Why Provident Financial Services (PFS) Is Up 5.3% After Fed Signals Rate Cut Hopes and Upbeat Analyst Outlook

- Provident Financial Services, along with several regional bank peers, saw increased investor interest following dovish comments from Federal Reserve Chair Jerome Powell at the recent Jackson Hole symposium, signaling the possibility of future interest rate cuts amid moderating inflation and low unemployment.

- Further supporting sentiment, analysts raised earnings estimates for Provident Financial Services over the last 60 days and assigned it a top Zacks Rank, highlighting a shift in outlook for the company.

- We’ll explore how renewed expectations for interest rate cuts may influence Provident Financial Services’ growth prospects and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Provident Financial Services Investment Narrative Recap

To be a shareholder in Provident Financial Services right now, you need to believe that improving economic sentiment, potentially supported by near-term Fed rate cuts, could bolster regional banks’ earnings and loan growth. The Fed’s recent dovish tone has improved short-term prospects for Provident by boosting confidence in net interest margins, though risks remain from rising deposit competition and geographic concentration, particularly if rate cuts don’t materialize as anticipated.

Of recent company developments, Provident’s strong second quarter results stand out, with net income rebounding to US$71.98 million from a loss last year, and net loan charge-offs decreasing. These results strengthen the view that moderating funding pressures and credit costs are currently acting as tailwinds for earnings, aligning with the optimism triggered by talk of future rate cuts.

On the other hand, investors should be aware that deposit competition from both traditional and nontraditional banks remains intense and could still challenge net interest margins if...

Read the full narrative on Provident Financial Services (it's free!)

Provident Financial Services is projected to reach $1.1 billion in revenue and $411.2 million in earnings by 2028. This implies an annual revenue growth rate of 8.9% and an increase in earnings of $180.3 million from the current $230.9 million.

Uncover how Provident Financial Services' forecasts yield a $21.92 fair value, a 11% upside to its current price.

Exploring Other Perspectives

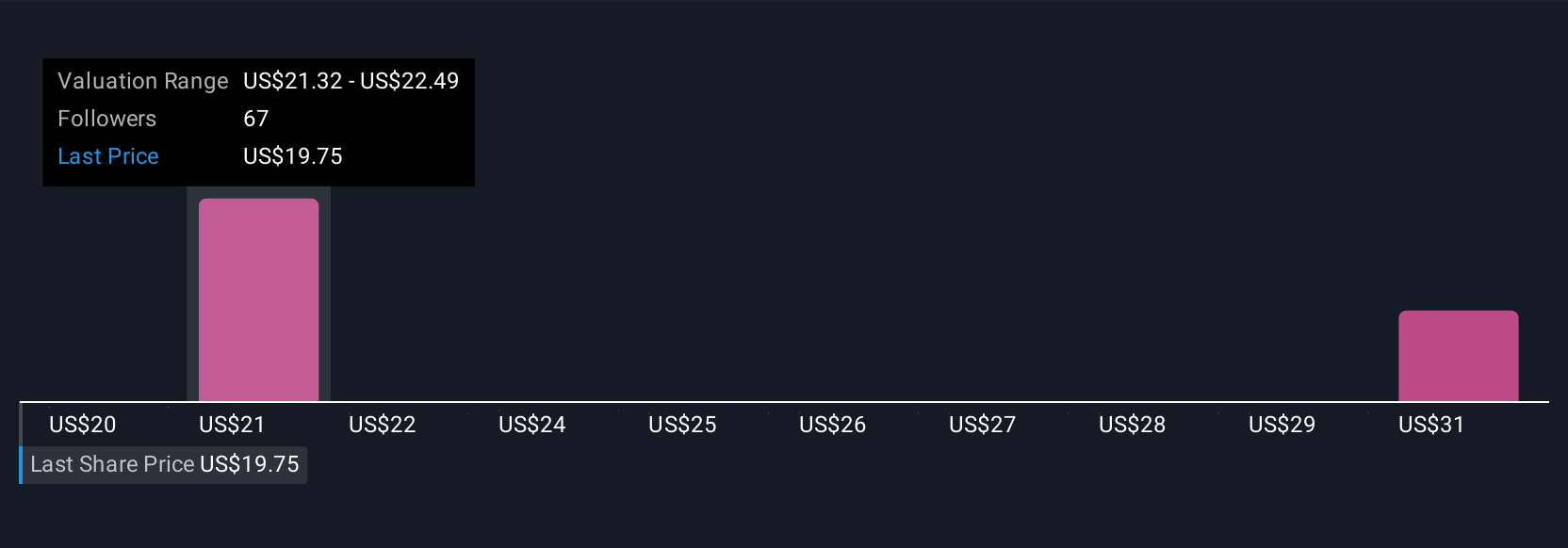

Simply Wall St Community members provided five separate fair value estimates for Provident Financial Services ranging from US$20.16 to US$32.73 per share. While many see upside potential, intense competition for deposits featured in recent analyses may influence performance well beyond headline events, so check out these contrasting viewpoints to make a more informed decision.

Explore 5 other fair value estimates on Provident Financial Services - why the stock might be worth as much as 66% more than the current price!

Build Your Own Provident Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Provident Financial Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Provident Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Provident Financial Services' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English