Will Celanese's (CE) New Credit Facility Shift the Focus to Margin Recovery or Debt Discipline?

- In August 2025, Celanese Corporation reported its second quarter results, showing net income of US$199 million on US$2.53 billion in sales, alongside the launch of a new US$1.75 billion senior unsecured revolving credit facility extending liquidity until August 2030.

- This combination of rising earnings per share despite lower sales, plus refreshed financial flexibility, highlights management’s focus on both profitability and balance sheet strength.

- We’ll assess how Celanese’s new long-term credit facility could influence the company’s investment narrative around margin recovery and cash flow.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Celanese Investment Narrative Recap

To be a shareholder in Celanese today, you need to believe in its ability to restore margin strength and earnings growth as global end-market demand normalizes, especially in its core acetyl and engineered materials businesses. The new US$1.75 billion revolving credit facility modestly bolsters near-term financial flexibility but does not materially alter the biggest short-term catalyst, volume and margin recovery as demand and pricing gradually stabilize, or the most pressing risk, which remains persistent weak demand and margin compression in key markets.

Among recent announcements, the extension and renewal of Celanese's credit facility stands out. By securing this financing through August 2030, the company has reinforced its liquidity at a time when cash flow is under pressure from subdued sales and challenging industry conditions, supporting management's margin recovery efforts even if demand headwinds persist.

On the other hand, investors should be aware...

Read the full narrative on Celanese (it's free!)

Celanese's narrative projects $10.3 billion revenue and $799.9 million earnings by 2028. This requires 1.1% yearly revenue growth and a $2.4 billion increase in earnings from -$1.6 billion currently.

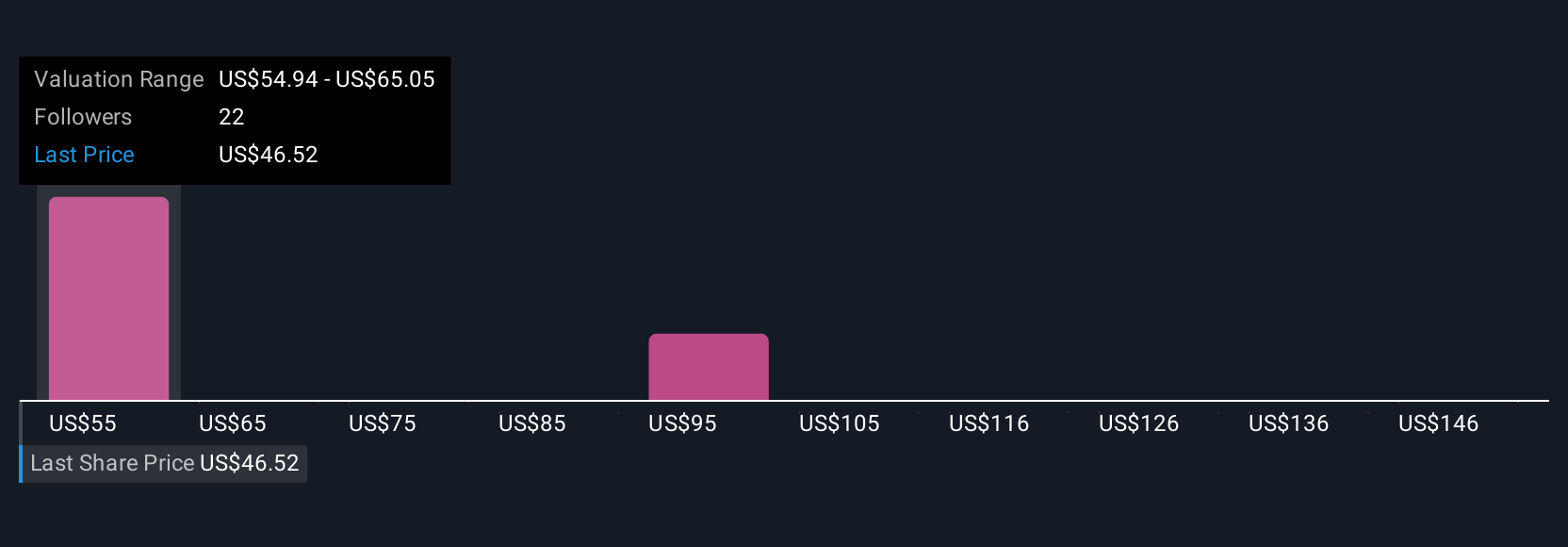

Uncover how Celanese's forecasts yield a $54.94 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fair value estimates from five Simply Wall St Community members span US$54.94 to US$156.05 per share, highlighting widely differing views among retail investors. With persistent overcapacity and margin risk still challenging recovery, it is worth exploring how others interpret Celanese's long-term prospects.

Explore 5 other fair value estimates on Celanese - why the stock might be worth over 3x more than the current price!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

No Opportunity In Celanese?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English