The Bull Case For Valley National Bancorp (VLY) Could Change Following Powell's Dovish Rate Cut Hints

- At the recent Jackson Hole symposium, Federal Reserve Chair Jerome Powell delivered dovish remarks suggesting a possible shift toward interest rate cuts, easing market concerns about prolonged high rates.

- This policy shift has sparked renewed optimism in the regional banking sector, as lower funding costs can bolster credit quality and operational performance.

- With the prospect of lower funding costs in focus, we’ll explore how this event could alter Valley National Bancorp’s investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Valley National Bancorp Investment Narrative Recap

To be a shareholder in Valley National Bancorp, you need to believe in the company’s ability to grow core deposits, drive operational efficiency, and maintain credit quality while capitalizing on ongoing expansion in high-growth markets. The Federal Reserve’s recent openness to rate cuts could help lower funding costs, a key near-term catalyst for the bank, potentially offsetting some pressure from rising deposit competition, though concerns over credit quality in commercial real estate remain material risks. The bank's latest Q2 earnings report (July 2025) showed net interest income and net income rising year over year, supporting optimism that improved funding conditions could reinforce Valley’s margin and earnings outlook if rate cuts materialize. While credit quality remains a concern, higher earnings growth in recent quarters signals operational resilience during changing rate cycles. Yet, despite these tailwinds, investors should not overlook the growing risk posed by persistent exposure to commercial real estate, which could impact future…

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's outlook anticipates $2.5 billion in revenue and $807.5 million in earnings by 2028. This projection implies 16.6% annual revenue growth and a $381.8 million increase in earnings from the current $425.7 million level.

Uncover how Valley National Bancorp's forecasts yield a $10.75 fair value, a 4% upside to its current price.

Exploring Other Perspectives

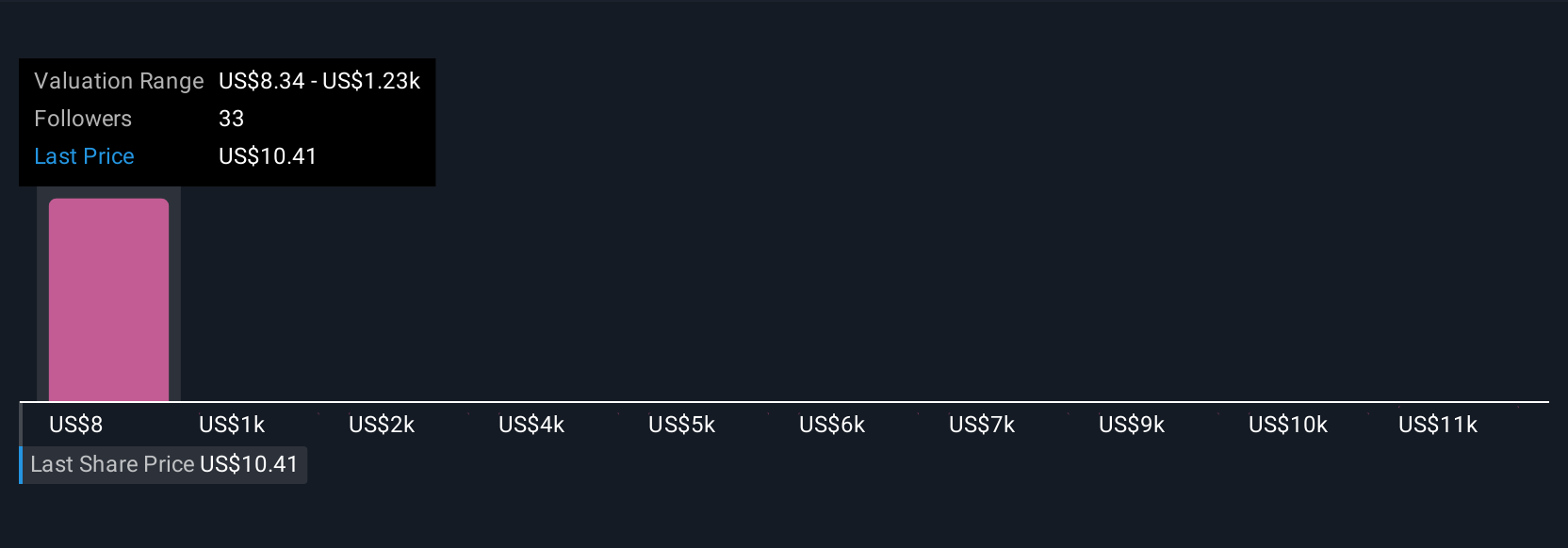

Five individual fair value estimates from the Simply Wall St Community span from US$8.34 up to an extreme US$12,190.04. As rate expectations shift, many continue to focus on Valley’s CRE loan concentrations and how these could shape the bank’s outlook; explore other perspectives to see how opinions differ.

Explore 5 other fair value estimates on Valley National Bancorp - why the stock might be a potential multi-bagger!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English