IBKR Rolls Out Connections: Is it Set to Ride on Product Expansion?

Interactive Brokers IBKR has introduced Connections, a new feature designed to help investors discover trading opportunities and evaluate investments by highlighting related ideas across global markets. This enables users to explore related stocks, exchange-traded funds (ETFs), options, economic indicators and other instruments from a single centralized location.

Milan Galik, CEO of Interactive Brokers, stated, “Clients of Interactive Brokers can access stocks, options, futures, currencies, bonds, funds, and more across 160 global markets from a single integrated platform.”

IBKR has been continuously making efforts to diversify its product suite to expand globally. Earlier this month, it launched zero-commission U.S. stock trading in Singapore. This, along with the company’s efforts to develop proprietary software to automate broker-dealer functions, has been aiding top-line growth.

Over the last five years (2019-2024), the company’s total net revenues witnessed a compound annual growth rate of 21.8%, with the upward momentum continuing in the first half of 2025.

Given Interactive Brokers’ technological superiority, its revenues are expected to continue to improve in the quarters ahead, supported by higher client acquisitions and continued product expansion efforts. The Zacks Consensus Estimate for the company’s 2025 and 2026 revenues is $5.68 billion and $6.03 billion, indicating year-over-year growth of 8.8% and 6.2%, respectively.

IBKR’s Competitors Expanding Product Suite

Interactive Brokers’ key competitors, TradeWeb Markets Inc. TW and Robinhood Markets, Inc. HOOD, have also been rolling out products to bolster their market share.

TradeWeb launched electronic portfolio trading for European government bonds, spanning U.K. Gilts, EUR and single currency notes. Tradeweb was also the first platform to launch portfolio trading for corporate bonds in 2019.

Likewise, Robinhood has been diversifying its offerings to capitalize on investor demands. Earlier this week, it launched a pro and college football prediction market, available through the prediction markets hub. Further, it launched Robinhood Legend in the U.K. In March 2025, the company introduced Robinhood Strategies, Robinhood Banking and Robinhood Cortex to boost wealth management offerings.

In February 2025, Robinhood launched options trading in the U.K., while in January, it launched Futures.

IBKR’s Price Performance, Valuation & Estimate Analysis

Shares of Interactive Brokers have jumped 41.4% so far this year compared with the industry’s growth of 20.7%.

Image Source: Zacks Investment Research

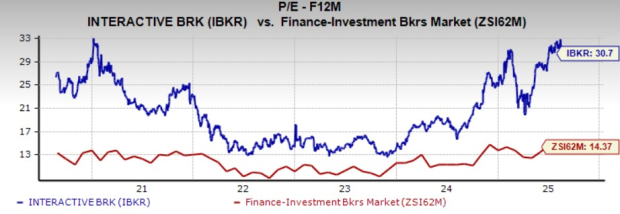

From a valuation standpoint, IBKR trades at a forward price-to-earnings (P/E) ratio of 30.7, well above the industry average.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Interactive Brokers’ 2025 and 2026 earnings indicates year-over-year growth of 11.4% and 6.1%, respectively. Over the past 30 days, earnings estimates for both years have been revised upward.

Image Source: Zacks Investment Research

Interactive Brokers currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

Tradeweb Markets Inc. (TW): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English