How National Recognition for Innovation and Sustainability at Kadant (KAI) Has Changed Its Investment Story

- Kadant Inc. was recently recognized by Newsweek as one of "America's Greatest Companies 2025," highlighting its achievements in stock performance, workforce engagement, sustainability, and innovation.

- This distinction reflects growing acknowledgment of Kadant's focus on sustainable industrial processing and high employee engagement as central strengths.

- We’ll explore how industry recognition for innovation and sustainability may influence Kadant's long-term investment narrative and future outlook.

AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kadant Investment Narrative Recap

To be a shareholder in Kadant, you generally need to believe in the importance of sustainable industrial processing, recurring high-margin aftermarket revenue, and the company's potential to benefit from global industry modernization and capital equipment spending. While Newsweek's recognition underscores strengths in sustainability and innovation, it does not materially change the current pressure from slowing order momentum or the risk that rising SG&A expenses could further erode margins in the near term.

Of Kadant’s recent developments, its lowered 2025 earnings and revenue guidance stands out as most relevant. Despite achieving industry accolades, revised forecasts reflect caution around demand patterns and profitability, emphasizing that positive brand recognition doesn't always counterbalance headwinds like delayed capital orders or ongoing cost inflation.

By contrast, investors should be aware that ongoing uncertainty in global trade policy could cause more unpredictable swings in capital equipment orders and...

Read the full narrative on Kadant (it's free!)

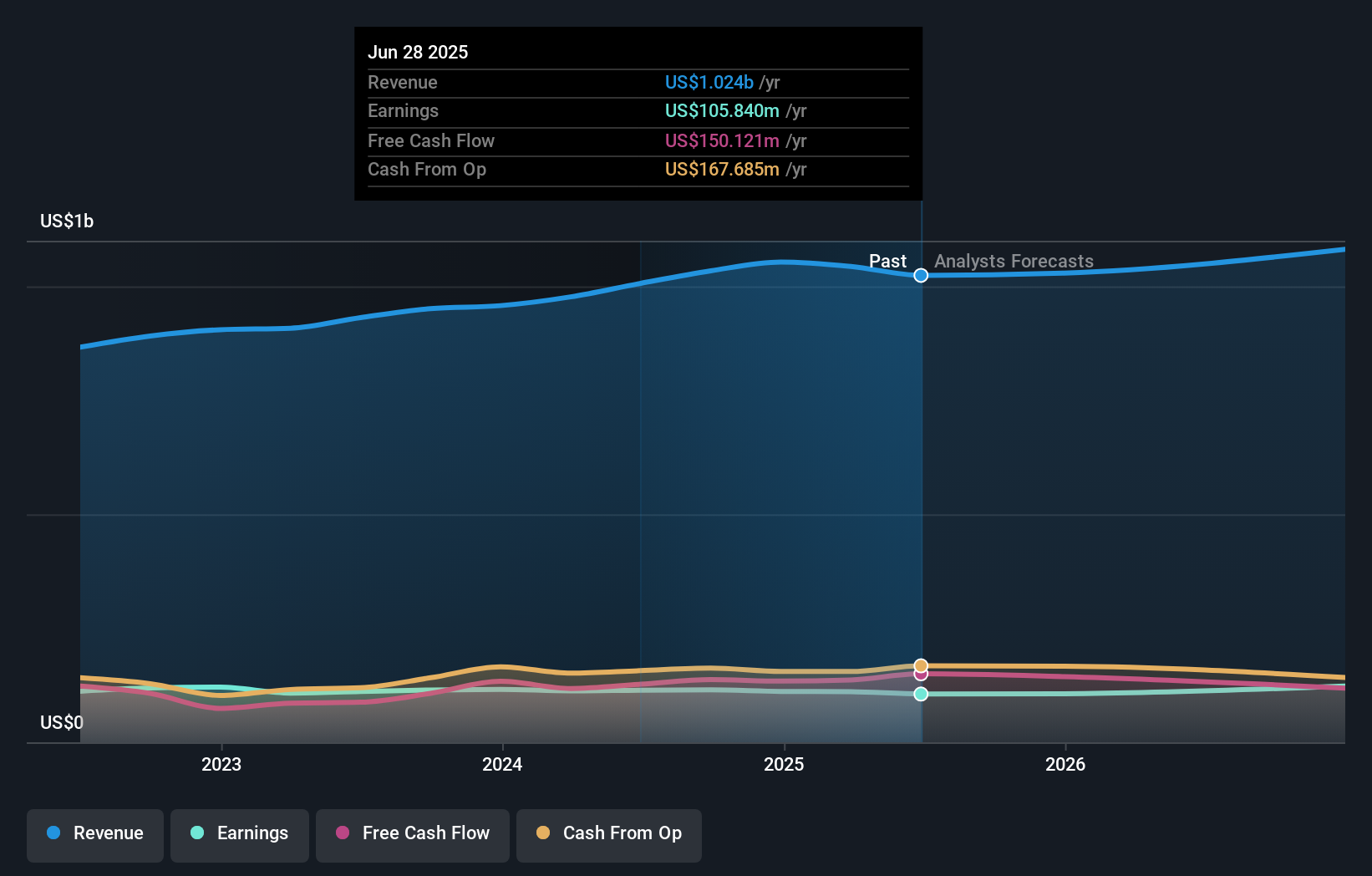

Kadant's outlook projects $1.1 billion in revenue and $141.4 million in earnings by 2028. This scenario is based on 3.5% annual revenue growth and a $35.6 million increase in earnings from the current $105.8 million.

Uncover how Kadant's forecasts yield a $343.33 fair value, in line with its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community assessed Kadant’s fair value between US$180,600 and US$200,000 per share. Their views reflect uncertainty even as the company’s revised guidance and ongoing cost pressures keep risk top of mind for many.

Explore 2 other fair value estimates on Kadant - why the stock might be worth as much as $200.00!

Build Your Own Kadant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kadant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadant's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English