Will Zions Bancorporation’s (ZION) New Debt Offering Signal a Shift in Balance Sheet Strategy?

- On August 11, 2025, Zions Bancorporation, N.A. announced it priced US$500 million of fixed-to-floating rate senior notes due August 18, 2028, with proceeds intended to reduce short-term borrowings and a hedging strategy implemented to manage interest expense risk.

- The offering’s structure, combining flexible interest terms, optional early redemption, and an interest rate hedge, reflects an effort to optimize funding costs amid evolving market conditions.

- We’ll now explore how this significant debt issuance aimed at balance sheet management could shape Zions Bancorporation’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zions Bancorporation National Association Investment Narrative Recap

To be a shareholder in Zions Bancorporation, investors must see value in its disciplined risk management, ongoing digital investments, and the demographic advantages of its Western U.S. markets. The recent US$500 million fixed-to-floating note issuance supports balance sheet flexibility, but does not materially alter the short-term catalyst: execution on technology upgrades to boost efficiency and defend margins. However, it is worth monitoring that a single market shock in commercial real estate or deposit trends could still pressure earnings.

Among recent announcements, July’s strong Q2 earnings are particularly relevant, demonstrating improved profitability and rising net interest income. These results provide a cushion for the bank as it manages its loan book and cost structure, which links directly to the catalysts investors are focused on, including further efficiency gains and margin protection. Yet, even with this positive momentum, investors should remember that...

Read the full narrative on Zions Bancorporation National Association (it's free!)

Zions Bancorporation National Association is projected to reach $3.5 billion in revenue and $818.0 million in earnings by 2028. This outlook assumes annual revenue growth of 3.7% and an increase in earnings of $12.0 million from the current $806.0 million.

Uncover how Zions Bancorporation National Association's forecasts yield a $61.14 fair value, a 14% upside to its current price.

Exploring Other Perspectives

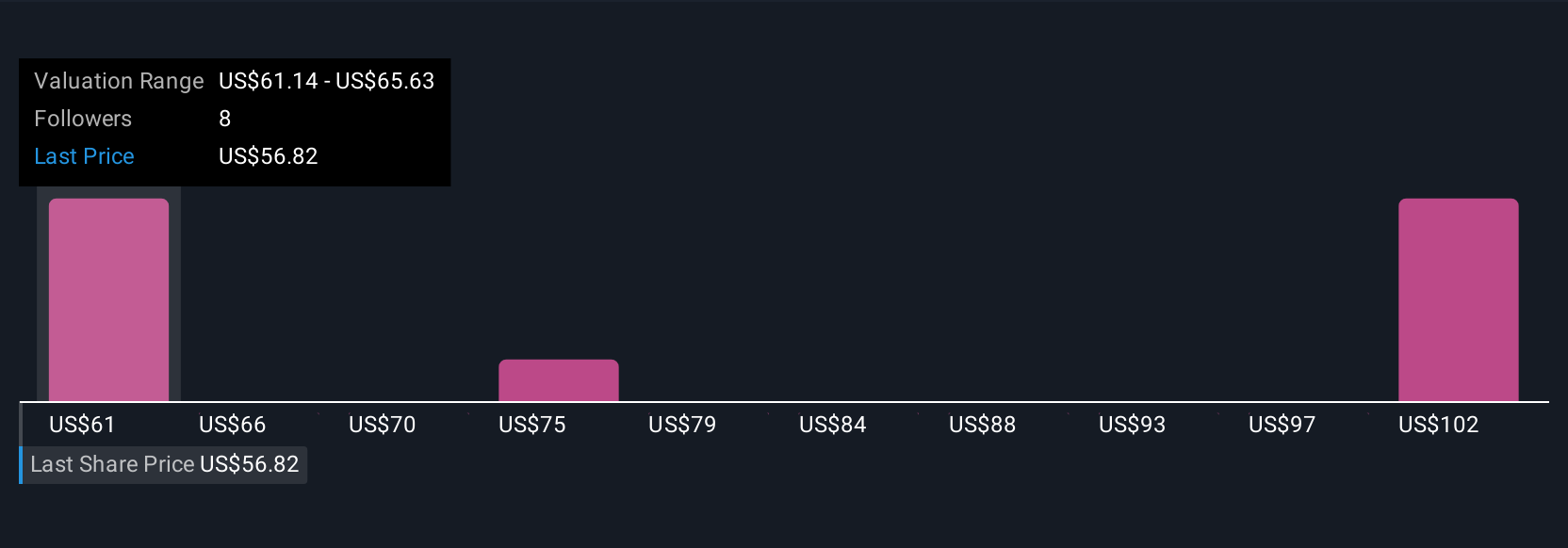

Retail investors in the Simply Wall St Community provided three fair value estimates ranging from US$61.14 to US$105.71 per share. While you see wide differences in valuation, keep in mind that risks like increasing competition for deposits could influence where Zions’ performance ultimately settles, so it pays to examine multiple viewpoints.

Explore 3 other fair value estimates on Zions Bancorporation National Association - why the stock might be worth as much as 97% more than the current price!

Build Your Own Zions Bancorporation National Association Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zions Bancorporation National Association research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zions Bancorporation National Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zions Bancorporation National Association's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English