3 Promising Penny Stocks With Market Caps Over $40M

Amidst a backdrop of market volatility and investor anticipation surrounding Federal Reserve Chair Jerome Powell's upcoming speech, the S&P 500 has been experiencing a notable decline. In such uncertain times, identifying stocks with strong financials becomes crucial for investors seeking stability and potential growth. Penny stocks, despite their outdated moniker, remain relevant as they often represent smaller or newer companies that can offer surprising value. This article will explore three penny stocks that stand out due to their financial strength and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.77 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.14 | $246.78M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.03 | $180.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.94 | $25.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $88.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.59 | $22.18M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.95 | $6.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $85.42M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.68 | $154.7M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $4.25 | $547.78M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 389 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States, with a market cap of $430.39 million.

Operations: The company's revenue is primarily generated from its Healthcare Facilities & Services segment, amounting to $202.61 million.

Market Cap: $430.39M

Talkspace has been making strides in the virtual behavioral healthcare sector, with recent partnerships enhancing its service offerings and expanding access. Its collaboration with Express Access aims to streamline mental health care delivery, potentially improving patient outcomes. Financially, Talkspace reported second-quarter revenue of US$54.31 million, showing growth from the previous year despite a net loss of US$0.541 million. The company remains debt-free and has a strong asset position relative to its liabilities, although insider selling was significant recently. While it trades below estimated fair value, one-off losses have impacted earnings quality over the last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Talkspace.

- Examine Talkspace's earnings growth report to understand how analysts expect it to perform.

ALX Oncology Holdings (ALXO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ALX Oncology Holdings Inc. is a clinical-stage immuno-oncology company developing cancer therapies in the United States, with a market cap of $44.55 million.

Operations: ALX Oncology Holdings Inc. has not reported any revenue segments.

