Why Scholar Rock (SRRK) Is Up 13.0% After FDA Priority Review for Apitegromab in SMA

- Earlier this month, Scholar Rock announced that positive Phase 3 SAPPHIRE trial results for its muscle-targeted therapy apitegromab in children and adults with spinal muscular atrophy (SMA) were published in The Lancet Neurology, also noting its Biologics License Application was accepted by the FDA for priority review.

- This marks apitegromab as the first muscle-targeted treatment candidate for SMA to achieve clinical success at a pivotal trial stage, further recognized by multiple special FDA and EMA designations.

- We’ll explore how the acceptance of apitegromab’s FDA application shapes Scholar Rock’s investment picture and outlook for rare disease therapies.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Scholar Rock Holding's Investment Narrative?

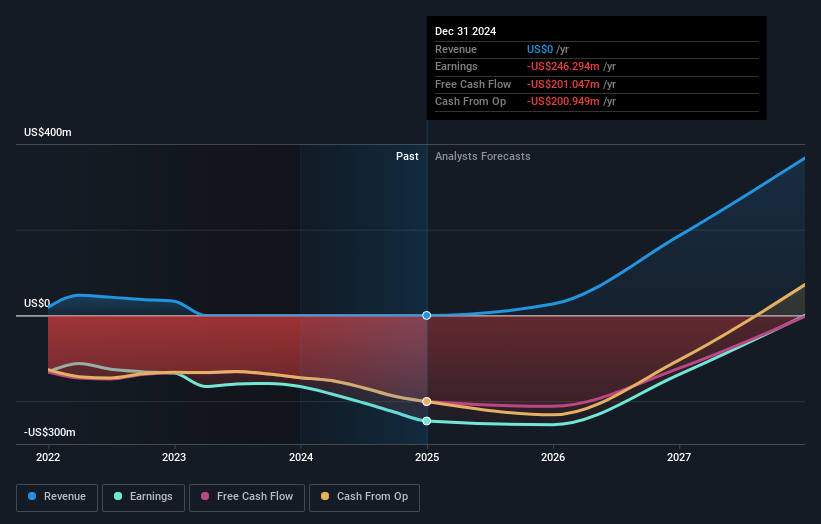

For anyone considering Scholar Rock, the big question remains whether its muscle-targeted therapy apitegromab can become a commercial success in spinal muscular atrophy. The publication of positive Phase 3 SAPPHIRE data and the FDA’s acceptance of apitegromab’s application for priority review are clear near-term catalysts, driving a jump in share price and raising expectations for regulatory decisions by September 2025. This marks a possible turning point, although the company still reports rising net losses, zero revenue, and ongoing executive turnover. The outlook may shift if the therapy is approved, but at present, Scholar Rock’s fortunes rest heavily on one pipeline asset reaching market. The risk profile has not disappeared, with cash burn and future funding needs taking center stage, but for now, the recent news stands as the main focus of investor optimism.

However, not all risks are tied to clinical outcomes, financial losses remain a critical point for investors to consider.

Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth as much as 41% more than the current price!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English