DENTSPLY SIRONA (XRAY): Evaluating Value After CEO’s Strategy Shift Towards Execution and Digital Integration

If you have been following DENTSPLY SIRONA (XRAY), the company’s latest comments may have given you a reason to look twice at the stock. The new CEO has signaled a clear pivot in strategy, moving away from making disruptive changes and instead doubling down on operational execution. That means focusing on integrated digital workflows and streamlining the customer experience, especially across product lines like EDS and Wellspect. Some believe this approach could set the stage for a steadier, more predictable business.

Investors might be paying closer attention, but the numbers tell a mixed story. DENTSPLY SIRONA shares have climbed about 5% over the past week but are still down 22% for the year and roughly 40% over the past twelve months. After a tough stretch, with the market reducing its risk appetite and the company posting a large annual net loss, there are hints that momentum may be shifting. However, skepticism remains about a near-term turnaround.

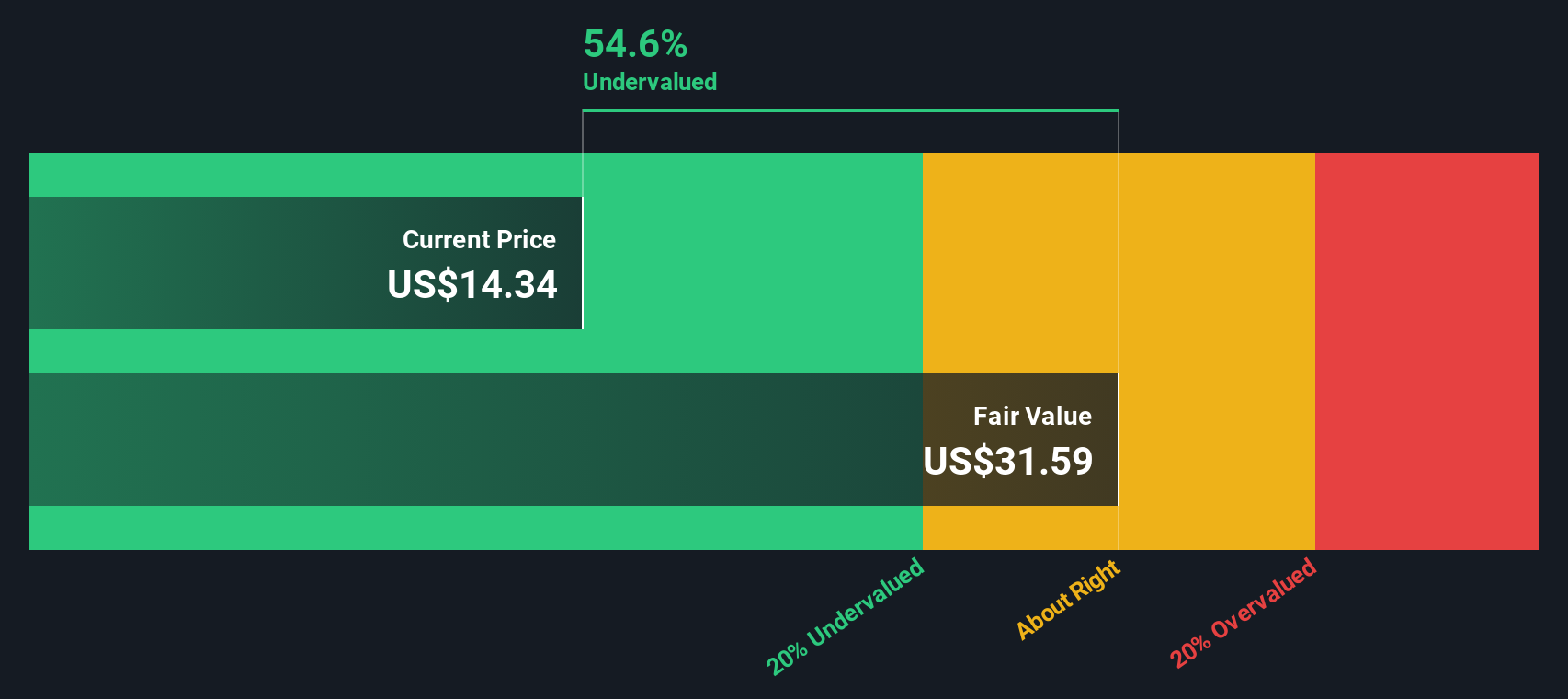

This brings up the real question: is DENTSPLY SIRONA now undervalued and primed for a rebound, or is the market simply adjusting to a less risky, slower-growth future?

Most Popular Narrative: 13% Undervalued

According to community narrative, DENTSPLY SIRONA is seen as undervalued, with analysts projecting a fair value that stands out above the current share price. This narrative focuses on the company’s improving execution, expansion in global dental markets, and a strategic emphasis on digital solutions and recurring revenues.

“DENTSPLY SIRONA is leveraging the increasing global demand for advanced dental care, driven by an aging population and rising middle class in emerging markets, by ramping up investments in product innovation and tailored field support. This is expected to accelerate international revenue growth over the long term.”

Want to unlock the hidden formula powering this valuation? At the core are some bold assumptions about profit turnaround, industry transformation, and a path to margin expansion the market cannot ignore. Want to see exactly which growth drivers and financial targets are included in this bullish case? Explore further to discover what is fueling the gap between price and value.

Result: Fair Value of $16.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent sales declines and ongoing cost pressures could threaten DENTSPLY SIRONA’s rebound. These challenges may impact the optimistic outlook reflected in current valuation models.

Find out about the key risks to this DENTSPLY SIRONA narrative.Another View: Discounted Cash Flow Valuation

Our DCF model tells a different story. It estimates DENTSPLY SIRONA’s value based on its future expected cash flows. This approach also points to the stock being undervalued. But which lens truly captures reality for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DENTSPLY SIRONA Narrative

If you think there is another angle or would rather reach your own conclusions, you can quickly craft your own interpretation using the available data. do it your way.

A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Move confidently toward your investment goals by searching for fresh opportunities. The right screener can help you uncover stocks you might otherwise miss. Don’t let the next big opportunity slip past you. Use these powerful tools to stay ahead in the market:

- Strengthen your income strategy by checking out dividend stocks with yields > 3% and discover companies offering attractive yields above 3% for long-term stability.

- Accelerate your portfolio’s growth by exploring AI penny stocks for access to cutting-edge AI leaders making waves in emerging technologies.

- Get ahead in the fast-moving digital finance world with cryptocurrency and blockchain stocks to find top businesses steering advancements in cryptocurrency and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English