Could Cushman & Wakefield's (CWK) Global Expansion With Woodside Signal a Shift in Recurring Revenue Strategy?

- Woodside Energy has appointed Cushman & Wakefield to deliver integrated real estate solutions across its global office portfolio in a five-year agreement spanning 14 countries, including regions in Asia Pacific, Europe, the Middle East & Africa, Latin America, and North America.

- This represents an expansion of a long-standing relationship and marks Cushman & Wakefield's first Global Occupier Services mandate with a client headquartered in Perth, illustrating the company's ongoing emphasis on global growth and service breadth.

- We'll now examine how securing a global mandate with Woodside Energy may influence Cushman & Wakefield's investment outlook and recurring revenue base.

Find companies with promising cash flow potential yet trading below their fair value.

Cushman & Wakefield Investment Narrative Recap

To be a Cushman & Wakefield shareholder, you need to believe the company can sustainably expand its recurring revenue through global client wins, offsetting its exposure to cyclical property markets. Landing the Woodside Energy mandate underscores Cushman & Wakefield's ability to deepen high-value client relationships and further diversify its revenue, which could help counterbalance the biggest short-term risk, persistent reliance on transactional leasing and capital markets revenues, though the near-term impact of this single deal may be limited.

Among recent announcements, the appointment of Susan Beth Daimler, the former President of Zillow, to the board stands out. Her background in digital real estate could be valuable as Cushman & Wakefield looks to defend revenue streams in a market increasingly influenced by technology and changing workplace needs, echoing both new business catalysts and the evolving threat from PropTech competitors.

But investors should be mindful that, despite the promise of major new clients, cyclical exposure to leasing volumes remains a key risk if...

Read the full narrative on Cushman & Wakefield (it's free!)

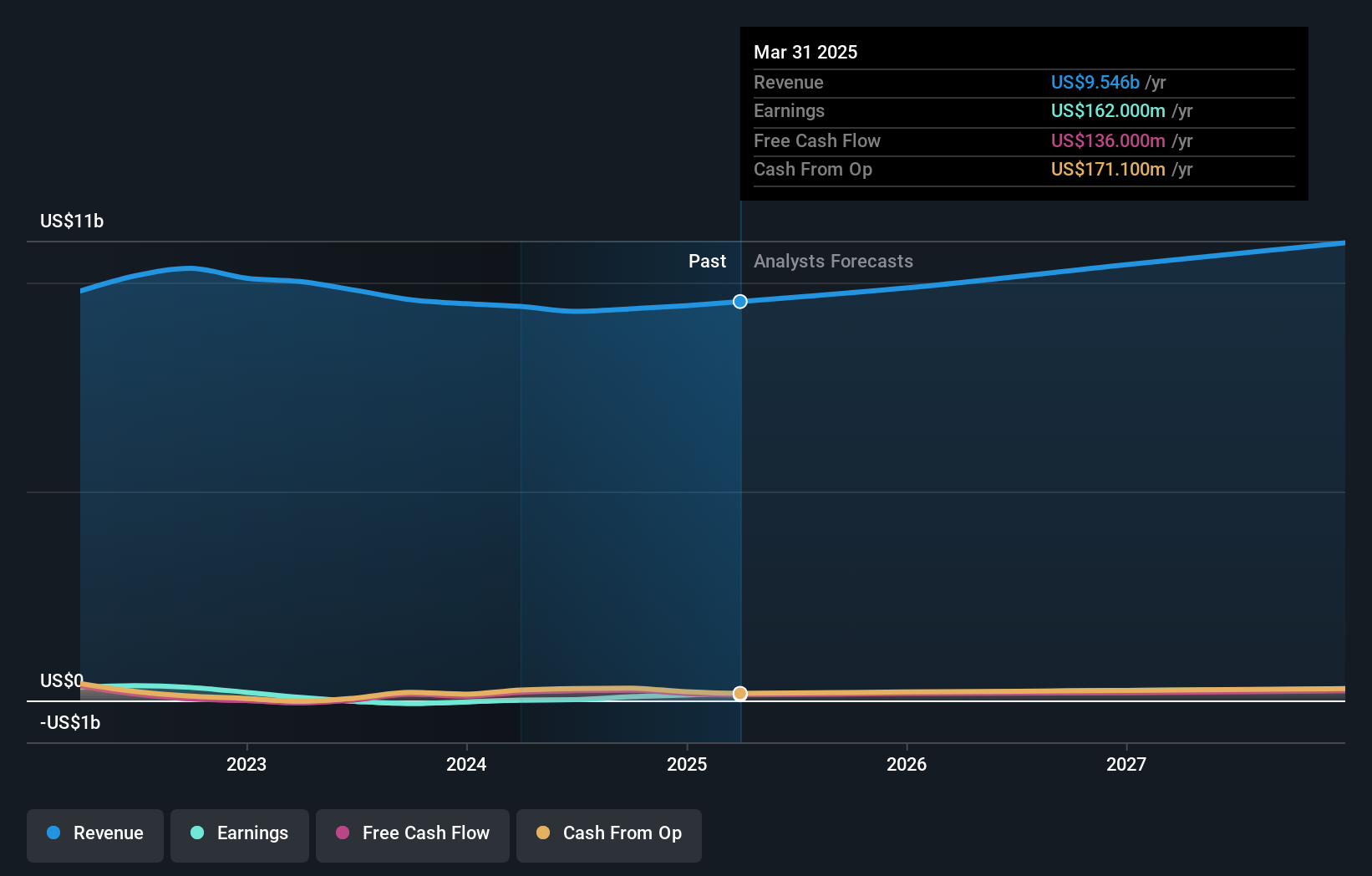

Cushman & Wakefield's outlook anticipates $11.4 billion in revenue and $325.3 million in earnings by 2028. This scenario is based on a 5.4% annual revenue growth rate and an earnings increase of $119.5 million from current earnings of $205.8 million.

Uncover how Cushman & Wakefield's forecasts yield a $15.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Cushman & Wakefield range widely, from US$4.64 to US$18.23 across 3 analyses. As recurring services gain ground, many still warn that sensitivity to commercial real estate cycles could undermine stability, explore how these viewpoints might influence your own outlook.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth less than half the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English