Will DENTSPLY SIRONA’s (XRAY) Maintained Dividend and Sales Guidance Shift Recovery Expectations?

- DENTSPLY SIRONA Inc. announced its second quarter 2025 results in August, revealing sales of US$936 million and a net loss of US$45 million, with management reaffirming its full-year sales guidance of US$3.60 billion to US$3.70 billion amid continued industry headwinds.

- An interesting aspect is the board’s decision to maintain its dividend at US$0.16 per share, contrasting with ongoing revenue pressure and signaling a commitment to shareholder returns despite financial challenges.

- We’ll explore how DENTSPLY SIRONA’s reaffirmed cautious sales outlook might reshape expectations about its recovery and future earnings growth.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

DENTSPLY SIRONA Investment Narrative Recap

To be a shareholder in DENTSPLY SIRONA today, you need to believe in management’s ability to restore growth and margin expansion, particularly through digital dentistry and operational streamlining. The most recent quarterly results reinforce ongoing top-line and profitability pressures, making any near-term turnaround reliant on management execution; however, this report does not materially change the company’s main short-term catalyst, returning to positive, sustainable sales growth, or the overriding risk, which remains further revenue and margin contraction if performance lags.

Of the recent announcements, the reaffirmation of full-year sales guidance is especially relevant: despite revenue declines and a wider net loss, management’s maintained outlook suggests confidence in mitigating current headwinds. This outlook, though measured, continues to emphasize stable near-term expectations, but also highlights the urgency for operational improvements and revenue stabilization as essential levers for the company’s recovery.

In contrast, with large parts of the business still exposed to persistent U.S. sales weakness and increasing tariff costs, investors should be aware that...

Read the full narrative on DENTSPLY SIRONA (it's free!)

DENTSPLY SIRONA is projected to achieve $3.9 billion in revenue and $502.2 million in earnings by 2028, based on analyst forecasts. This scenario requires a 2.3% annual revenue growth rate and an earnings increase of $1.45 billion from current earnings of -$949.0 million.

Uncover how DENTSPLY SIRONA's forecasts yield a $16.86 fair value, a 18% upside to its current price.

Exploring Other Perspectives

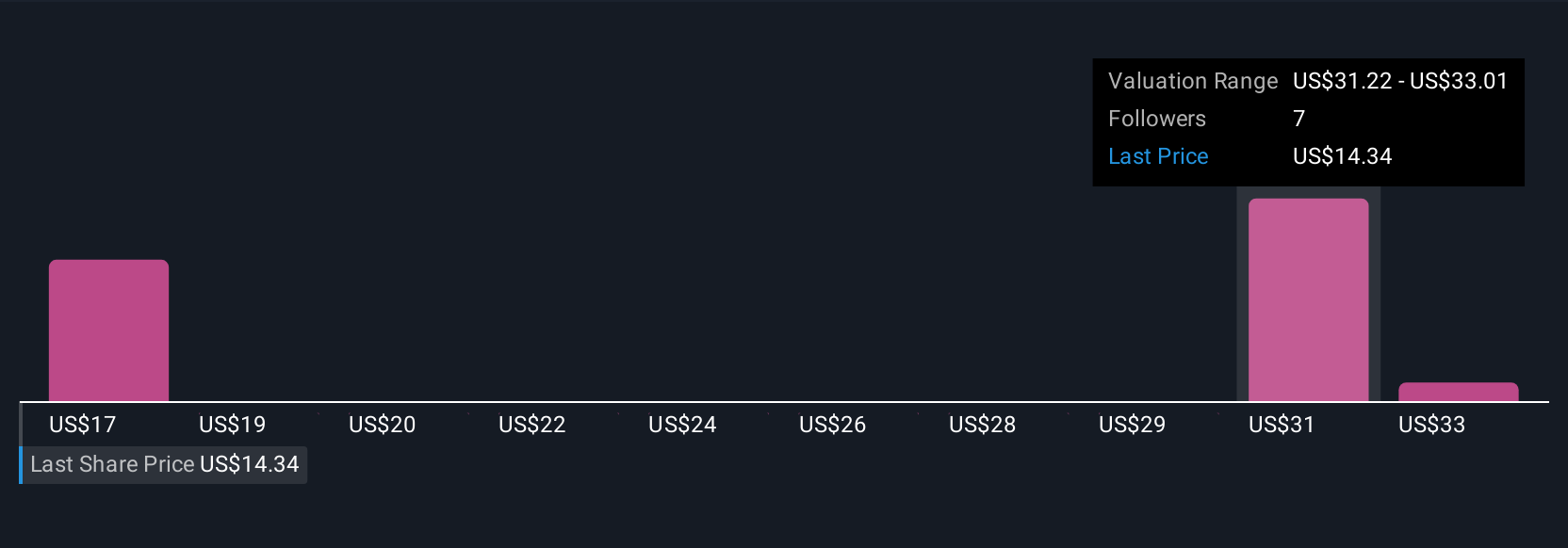

Three separate fair value estimates from the Simply Wall St Community range from US$16.86 to US$34.81 per share. While some see deep value, slowing US sales growth and rising cost challenges remain front of mind for many, inviting you to compare different views on where the company may be headed next.

Explore 3 other fair value estimates on DENTSPLY SIRONA - why the stock might be worth over 2x more than the current price!

Build Your Own DENTSPLY SIRONA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DENTSPLY SIRONA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DENTSPLY SIRONA's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English