Market Cap: $44.55M

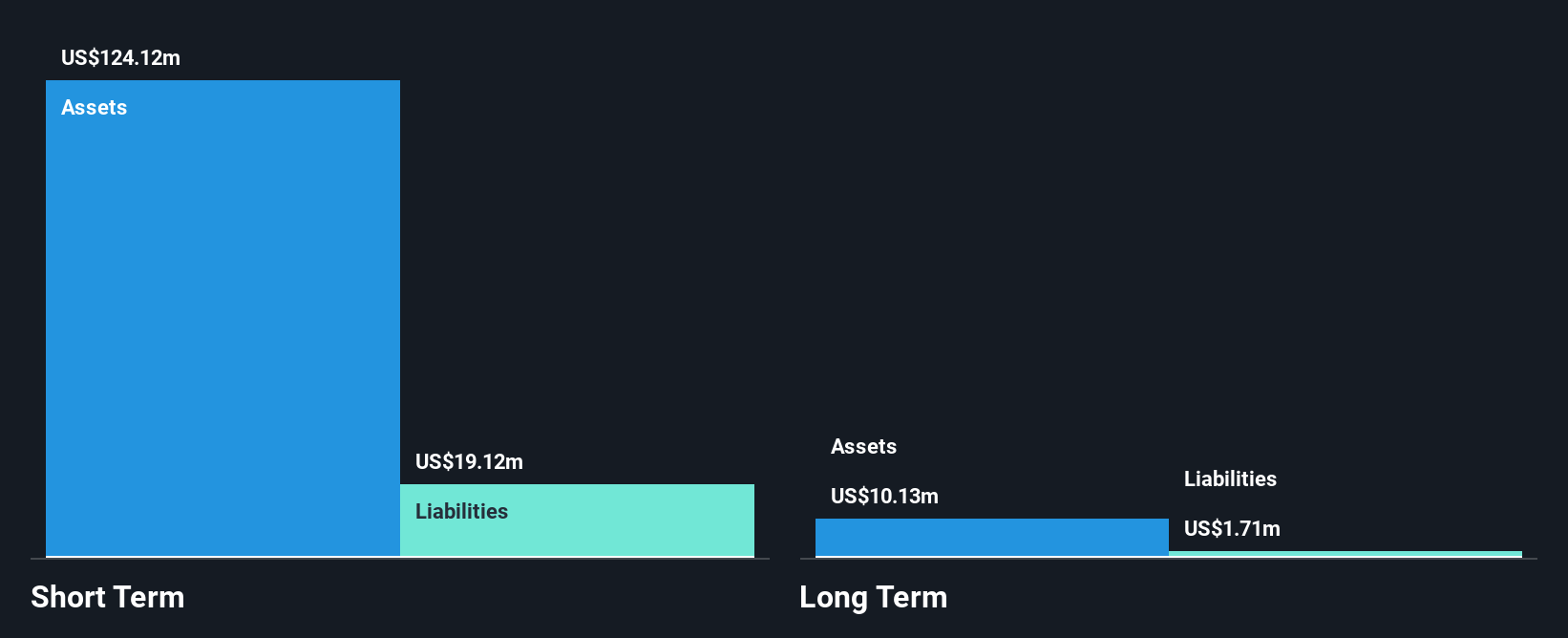

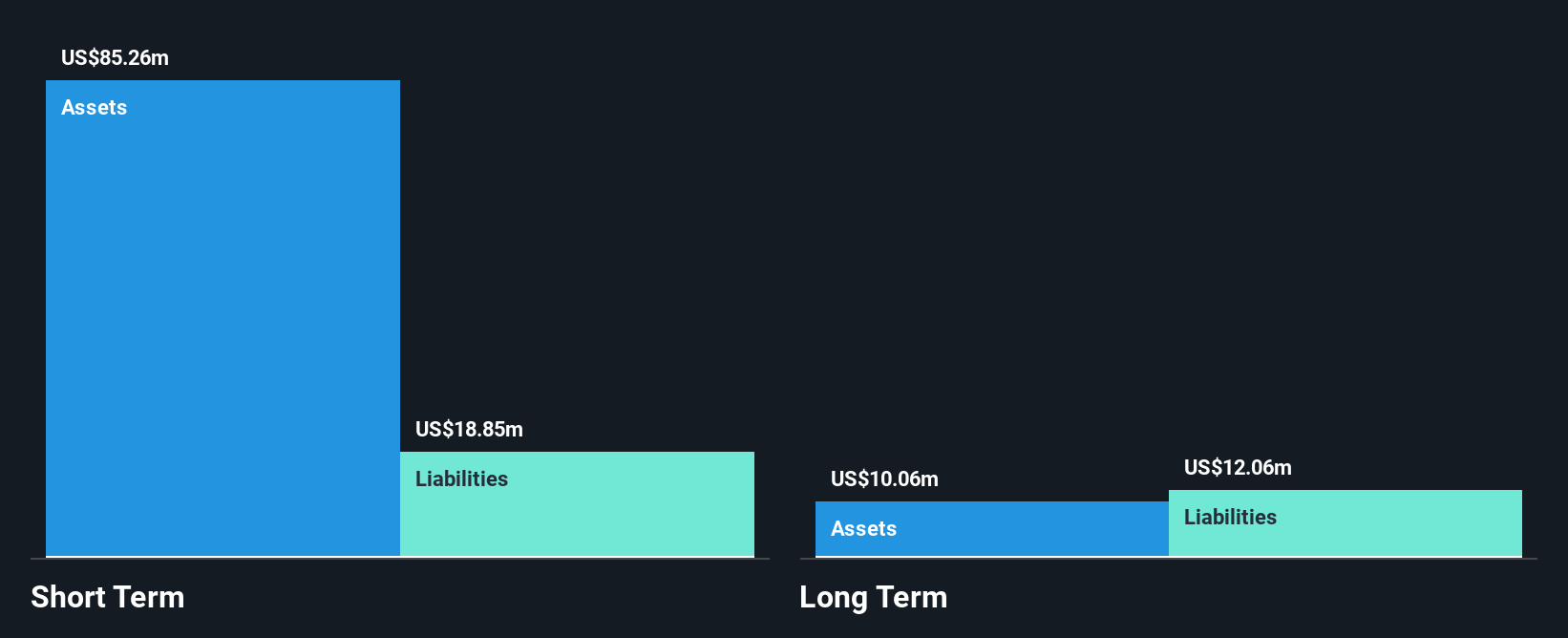

ALX Oncology Holdings, a clinical-stage immuno-oncology firm, is pre-revenue with a market cap of US$44.55 million. The company recently dosed its first patient in a Phase 1 trial for ALX2004, targeting EGFR-expressing tumors. Despite its unprofitability and increased losses over five years, ALX maintains more cash than debt and has sufficient short-term assets to cover liabilities. Recent executive changes aim to bolster strategic growth. With high volatility and limited cash runway under current conditions, the company's focus on innovative cancer therapies could offer potential upside contingent on clinical outcomes and strategic execution.

