How Does Analyst Skepticism Over Gas Oversupply Shape Comstock Resources' (CRK) Long-Term Strategy?

- Earlier this week, Comstock Resources faced a downgrade to 'Sell' by Roth MKM and other analysts, who voiced concerns over persistent oversupply and weak fundamentals in the natural gas market.

- Although Comstock reported robust quarterly earnings, the company's exposure to gas price volatility and ongoing supply-demand challenges is weighing on its broader outlook.

- We will assess how analyst caution over sustained natural gas oversupply could shape Comstock Resources' longer-term investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Comstock Resources Investment Narrative Recap

To be a shareholder in Comstock Resources right now, you need conviction that natural gas fundamentals will recover enough for the company’s Haynesville shale focus and cost efficiencies to drive returns, despite ongoing volatility and weak gas prices. The recent analyst downgrades intensify the spotlight on oversupply risks, the market’s biggest short-term concern, even after a strong earnings beat; if gas prices stay low, this catalyst’s impact could be muted in the near term.

The company’s robust Q2 results, with revenue up to US$470.26 million and net income swinging positive year-on-year, were a recent highlight. However, production volumes declined for another quarter, signaling that even operational and financial wins face headwinds if market supply-demand conditions do not improve.

On the other hand, the concentrated exposure to Haynesville shale creates a risk that investors should be aware of if regional oversupply persists...

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' narrative projects $2.5 billion in revenue and $713.4 million in earnings by 2028. This requires 15.0% yearly revenue growth and a $786 million earnings increase from the current -$72.6 million.

Uncover how Comstock Resources' forecasts yield a $20.43 fair value, a 33% upside to its current price.

Exploring Other Perspectives

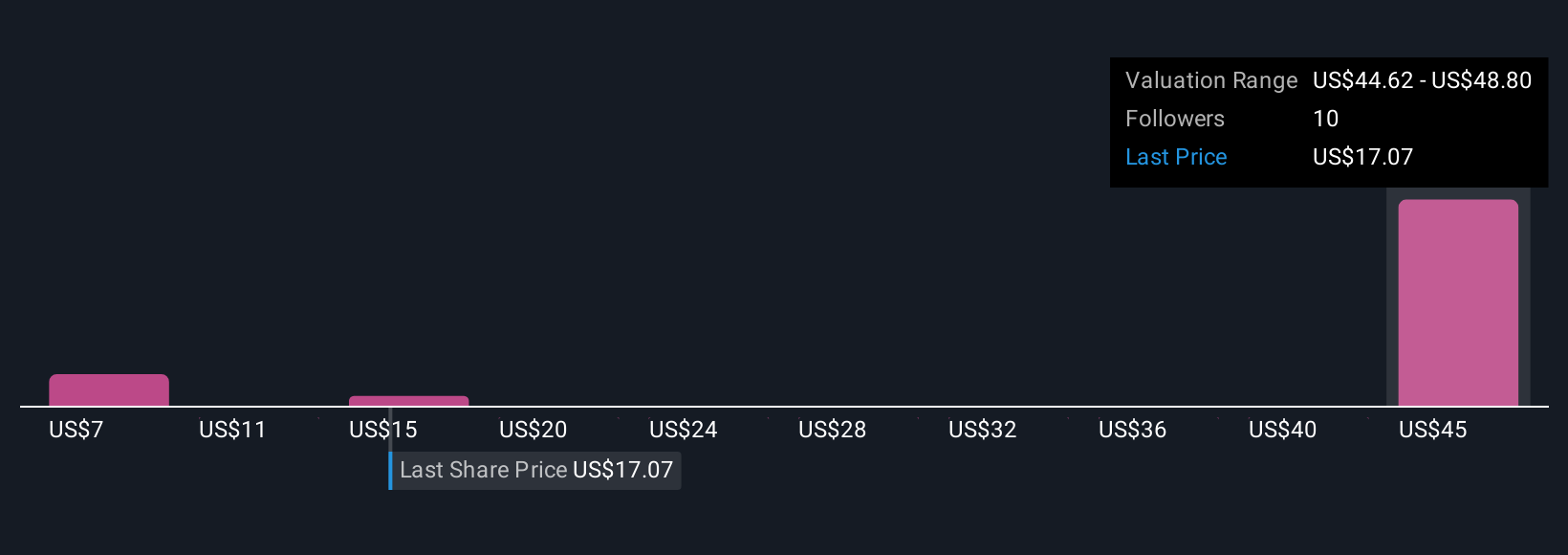

Four private investors in the Simply Wall St Community set fair value estimates for Comstock from US$6.97 to US$20.43 per share. While opinions disagree widely, ongoing concerns about persistent oversupply hint that price recovery may remain elusive for longer than some expect.

Explore 4 other fair value estimates on Comstock Resources - why the stock might be worth less than half the current price!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English