CEO Share Purchase and Major East Texas Farmout Deal Might Change The Case For Investing In Black Stone Minerals (BSM)

- Earlier this week, Black Stone Minerals announced that CEO Thomas L. Carter acquired 41,000 shares and entered a five-year farmout agreement with Ellipsis U.S. Onshore Holdings for 270,000 acres in East Texas.

- The CEO’s stock purchase and the new agreement signal leadership confidence and potentially strengthen Black Stone’s access to high-potential natural gas acreage.

- We’ll explore how this new farmout partnership in East Texas could reshape the outlook for Black Stone Minerals’ future growth and diversification.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Black Stone Minerals Investment Narrative Recap

The core idea behind owning Black Stone Minerals is whether you believe in the ability of its mineral and royalty model to support sustainable revenues, despite commodity volatility and concentrated geographic exposure. The newly announced farmout agreement with Ellipsis U.S. Onshore Holdings may help secure new drilling activity in East Texas, which could offset some near-term production risks, but the company's revised 2025 guidance remains the most immediate catalyst, while concentrated dependency on third-party operators remains its central challenge.

Among recent updates, the expanded development agreement in the Shelby Trough with Revenant Energy is most closely tied to the current catalyst of ramping production. That earlier deal more than doubled future drilling obligations and is intended to improve natural gas output in Black Stone’s key basins, directly addressing recent guidance cuts and operator risk.

However, despite new prospects, if operator activity slows further, especially in the Haynesville and Bossier, investors should be aware...

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals' narrative projects $530.3 million revenue and $283.0 million earnings by 2028. This requires 8.6% yearly revenue growth and a $37.4 million earnings increase from $245.6 million currently.

Uncover how Black Stone Minerals' forecasts yield a $13.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

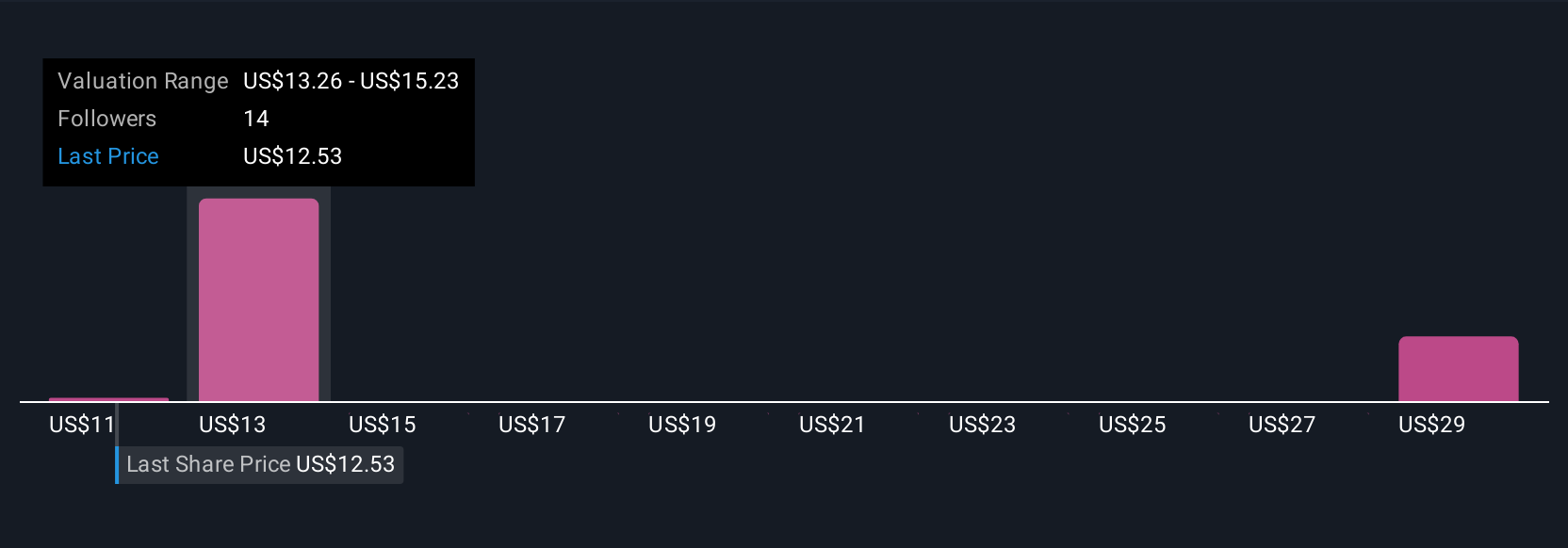

Four members of the Simply Wall St Community provided fair value estimates for Black Stone Minerals between US$10.00 and US$20.76 per share. With production guidance recently lowered for 2025, this range highlights how investor assumptions about future drilling and royalty income can vary significantly, so it’s worth exploring multiple viewpoints.

Explore 4 other fair value estimates on Black Stone Minerals - why the stock might be worth 18% less than the current price!

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English