Is AEVA's Record Q2 Revenues the Spark for Lasting Growth?

LiDAR sensor maker Aeva Technologies (AEVA) posted record second-quarter 2025 revenues of $5.5 million, a more than 60% sequential jump and well above expectations. This growth was driven by a rise in product shipments and increased revenues from early-stage development programs. This marks an important milestone for the company, signaling that initial partnerships are now beginning to generate tangible commercial success. Management also raised its full-year growth forecast, expecting revenues to increase by 100-110% from prior expectations of doubling revenues.

The company’s improved trajectory is supported by demand for its LiDAR products in both the automotive and industrial sectors. For example, AEVA’s role as a key long-range sensor supplier for Daimler Truck provides visibility into multi-year production revenue. Industrial applications are also gaining momentum. This blend of early sales and engineering contracts reflects a more standard ramp-up toward broader commercialization, reinforced by improving gross margins that are now tracking toward the 35-45% range expected at scale.

Looking ahead, the company sees opportunities for much larger contracts. Just a few full-scale automotive programs could represent between $400 million and $500 million in annual revenue. The potential for growth in industrial automation and consumer applications further expands this potential. With shipments rising and orders firming up, AEVA’s performance suggests it is steadily moving from pilot projects to a full commercialization cycle.

Peer Trends

Ouster's (OUST) revenue trajectory is on an upward trend, too. The company delivered strong Q2 results with revenues of over $35 million, surpassing the high end of Ouster’s guidance. This represents a 30% year-over-year increase and marks Ouster's tenth consecutive quarter of revenue growth. The performance was driven by a record number of sensor shipments.

However, Luminar Technologies’ (LAZR) revenue trajectory shows a sequential decline, with Q2 revenues coming in at $15.6 million, a 5% drop from the same period last year. This was attributed to a reduction in production volume estimates for Luminar’s key automotive program and a strategic exit from non-core businesses. Luminar is now shifting its focus to commercial markets for near-term revenue opportunities.

AEVA’s Price Performance, Valuation and Estimates

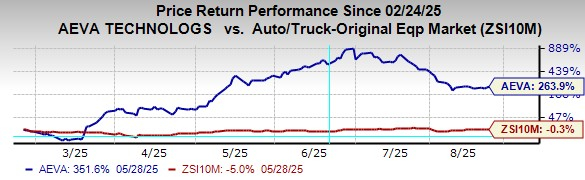

Shares of Aeva Technologies have increased around 264% over the past six months against the industry’s decline of 0.3%.

Image Source: Zacks Investment Research

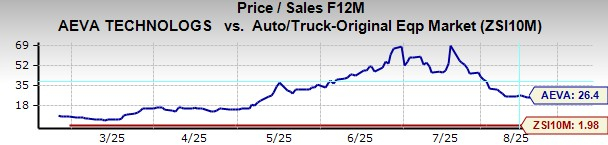

Image Source: Zacks Investment Research

From a valuation standpoint, AEVA trades at a forward price-to-sales ratio of over 26, well above the industry. AEVA carries a Value Score of F.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

See how the Zacks Consensus Estimate for Aeva Technologies’ earnings has been revised over the past 90 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Big Gain, Every Trading Day

To help you take full advantage of this market, you’re invited to access every stock recommendation in all our private portfolios - for just $1.

Zacks private portfolio services that closed 256 double and triple-digit winners in 2024 alone. That’s about one big gain every day the market was open. Of course, not all our picks are winners, but members have seen recent gains as high as +627% +1,340%, and +1,708%.

Imagine how much you could profit with a steady stream of real-time picks from all our services that cover a number of strategies to suit a variety of investing and trading styles.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Luminar Technologies, Inc. (LAZR): Free Stock Analysis Report

Ouster, Inc. (OUST): Free Stock Analysis Report

Aeva Technologies, Inc. (AEVA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English