China Yuchai International (NYSE:CYD): Assessing Valuation After Strong Earnings and Analyst Upgrades

China Yuchai International (NYSE:CYD) just reported its half-year earnings, and the results are prompting investors to take another look at the stock. Sales climbed substantially from a year ago, and net income followed suit, which may indicate that the company’s fundamentals are heading in a positive direction. Adding to the news, analysts have updated their earnings outlook aggressively, and optimism around China Yuchai International’s prospects appears to be spreading.

This upbeat news follows a notable rise for the company’s shares. Momentum has been strong, with the stock jumping over 33% in the past month and increasing by more than 200% year-to-date. Long-term performance in recent years has also outpaced much of the sector, suggesting that recent gains are not solely a short-term reaction to headlines. Taken together, these developments imply that confidence is building among both investors and analysts and is being influenced by more than just the latest earnings report.

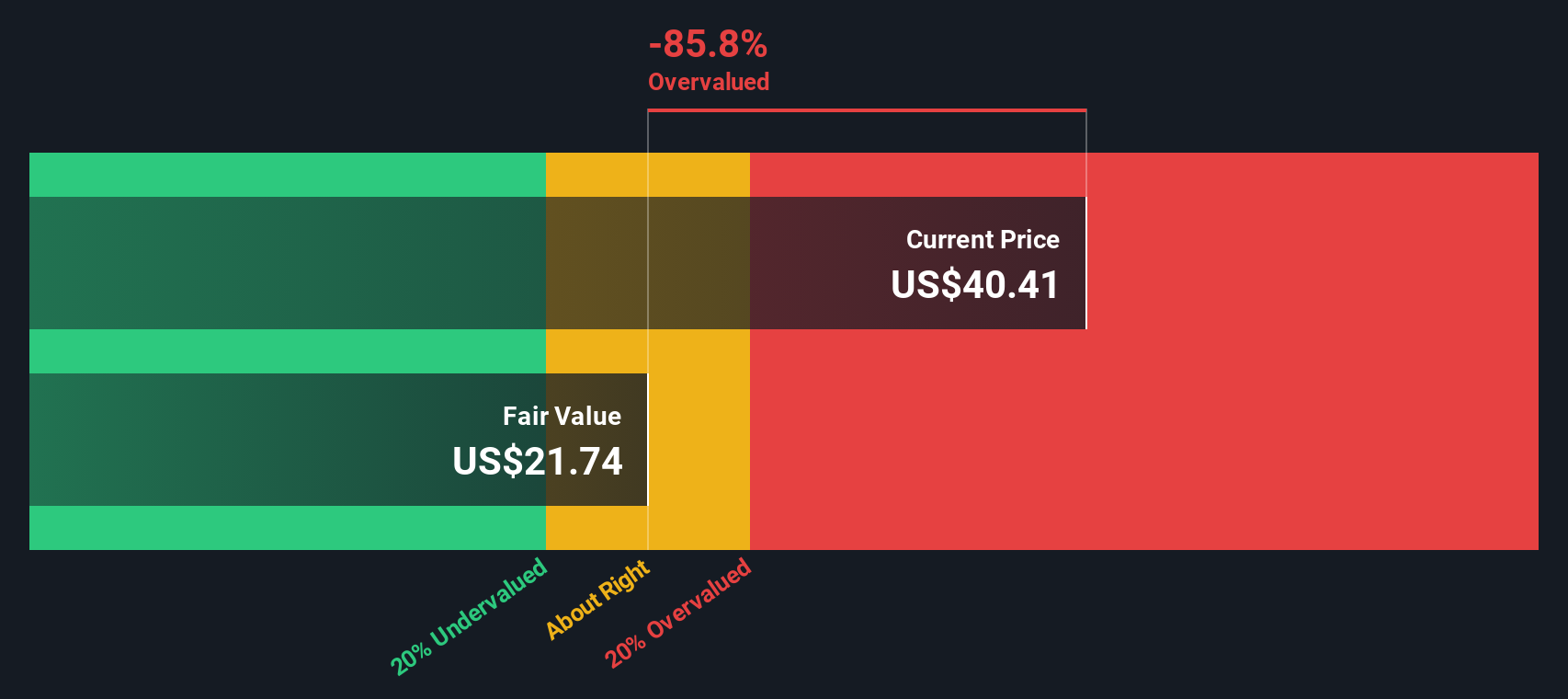

With the stock now reaching new highs, the main question is whether China Yuchai International remains a bargain or if the market is fully reflecting its future growth potential. Is there additional room for growth, or are expectations already factored in?

Most Popular Narrative: 49% Overvalued

According to community narrative, analysts believe China Yuchai International is currently trading well above its estimated fair value based on future earnings growth and profit margins.

Recent results may be benefiting from a temporary surge in demand for diesel and gas engines for data center backup power due to rapid digitalization and infrastructure build-out. However, over the long term, global shifts towards electric vehicles and zero-emissions regulations could significantly reduce addressable markets and pressure topline revenue.

The numbers driving this narrative might surprise you. Is the fair value based on steady profits or major changes in the company’s growth trajectory? Curious about which fundamental shifts and industry forecasts push this stock so far from the consensus price target? The story behind these projections will change how you see China Yuchai International’s prospects.

Result: Fair Value of $20.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust export growth or successful investments in alternative fuels could challenge this view and provide support for stronger long-term results for China Yuchai International.

Find out about the key risks to this China Yuchai International narrative.Another View: What About the SWS DCF Model?

While market comparisons highlight China Yuchai International as expensive, our DCF model offers a different perspective. By analyzing future cash flows, this approach actually suggests the company is also trading above its fair value. Could there be a disconnect between what the market sees and what these fundamentals reveal?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own China Yuchai International Narrative

If you have a different view or simply want to dive deeper into the numbers, you can easily craft your own perspective in just a few minutes. Why not do it your way.

A great starting point for your China Yuchai International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

There is a world of opportunity waiting beyond one stock. If you want to stay ahead, use the market insights and dynamic tools already catching the attention of smart investors. Here are some places to start if you are seeking a well-rounded portfolio and fresh strategies you might be missing out on:

- Spot new income opportunities by reviewing companies with regular payouts and see which ones offer dividend stocks with yields > 3%.

- Get a jump on the next technological leap by exploring innovators with early breakthroughs in quantum computing stocks.

- Strengthen your watchlist by checking out stocks trading well below intrinsic value through the lens of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English