What Affiliated Managers Group (AMG)'s Board Refresh Means for Shareholders Amid Expanding Investment Strategies

- Affiliated Managers Group recently announced the appointment of Marcy Engel to its Board of Directors, effective September 30, 2025, coinciding with the retirement of long-serving board member Dwight D. Churchill.

- Engel's extensive experience in alternatives and broad leadership roles across major asset managers highlights AMG's ongoing focus on strengthening governance as it expands in specialized investment strategies.

- With this board addition, we'll explore how AMG's evolving leadership could support its ongoing momentum and align with analyst optimism around earnings growth.

The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Affiliated Managers Group Investment Narrative Recap

AMG investors need confidence in the company's ability to offset ongoing outflows from traditional active equity strategies with rapid expansion in alternatives, while maintaining stable earnings from its largest affiliates. The recent appointment of Marcy Engel to the board, though a sign of continued governance focus, is unlikely to materially influence near-term catalysts like organic growth or the risk of revenue volatility driven by concentrated earnings.

Among recent developments, AMG's aggressive share buyback activity, 593,000 shares repurchased for US$100 million in Q2, stands out as most relevant. These continued buybacks reflect management’s focus on compounding per-share results, tying directly to the core earnings growth catalyst for shareholders.

However, investors should also keep a close eye on the potential impact if core affiliates such as Pantheon or AQR face...

Read the full narrative on Affiliated Managers Group (it's free!)

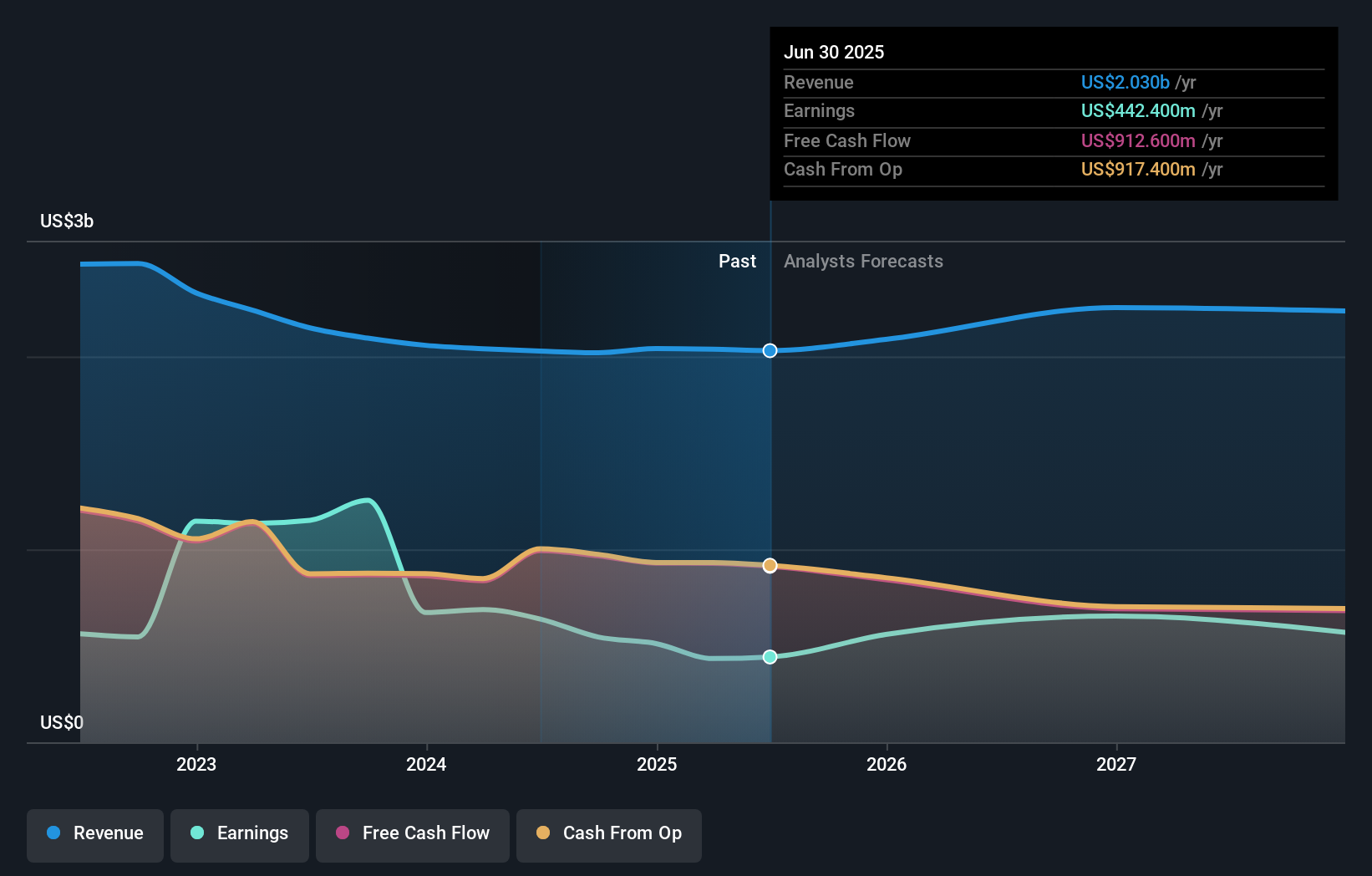

Affiliated Managers Group's narrative projects $2.2 billion revenue and $594.9 million earnings by 2028. This requires 2.7% yearly revenue growth and a $152.5 million earnings increase from $442.4 million today.

Uncover how Affiliated Managers Group's forecasts yield a $240.29 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value forecasts for AMG range from US$240.29 to US$262.08, reflecting two individual perspectives. While opinions differ, the company’s dependence on major affiliates could shape its earnings consistency in the future, a key aspect watched by many.

Explore 2 other fair value estimates on Affiliated Managers Group - why the stock might be worth just $240.29!

Build Your Own Affiliated Managers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affiliated Managers Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Affiliated Managers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affiliated Managers Group's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English