General Mills (GIS): Exploring Its Valuation After Recent Share Price Decline

General Mills (GIS) just slipped into headlines after another dip, as shares gave up roughly half a percent at the close. The move might seem modest, but it is enough to catch some investors’ attention, especially for those watching the food sector’s defensive names. Without a single event behind the slide, it does raise the question: are traders simply recalibrating expectations, or is something bigger brewing under the surface?

If you pan out, the bigger story comes into focus. Over the past year, General Mills has seen its stock drop by 27%. Short-term momentum has not fared much better, with returns over the past three months down about 7%. Revenue and profit growth have both slipped ever so slightly, contributing to this steady pressure. While there have not been any headline-grabbing surprises lately, the market’s view seems to have shifted, either toward more caution or perhaps less faith in near-term growth for packaged food giants.

After a year of sliding returns and minor disappointments, should investors be eyeing General Mills as a possible bargain, or is the market by now baking in all the future risks and challenges?

Most Popular Narrative: 10% Undervalued

According to community narrative, General Mills is considered approximately 10% undervalued versus its analyst consensus fair value. Expectations are shaped by both projected challenges and strategic changes.

General Mills plans a sizable step-up in investment for fiscal '26, including at least 5% through Holistic Margin Management (HMM) savings and $100 million in additional cost savings. However, reinvestment of these savings into pricing, innovation, in-store activity, and media could delay improvements in net margins and overall earnings in the short term.

What is fueling this undervalued rating? Behind this valuation are bold financial projections, ambitious margin recovery strategies, and cautious optimism about future earnings. Which key assumptions are driving this surprising fair value? The answers may challenge conventional wisdom about where General Mills is heading.

Result: Fair Value of $55.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger marketing or successful innovation could quickly boost sales and margins. This could potentially challenge the current cautious outlook for General Mills.

Find out about the key risks to this General Mills narrative.Another View: What Does Our DCF Model Say?

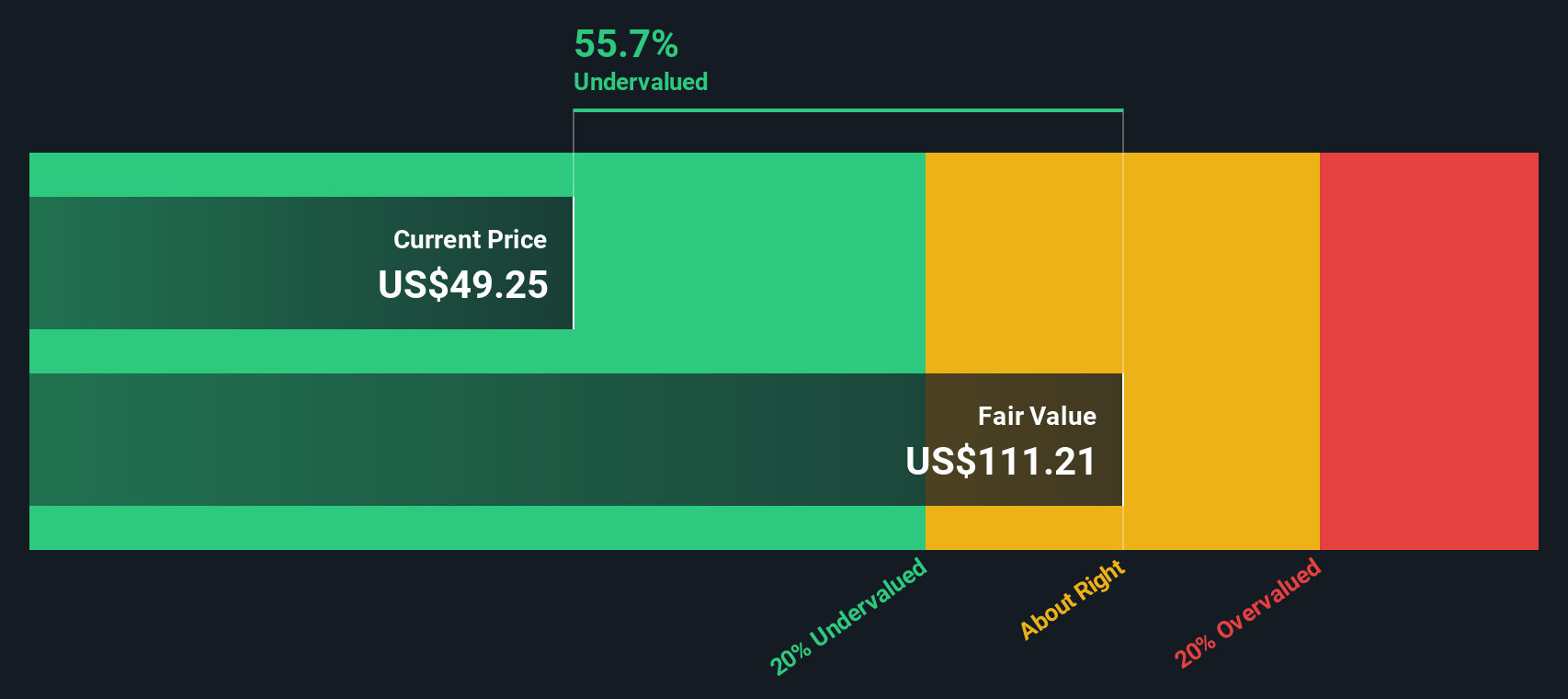

Taking a different approach, our DCF model also suggests the stock is undervalued. This supports what the multiple-driven valuation showed. But could the market be missing something? Is there more under the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own General Mills Narrative

If you see things differently or want to dive into the details yourself, you can easily build your own analysis in just a few minutes. do it your way.

A great starting point for your General Mills research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next great opportunity slip away. The right tools can reveal inspiring, overlooked, or fast-growing stocks you might otherwise miss. Check out these hand-picked ideas using the Simply Wall Street Screener to give your investing strategy an edge:

- Unlock the income potential of reliable, high-yield opportunities when you browse dividend stocks with yields > 3%. These stocks consistently deliver returns above 3% for income-focused investors.

- Spot AI innovators transforming healthcare as you scan the market for healthcare AI stocks. This can let you ride the momentum of next-generation medicine and diagnostics.

- Jump on undervalued gems backed by strong cash flow with undervalued stocks based on cash flows and get ahead before the market catches up to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English