Should Autohome's (ATHM) Share Buyback Extension Shape Investor Views on Capital Allocation Strategy?

- Earlier this month, Autohome announced it had extended its share repurchase plan to December 31, 2025, after buying back 5,422,647 shares (4.5% of shares outstanding) for a total of US$144.33 million since the September 2024 announcement.

- This move underscores management’s ongoing confidence in the business and provides additional support for shareholders as the company continues its capital return efforts.

- We’ll explore how the extension of Autohome’s buyback program influences its investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Autohome Investment Narrative Recap

To be a shareholder in Autohome, you need to believe in the company's ability to drive user engagement and digital innovation in China's auto market, despite challenging conditions for advertising revenue and growing competition from other online channels. The extension of the share buyback plan offers some near-term support to investor sentiment but does not meaningfully affect the most important short-term catalyst, Autohome’s push for AI-powered tools and O2O retail expansion, nor does it offset the key risk of pressure on gross margins from ongoing price wars and overcapacity across the auto industry.

The recent dividend announcement in November 2024, approving a cash payment of US$1.15 per ADS, is particularly relevant here as it reflects management’s continued capital return to shareholders alongside buybacks. However, sustainability of such shareholder payouts will likely hinge on improvements in top-line performance and the company’s ability to counteract margin pressure through innovation and operational efficiencies.

In contrast, investors should be aware that Autohome’s exposure to industry-wide pricing pressures and margin declines could challenge...

Read the full narrative on Autohome (it's free!)

Autohome's outlook anticipates CN¥7.6 billion in revenue and CN¥1.8 billion in earnings by 2028. This scenario assumes annual revenue growth of 3.8%, and a CN¥0.3 billion increase in earnings from the current CN¥1.5 billion.

Uncover how Autohome's forecasts yield a $28.87 fair value, in line with its current price.

Exploring Other Perspectives

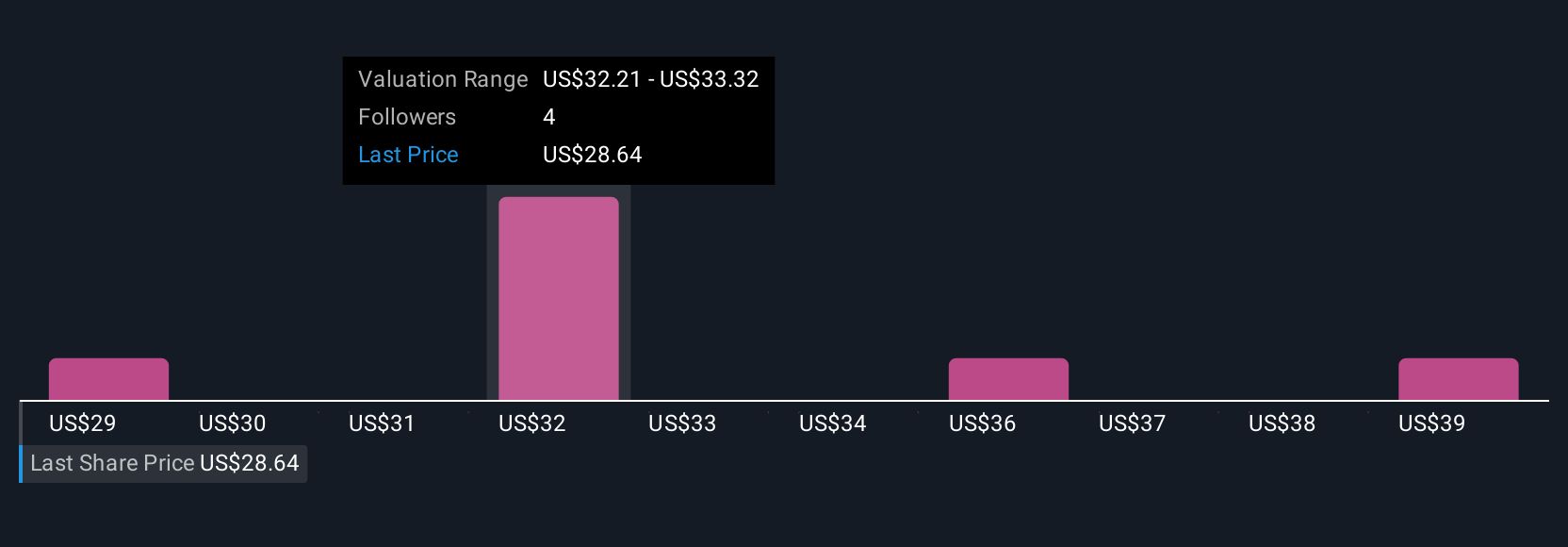

Simply Wall St Community members set fair values for Autohome between US$28.87 and US$40, with four opinions represented. While many see upside potential, concerns about persistent gross margin compression remain key for your assessment of future returns.

Explore 4 other fair value estimates on Autohome - why the stock might be worth as much as 41% more than the current price!

Build Your Own Autohome Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autohome research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autohome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autohome's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English