OPKO Health Investment Narrative Recap

To believe in OPKO Health as a shareholder today, you need confidence in the company’s ability to refocus on its key diagnostics and therapeutic programs, drive clinical progress, and eventually move toward profitability. The recent plan to sell BioReference assets to Labcorp may accelerate OPKO’s push for a leaner business model and improve liquidity, but does not materially shift concerns around sustained net losses and ongoing capital structure challenges in the near term, the most important risk remains the company’s path to consistent earnings.

Among OPKO’s recent announcements, the sale of BioReference’s oncology and clinical testing assets stands out, as it is directly tied to the company’s renewed focus on core businesses and cost savings targets. While this divestiture aims to position OPKO for improved operating margins and financial flexibility, it remains to be seen whether these steps will be enough to drive sustainable profit growth and reduce reliance on ongoing asset sales as a financial crutch.

On the flip side, investors should be aware that ongoing share dilution and recurring net losses could...

Read the full narrative on OPKO Health (it's free!)

OPKO Health's outlook projects $754.1 million in revenue and $41.1 million in earnings by 2028. This requires 4.3% annual revenue growth and a $218.2 million increase in earnings from the current -$177.1 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 161% upside to its current price.

Exploring Other Perspectives

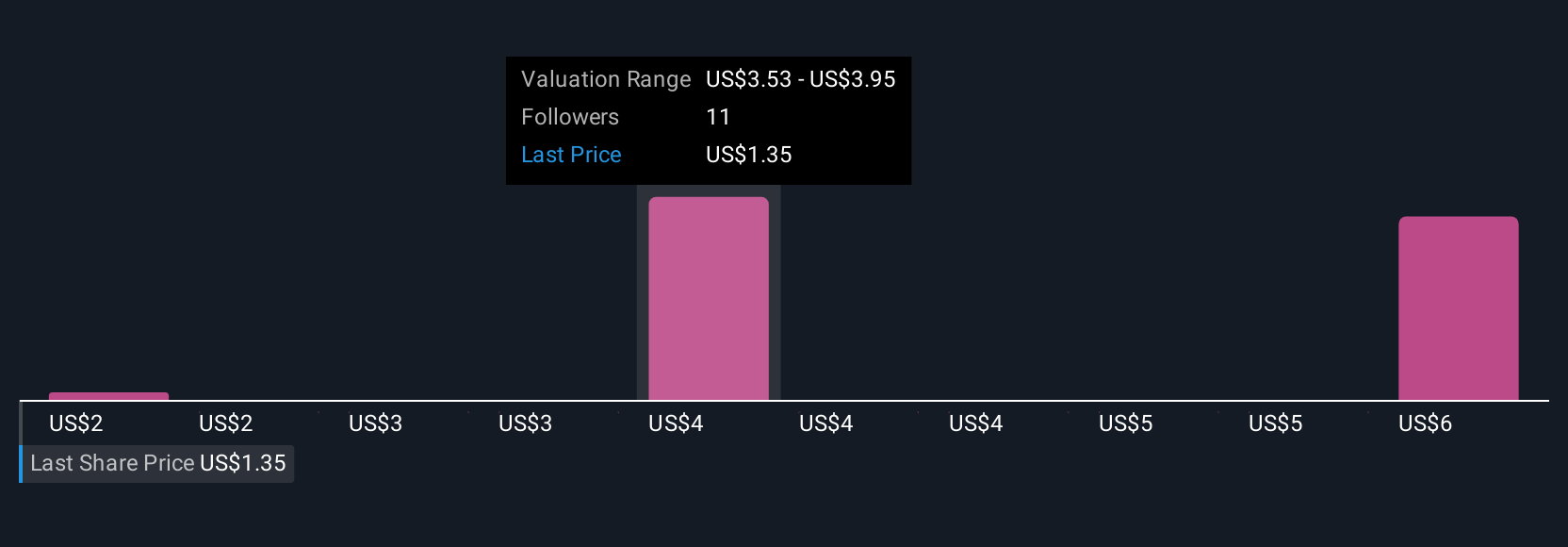

Three fair value estimates from the Simply Wall St Community span from US$1.85 to US$6.06 per share. With persistent net losses and no clear path to profitability identified by analysts, it is important to consider how these broad expectations could impact future confidence in OPKO’s turnaround potential.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth just $1.85!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English