Assessing PagSeguro Digital (NYSE:PAGS) Valuation Following Q2 Earnings Growth and Renewed Investor Interest

PagSeguro Digital (NYSE:PAGS) has given investors something to talk about this week with its second quarter earnings release. The company posted year-over-year gains in both revenue and net income, indicating that its core payments business continues to expand despite ongoing competition. For investors watching the stock, this uptick in financial performance could suggest that PagSeguro is finding ways to grow profitably even as the market shifts.

Looking at the big picture, PagSeguro Digital’s stock has seen significant volatility in recent years. Shares are up more than 36% since January, outpacing the broader fintech sector. However, the price is still down over the past year and remains well below highs from previous periods. This recent momentum, combined with solid earnings growth, suggests that investor sentiment may be improving as concerns about growth and profitability begin to shift.

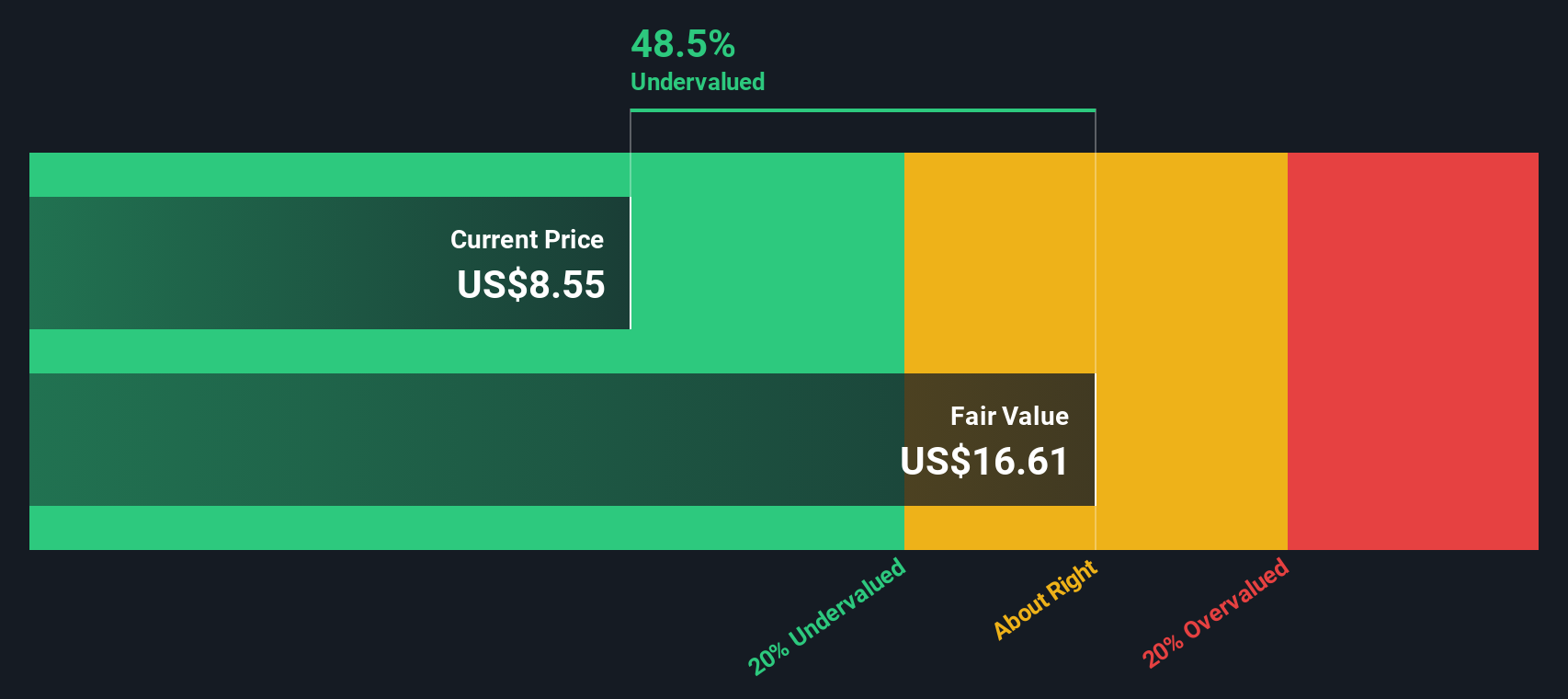

With shares rebounding following this latest earnings report, it is worth considering whether PagSeguro Digital is trading at a discount or if the market is already factoring in future growth. The question remains whether there is a genuine buying opportunity at present or if it may be prudent to wait and observe further developments.

Most Popular Narrative: 23.9% Undervalued

According to community narrative, PagSeguro Digital is currently trading well below analyst fair value estimates. Analysts believe the company is undervalued, given its future growth prospects and improved profitability.

PagSeguro's credit portfolio grew by 36% year-over-year, focusing on secured loans and a sustainable strategy. This approach is expected to enhance net income growth through increased interest income from low-risk lending. Strong repricing strategies in response to the hiking interest rates in Brazil are expected to partly mitigate the impact on financial costs, contributing positively to gross profit and overall earnings.

Curious about the bold projections fueling this undervaluation call? Analysts are relying on a combination of profit expansion and improved monetization to target a striking fair value. Want to uncover the specific growth levers and the all-important earnings forecast that could shift PagSeguro's market narrative? Delve into the numbers behind this valuation thesis; you might be surprised by what is driving the consensus call.

Result: Fair Value of $11.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high interest rates or tougher competition from alternatives like PIX could quickly challenge the bullish outlook for PagSeguro Digital’s potential upside.

Find out about the key risks to this PagSeguro Digital narrative.Another View: What Does the DCF Model Say?

Taking a different approach, the SWS DCF model also points to a story of undervaluation for PagSeguro Digital. Two distinct methods now spotlight potential upside. The question remains: which model will the market ultimately trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PagSeguro Digital Narrative

If your perspective differs, or you would rather take a hands-on approach, you can craft your own narrative in just a few minutes. do it your way.

A great starting point for your PagSeguro Digital research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Seeking More Smart Investment Opportunities?

Missing out on market leaders and hidden gems could mean leaving strong returns on the table. Give yourself every chance to succeed by checking out unique stock ideas curated by Simply Wall Street’s powerful screener tools. Elevate your portfolio with these timely opportunities:

- Capture steady income and long-term growth by targeting companies offering dividend stocks with yields > 3% to build a robust stream of reliable payouts.

- Tap into the next tech breakthrough by exploring AI penny stocks making waves in artificial intelligence innovation.

- Uncover potential value plays with undervalued stocks based on cash flows that may be flying under Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English