iRhythm Technologies (IRTC): Valuation in Focus After DOJ Probe and FDA Safety Concerns Shake Confidence

Most Popular Narrative: 5.4% Undervalued

According to the community narrative, iRhythm Technologies is currently trading below its estimated fair value. This view is shaped by forward-looking assumptions about long-term earnings growth, profit margins, and strategic positioning in a rapidly evolving digital healthcare landscape.

Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership), is improving product differentiation, diagnostic yield, and workflow efficiency. This may lead to higher gross margins and operating leverage as software and data become a larger component of the business.

Want to uncover what could push iRhythm's stock even higher? The heart of this narrative is a bold profit turnaround, recurring growth, and financial assumptions that rival tech darlings. Curious about the crucial numbers that make analysts optimistic? Find out which key projections anchor this fair value target and why the upside may surprise you.

Result: Fair Value of $178.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from new wearable tech rivals and ongoing regulatory uncertainty could quickly challenge these optimistic forecasts. These factors may also reshape iRhythm’s growth trajectory.

Find out about the key risks to this iRhythm Technologies narrative.Another View: A Market Ratio Snapshot

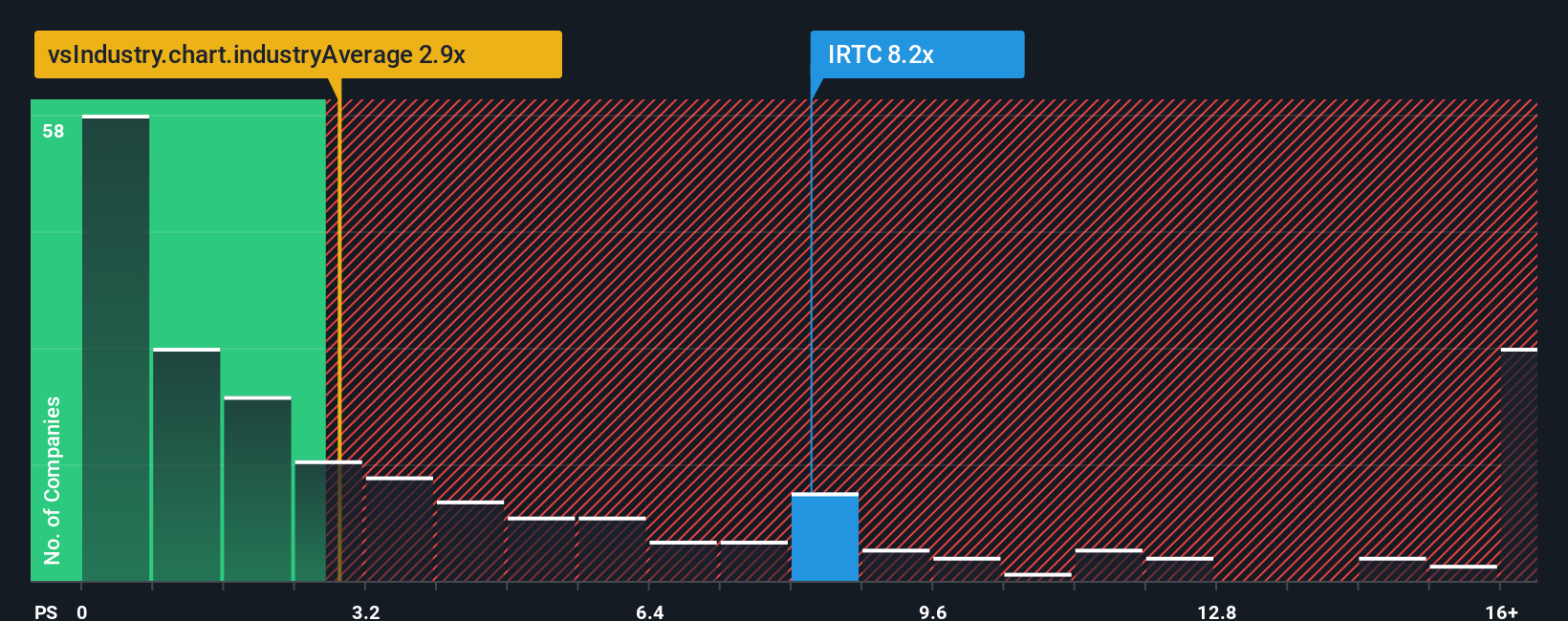

While the analyst-driven valuation points to upside, a comparison to the broader industry raises eyebrows. By looking at current share price versus revenues, iRhythm appears noticeably more expensive than its sector peers. Could optimism be clouding the true risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If you see things differently or want to follow your own trail through iRhythm Technologies' numbers, you are free to craft a narrative in just a few minutes. do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Opportunities?

Make your next investing move count by scanning the market with strategies proven to uncover potential standouts. Don’t miss the chance to get ahead. These handpicked ideas could spark your portfolio’s next big win.

- Capture income and growth as you spot companies offering dividend stocks with yields > 3% that can boost your long-term returns.

- Access the frontiers of innovation when you target game-changing firms in quantum computing stocks pushing advancements in quantum technology.

- Accelerate your search for value by focusing on undervalued stocks based on cash flows, stocks trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English