Lennar (LEN): Exploring Valuation After Recent Share Slip and 3-Month Rally

Lennar (LEN) just saw its shares slip nearly 1% in the last session, perhaps raising an eyebrow or two among investors trying to determine if this is a meaningful signal or just ordinary day-to-day noise. There was no headline or material event driving the move. Sometimes, however, small shifts like this prompt questions about whether we are seeing the early stages of something interesting or if it is simply time for a valuation check.

Looking at the bigger picture, Lennar’s stock is down 21% over the past year, despite posting an impressive 23% climb in the past three months. That swing follows a year of moderate revenue growth and a decline in net income, while the company continues to trade at a meaningful discount to some analyst-derived value estimates. With momentum picking up recently after a tougher stretch, it is a stock attracting new attention for both its volatility and its strong three-year performance.

The current three-month rally is raising questions about whether it marks the start of a true turnaround or if the market has already factored in the company’s future growth. A closer look at Lennar’s valuation could offer additional insights into what might be driving this performance.

Most Popular Narrative: 20.5% Undervalued

According to the narrative by Zev, Lennar is currently trading well below its estimated fair value, suggesting meaningful upside potential if underlying assumptions play out. The valuation factors in expected earnings growth, improved margins, and a three-year bullish outlook for the homebuilding sector.

A balanced market requires a balance between supply and demand. Taking a quick look at the past five years of the FRED's months' supply data shows that it is at new heights, similar to levels during the Great Recession. This indicates a surplus of housing relative to demand. People are not exactly lining up to buy houses, as the ratio has sharply increased from 5.6 in February 2020 to 8.9 in November 2024. This is primarily due to high mortgage rates and the fact that many homes started during the low mortgage rate housing boom of 2020-2021 came to market in 2023 and 2024, coinciding with a period of reduced demand.

Want to know the underlying force behind this undervalued call? The narrative's bullish stance hinges on a turning point in the housing market, fueled by projected earnings and margin shifts. Looking for the numbers and reasoning that set this price? Dig deeper and find out what could change Lennar's fortunes.

Result: Fair Value of $162.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as persistently higher interest rates or slower than expected demand recovery could quickly challenge the bullish outlook set by current valuations.

Find out about the key risks to this Lennar narrative.Another View: Discounted Cash Flow Model

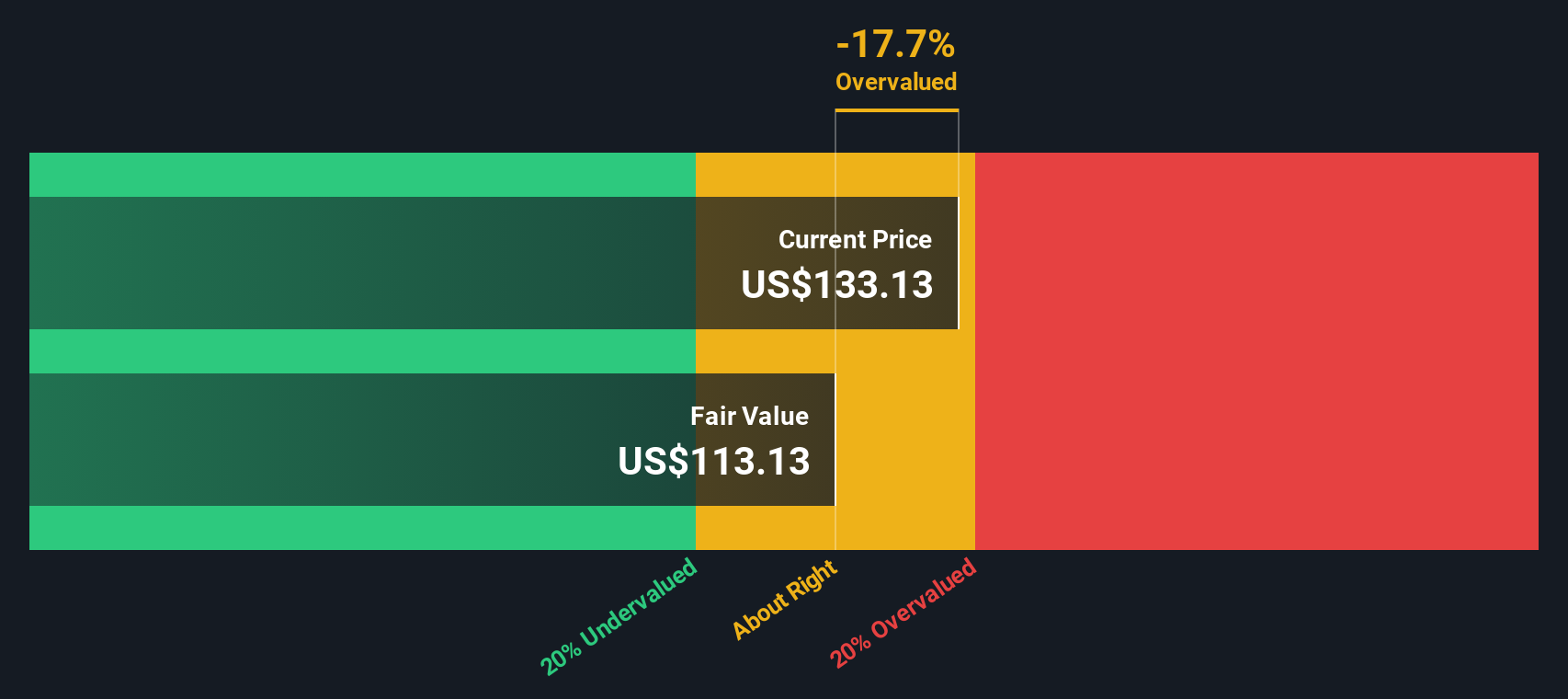

While the earlier narrative points to Lennar’s shares being attractively priced, our DCF model offers a more conservative perspective and suggests the stock might be trading above fair value. Could this mean expectations are too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lennar Narrative

If you have a different perspective or want to dive into the numbers on your own, you can put together your own narrative in just minutes. do it your way.

A great starting point for your Lennar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your research and get ahead of trends before others catch on. With Simply Wall Street’s unique screeners, you can pinpoint stocks that match your strategy, unlock hidden value, and position yourself for what’s next in the market. Don’t let the best opportunities pass you by:

- Tap into a new wave of growth by tracking healthcare companies that leverage AI innovations with healthcare AI stocks.

- Fuel your portfolio with stocks boasting attractive dividend yields above 3%. Find these reliable income plays with dividend stocks with yields > 3%.

- Harness the potential of quantum computing leaders poised to disrupt entire industries by using quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English