Will Sabra Health Care REIT's (SBRA) New Management Deal Enhance Its Senior Housing Edge?

- Sunshine Retirement Living recently announced a management agreement with Sabra Health Care REIT to oversee five independent living communities in Arizona, California, Utah, and Washington, growing Sunshine’s portfolio from 35 to 40 communities.

- This partnership signifies Sunshine's expansion into third-party management for the first time, reflecting broader shifts in the senior housing industry as the over-85 population rises.

- Let’s examine how this expanded management arrangement could influence Sabra’s positioning in the growing senior living market.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sabra Health Care REIT Investment Narrative Recap

To be a shareholder in Sabra Health Care REIT, you need to believe in the long-term demand for senior living driven by demographic tailwinds, especially as the population ages. The recently announced partnership with Sunshine Retirement Living deepens Sabra’s involvement in independent living communities, but this move is not likely to materially shift the near-term catalyst of persistent demand outpacing new supply or address the largest current risk: operator execution during portfolio transitions. The risk of operational disruption during operator changes remains present, especially as Sabra partners with new third-party managers. Among recent company updates, the successful completion of a US$390.7 million follow-on equity offering stands out as most relevant to this news. This new capital could support investments aligned with rising senior housing demand, a trend supported by the Sunshine agreement, but any positive impact hinges on management’s ability to select and oversee operators who maintain high property performance. Yet, in contrast to recent expansion, investors should watch for signs that operator transitions could...

Read the full narrative on Sabra Health Care REIT (it's free!)

Sabra Health Care REIT is projected to reach $871.3 million in revenue and $209.1 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 5.9% and a $26.8 million increase in earnings from the current $182.3 million.

Uncover how Sabra Health Care REIT's forecasts yield a $20.09 fair value, in line with its current price.

Exploring Other Perspectives

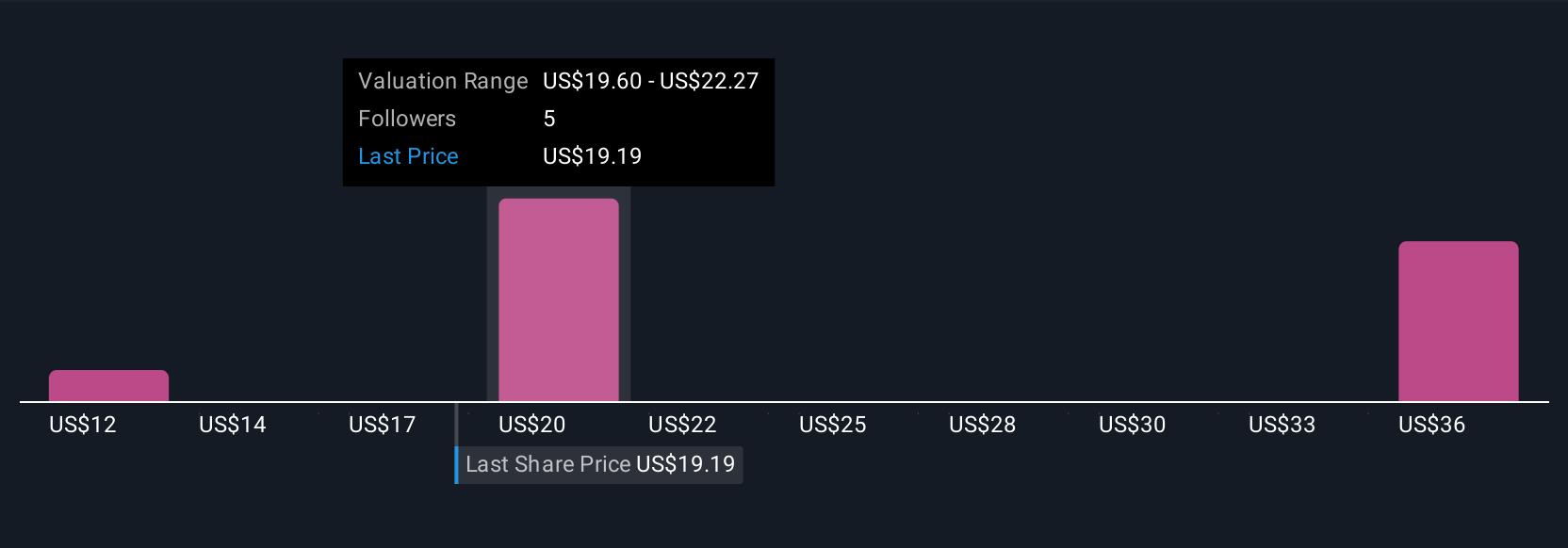

Three fair value estimates from the Simply Wall St Community stretch from US$11.59 to US$38.04, reflecting a wide range of investor outlooks. This variety stands against ongoing risks tied to new operator execution, highlighting why readers should explore several points of view.

Explore 3 other fair value estimates on Sabra Health Care REIT - why the stock might be worth 41% less than the current price!

Build Your Own Sabra Health Care REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sabra Health Care REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sabra Health Care REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sabra Health Care REIT's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English