Marex Group (NasdaqGS:MRX): Evaluating Value After Short Report Sparks Accounting and Legal Concerns

If you’re holding Marex Group (NasdaqGS:MRX) or considering an investment, the recent short report has likely caught your attention. Accusations regarding questionable off-balance sheet dealings and misleading disclosures have put Marex under scrutiny, raising challenging questions for investors about the reliability of its financial statements. With a shareholder rights law firm now investigating, an additional legal concern has emerged that is difficult to overlook.

Marex has experienced significant changes recently. The stock has returned 57% over the past year, partly due to strong net income growth. However, this momentum slowed in the past three months, with the share price falling 18%. These fluctuations follow not only the short seller allegations, but also ongoing business developments such as robust half-year earnings and a recently reaffirmed quarterly dividend. Under other circumstances, these factors might have indicated stable confidence, but the recent controversy has altered the outlook.

This situation raises a key question: Is this decline a temporary market overreaction, or is Marex’s price now reflecting previously unaccounted-for risks?

Most Popular Narrative: 29.8% Undervalued

According to community narrative, Marex Group is seen as significantly undervalued with analysts forecasting robust improvements in profit margins and a future valuation below industry averages.

Ongoing M&A activity, particularly the transformative Winterflood acquisition along with a strong pipeline of smaller deals, is expected to drive both revenue and margin synergies. This may occur through product or geographic diversification, cross-selling, and operational scale, which could have a positive impact on topline and earnings stability.

Curious how analysts land on such a positive view for Marex? The narrative points to significant assumptions about the company’s potential to drive future profits, transform its global presence, and achieve operating leverage that could exceed peers. What kind of growth roadmap does this suggest for Marex in the future? The answer might surprise you.

Result: Fair Value of $50.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent integration challenges from acquisitions and mounting competition from digital trading platforms could threaten Marex’s growth story and margin expectations.

Find out about the key risks to this Marex Group narrative.Another View: What Does Our DCF Model Say?

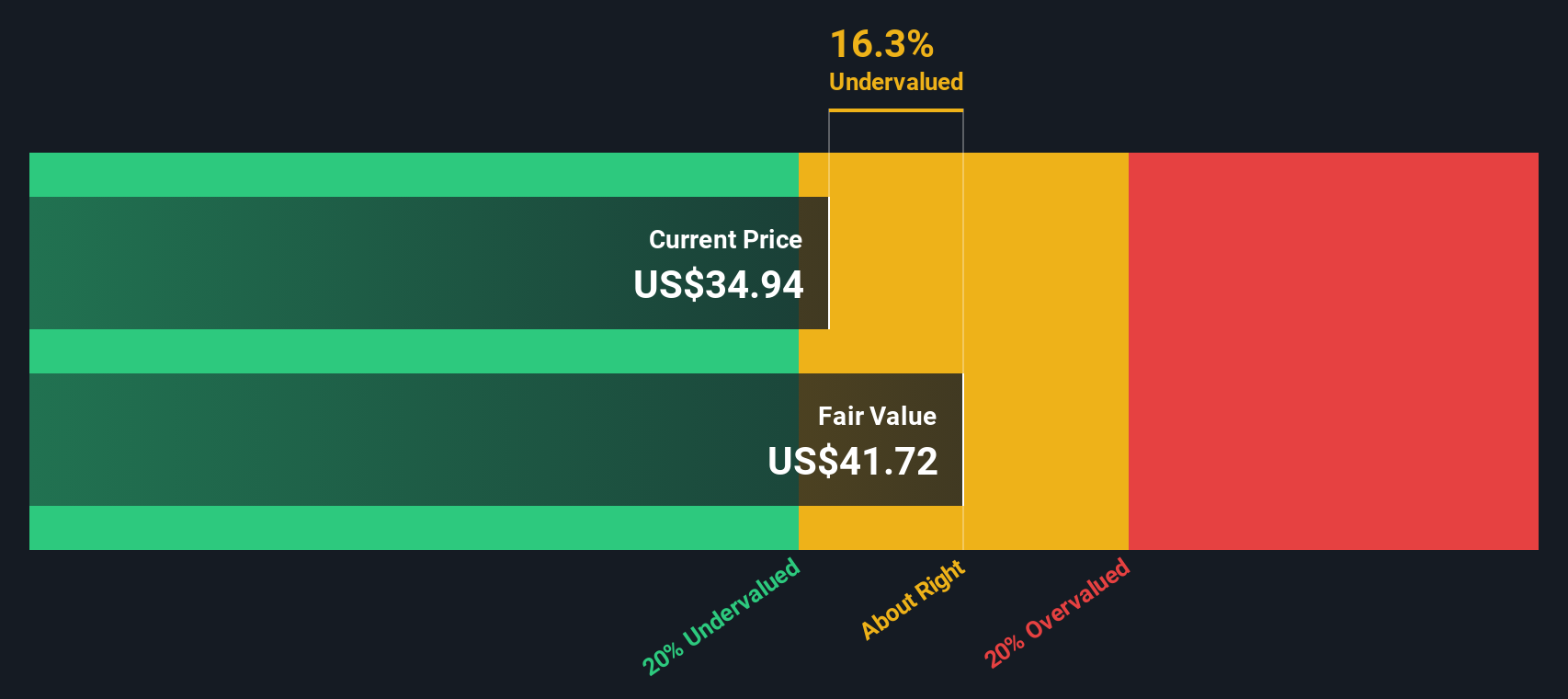

While analysts rely on forward earnings and industry comparisons, the SWS DCF model takes a different approach by estimating Marex’s intrinsic value using future cash flows. This method also points to the stock being undervalued, but does it capture all the recent uncertainty? Which approach best reflects reality for investors right now?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Marex Group Narrative

If you want to reach your own conclusions or dig deeper into the figures, you have the tools to shape a narrative yourself in just a few minutes, so why not do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Marex Group.

Looking for More Investment Ideas?

Don’t limit your opportunities to just one stock when there are so many exciting directions your portfolio could take. Expand your investing horizon by seeking out companies with unique potential, untapped growth, or strong financials. Here are three compelling ideas to get you moving today:

- Unlock passive income potential by targeting dividend stocks with yields > 3%; these can offer consistent returns with yields above 3%.

- Seize the future of medicine with healthcare AI stocks, where cutting-edge innovation meets real-world healthcare impact.

- Tap into next-level tech by tracking quantum computing stocks and be part of the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English