How Atmus Filtration Technologies' (ATMU) Dividend Hike Signals a Shift in Capital Allocation Strategy

- Earlier this month, Atmus Filtration Technologies announced that its Board of Directors approved a quarterly cash dividend increase to US$0.055 per common share, up 10% from the previous dividend, payable on September 10, 2025 to shareholders of record as of August 26, 2025.

- This boost in the company's dividend payout reflects management's confidence in financial health and commitment to providing greater returns to shareholders.

- We will explore how this dividend increase may influence Atmus's investment narrative, with a focus on its capital allocation approach.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Atmus Filtration Technologies Investment Narrative Recap

To be a shareholder in Atmus Filtration Technologies, you need to believe in the company’s ability to capture expanding demand for advanced filtration amid tightening environmental regulations and continued growth in aftermarket services. The recent 10% dividend increase may reassure some regarding Atmus’s financial health, but it does not materially change the biggest short-term catalyst, growth in OEM partnerships, or address the most critical risk, which is the company’s high aftermarket concentration as structural engine changes continue.

Of recent company announcements, Atmus’s August earnings release is especially relevant: the firm reported higher sales and earnings for Q2 2025 and raised its full-year revenue guidance. Alongside the dividend hike, these developments suggest that Atmus is maintaining profitability and has room for steady capital returns to shareholders, providing some stability as the company seeks exposure to more diversified end-markets.

However, investors should also consider that, despite these positives, risks remain around Atmus’s heavy exposure to the aftermarket and the possible impact of...

Read the full narrative on Atmus Filtration Technologies (it's free!)

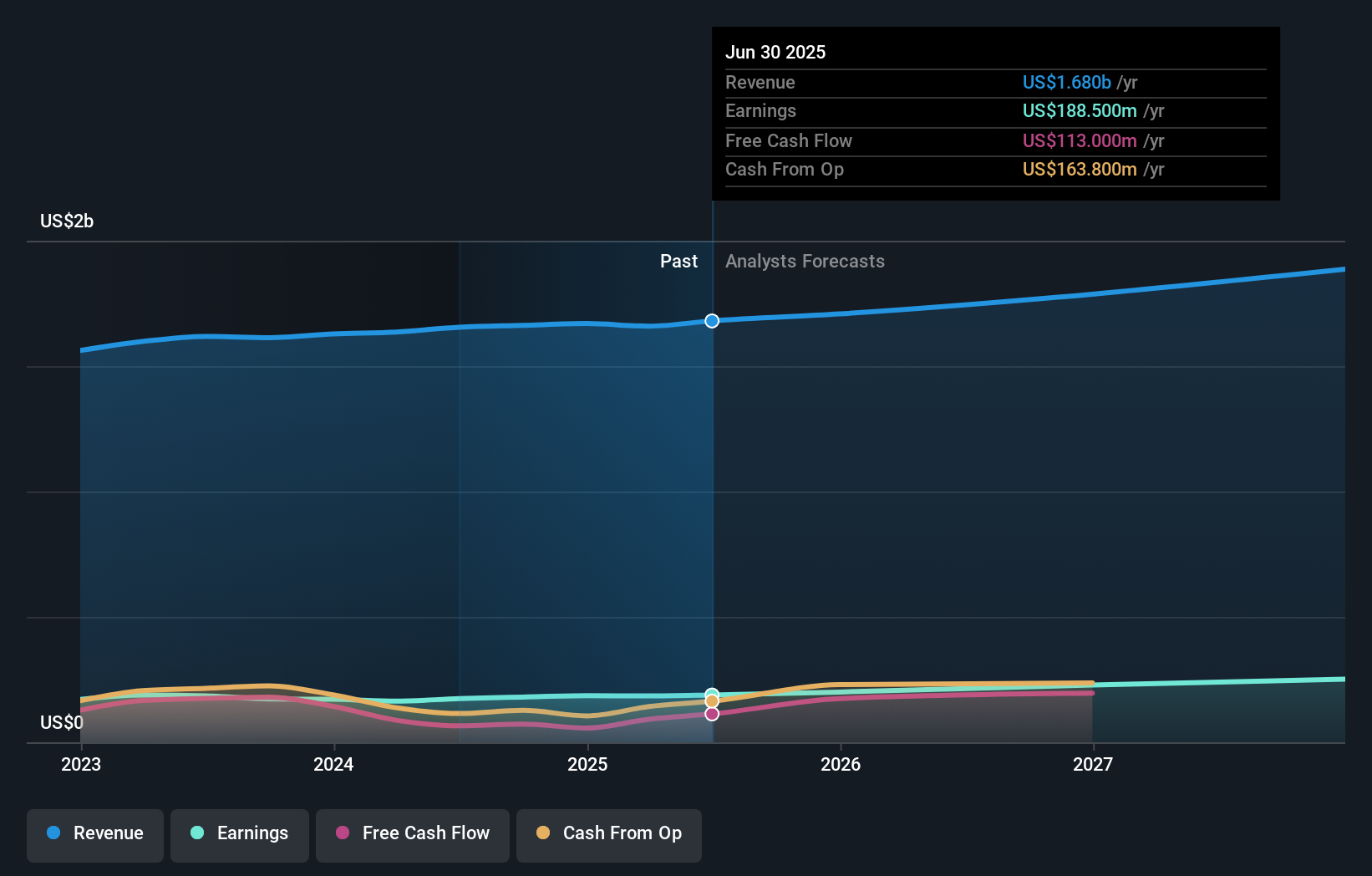

Atmus Filtration Technologies is expected to reach $1.9 billion in revenue and $268.6 million in earnings by 2028. This outlook is based on analysts’ assumptions of a 4.5% annual revenue growth rate and a $80.1 million increase in earnings from the current $188.5 million.

Uncover how Atmus Filtration Technologies' forecasts yield a $45.80 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided 1 fair value estimate at US$70.77, suggesting potential undervaluation compared to current prices. Yet with the company’s high reliance on the replacement aftermarket, you may want to weigh these views carefully and explore several perspectives.

Explore another fair value estimate on Atmus Filtration Technologies - why the stock might be worth just $70.77!

Build Your Own Atmus Filtration Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atmus Filtration Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atmus Filtration Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atmus Filtration Technologies' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English