Curtiss-Wright (CW): Examining Valuation After a Year of Steady Share Price Gains

It is not every day that Curtiss-Wright (CW) draws attention for a sudden price pop. The company’s shares have quietly climbed over 59% in the past year, catching many investors’ eyes even without a headline-grabbing catalyst. This kind of steady upward movement, especially in the absence of dramatic news or a game-changing announcement, naturally raises questions. Is this simply a case of the market recognizing hidden value, or are buyers chasing momentum?

Looking at the broader picture, Curtiss-Wright’s run-up has unfolded alongside solid revenue and net income growth, with annual gains of 7% and 9% respectively. The stock’s upward trajectory has accelerated over the past three months with a 13% gain, following a pattern of consistent long-term performance. Recent trading suggests buyers may see something in Curtiss-Wright that extends beyond the usual quarterly results. This may hint at optimism for future growth or changes in risk perception.

After a year of strong performance, the central question remains: Is Curtiss-Wright undervalued at these levels, or has the market already priced in all its upside?

Most Popular Narrative: 6.9% Undervalued

According to the community narrative, Curtiss-Wright may be trading below its true worth. Analysts believe future growth prospects could justify a higher share price, making the current valuation look potentially attractive compared to consensus expectations.

The global nuclear resurgence, driven by decarbonization, energy security, and supportive regulatory moves (such as the U.S. plan to quadruple domestic nuclear output by 2050), creates significant optionality for Curtiss-Wright's nuclear segment. The CEO has outlined opportunities to quadruple commercial nuclear revenues to $1.5 billion by the middle of the next decade, which could provide a long-cycle growth engine for both revenue and improved margins from high-value content.

Curious what powers the bullish outlook? There are bold assumptions behind Curtiss-Wright’s fair value, including ambitious projections for sales and margin increases. This narrative examines growth drivers and points to forward profit multiples that stand out from industry norms. Take a closer look at the details supporting this undervalued call.

Result: Fair Value of $520.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on major defense contracts and the potential for shifting customer preferences could quickly change the growth outlook for Curtiss-Wright.

Find out about the key risks to this Curtiss-Wright narrative.Another View: A Different Measure of Value

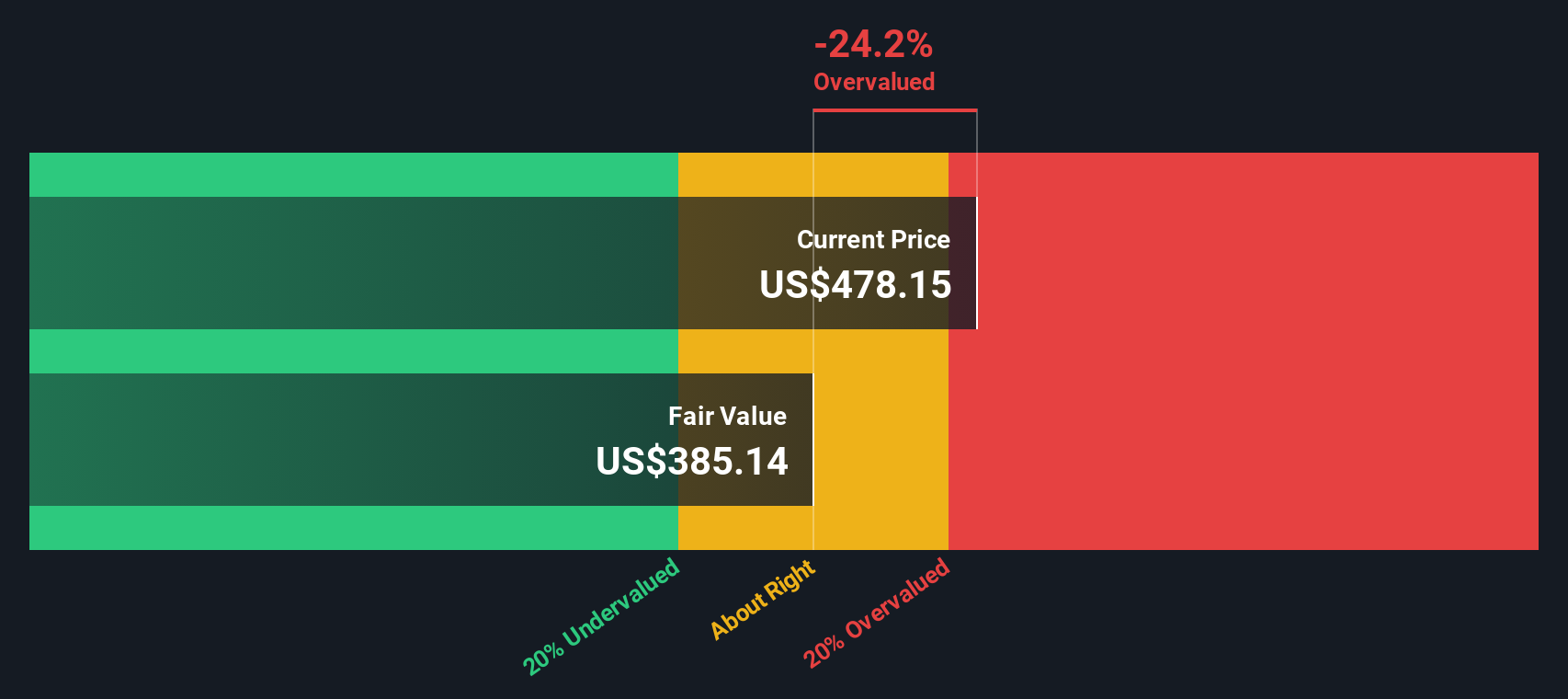

Looking through the lens of our DCF model, the picture shifts. While the earlier analysis suggested upside, this approach paints Curtiss-Wright as overvalued when evaluated against cash flow fundamentals instead of future profit multiples. This could highlight market optimism or point to an overlooked risk.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Curtiss-Wright Narrative

If you have a different perspective or want to dig into the numbers yourself, shaping your own narrative takes just a few minutes. do it your way.

A great starting point for your Curtiss-Wright research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always staying ahead with fresh opportunities. Don’t miss your chance to uncover unique ways to grow your portfolio. These handpicked investment ideas can help you tap into exciting sectors and strong performers right now.

- Uncover powerful income opportunities by checking out dividend stocks with yields > 3%. These picks deliver robust yields and steady cash flow.

- Seize the tech revolution by finding standout opportunities among AI penny stocks. These companies use artificial intelligence to transform industries and accelerate growth.

- Take advantage of tomorrow’s breakthroughs by exploring the world of quantum computing stocks. This area is driving quantum innovation and reshaping high-tech markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English