- Click here to discover the nuances of ALX Oncology Holdings with our detailed analytical financial health report.

- Gain insights into ALX Oncology Holdings' outlook and expected performance with our report on the company's earnings estimates.

Clover Health Investments (CLOV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.30 billion.

Operations: Clover Health's revenue primarily comes from its Insurance segment, which generated $1.61 billion.

Market Cap: $1.3B

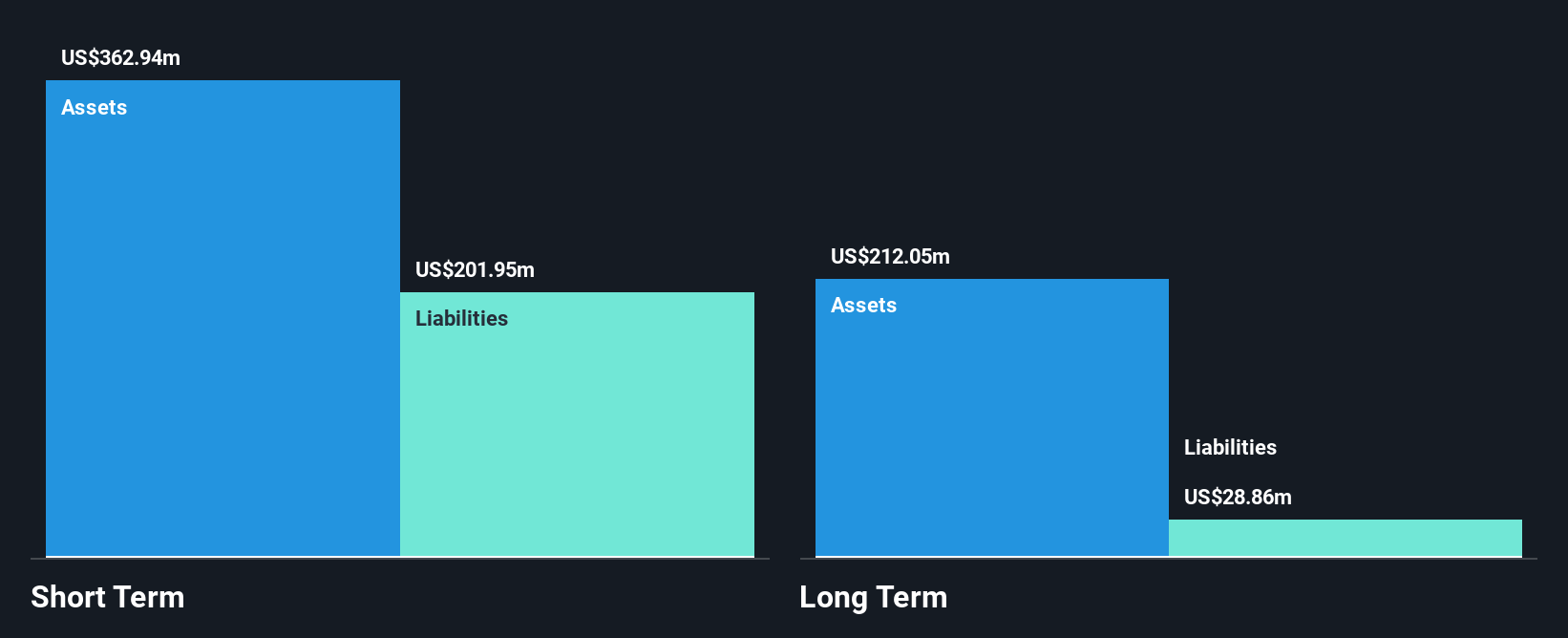

Clover Health Investments, Corp. operates in the healthcare sector with a market cap of approximately US$1.30 billion and generates significant revenue from its Insurance segment, totaling US$1.61 billion. Despite being unprofitable with a net loss of US$10.58 million for Q2 2025, Clover has reduced losses over five years and maintains a strong cash runway exceeding three years without debt obligations. The company is trading below its estimated fair value and offers good relative value compared to peers. Recent initiatives include launching a pharmacy pilot program in New Jersey to enhance medication management for seniors using advanced technology and local partnerships.

- Take a closer look at Clover Health Investments' potential here in our financial health report.

- Understand Clover Health Investments' earnings outlook by examining our growth report.

Key Takeaways

- Dive into all 389 of the US Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English